Pandemic business interruption insurance covers losses due to disruptions in business operations caused by infectious disease outbreaks, including mandated closures or reduced activities. Event cancellation insurance protects against financial losses resulting from the cancellation, postponement, or disruption of specific events due to unforeseen circumstances like natural disasters or government restrictions. Explore detailed comparisons and policy options to safeguard your business effectively during crises.

Why it is important

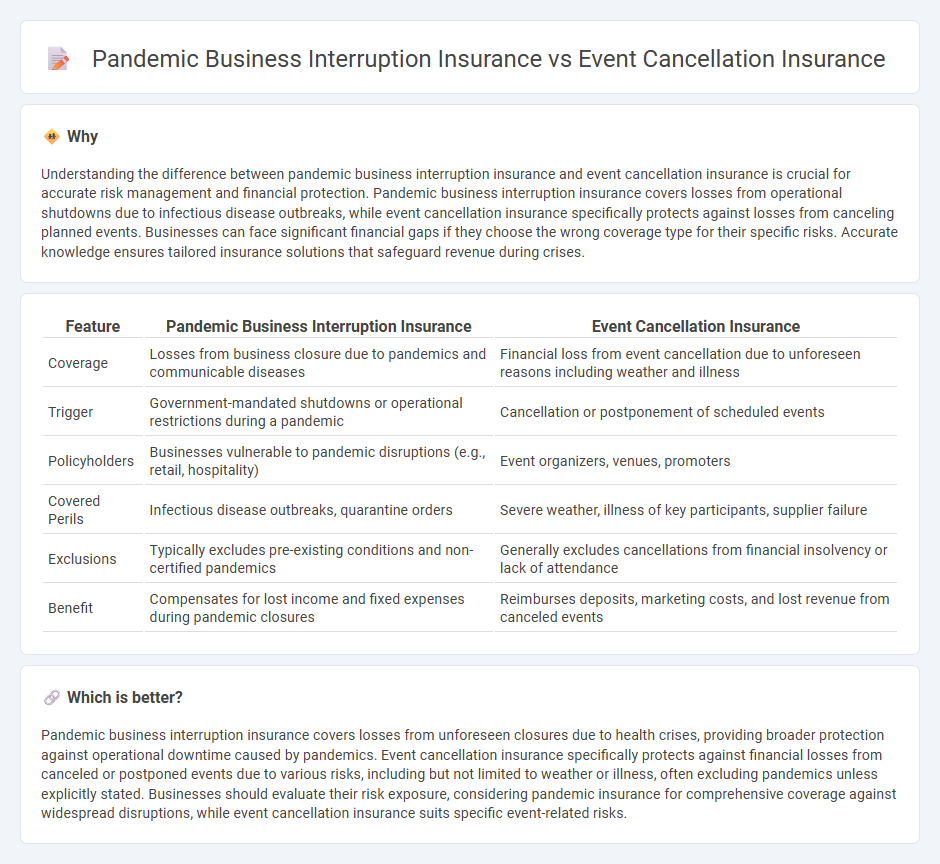

Understanding the difference between pandemic business interruption insurance and event cancellation insurance is crucial for accurate risk management and financial protection. Pandemic business interruption insurance covers losses from operational shutdowns due to infectious disease outbreaks, while event cancellation insurance specifically protects against losses from canceling planned events. Businesses can face significant financial gaps if they choose the wrong coverage type for their specific risks. Accurate knowledge ensures tailored insurance solutions that safeguard revenue during crises.

Comparison Table

| Feature | Pandemic Business Interruption Insurance | Event Cancellation Insurance |

|---|---|---|

| Coverage | Losses from business closure due to pandemics and communicable diseases | Financial loss from event cancellation due to unforeseen reasons including weather and illness |

| Trigger | Government-mandated shutdowns or operational restrictions during a pandemic | Cancellation or postponement of scheduled events |

| Policyholders | Businesses vulnerable to pandemic disruptions (e.g., retail, hospitality) | Event organizers, venues, promoters |

| Covered Perils | Infectious disease outbreaks, quarantine orders | Severe weather, illness of key participants, supplier failure |

| Exclusions | Typically excludes pre-existing conditions and non-certified pandemics | Generally excludes cancellations from financial insolvency or lack of attendance |

| Benefit | Compensates for lost income and fixed expenses during pandemic closures | Reimburses deposits, marketing costs, and lost revenue from canceled events |

Which is better?

Pandemic business interruption insurance covers losses from unforeseen closures due to health crises, providing broader protection against operational downtime caused by pandemics. Event cancellation insurance specifically protects against financial losses from canceled or postponed events due to various risks, including but not limited to weather or illness, often excluding pandemics unless explicitly stated. Businesses should evaluate their risk exposure, considering pandemic insurance for comprehensive coverage against widespread disruptions, while event cancellation insurance suits specific event-related risks.

Connection

Pandemic business interruption insurance and event cancellation insurance both provide financial protection against losses caused by unforeseen disruptions, particularly those related to public health crises. These coverages address the economic impact of pandemics by reimbursing policyholders for income loss due to halted operations or canceled events. Their interconnected nature reflects the increasing need for comprehensive risk management strategies in the face of global health emergencies.

Key Terms

**Event Cancellation Insurance:**

Event cancellation insurance primarily covers losses arising from unforeseen event cancellations due to reasons like extreme weather, venue damage, or key participant unavailability. It protects event organizers from financial risks linked to non-refundable expenses, including deposits, marketing costs, and vendor fees. Explore how event cancellation insurance can safeguard your business against unexpected disruptions.

Non-Appearance

Event cancellation insurance typically covers losses due to unforeseen event disruptions, but often excludes coverage for non-appearance unless specifically endorsed. Pandemic business interruption insurance provides broader protection against revenue loss caused by infectious disease outbreaks, including non-appearance of key individuals critical to event execution. Explore the intricacies and policy options to safeguard your business against these unique risks.

Force Majeure

Event cancellation insurance generally covers losses due to unforeseen occurrences like natural disasters but often excludes pandemics under Force Majeure clauses. Pandemic business interruption insurance specifically addresses revenue losses from government-mandated closures or disruptions caused by infectious diseases. Explore the distinct protections of these policies to safeguard your business effectively.

Source and External Links

Event Cancellation and Non-Appearance Insurance - Risk Strategies - Event cancellation insurance reimburses irrecoverable expenses, lost revenues, and advance revenues that may need to be refunded if an event is canceled, postponed, or disrupted due to covered risks like severe weather, venue damage, terrorism, or non-appearance of key participants.

Event Cancellation Insurance: Protect Your Event Revenues - Alliant EXPO Guard(tm) offers comprehensive financial loss protection for event organizers against cancellation, postponement, or disruption caused by adverse weather, venue damage, civil unrest, terrorism, or other unforeseen events, with optional cyber coverage and specialized claims support.

Wedding & Special Event Insurance - GEICO - GEICO's event cancellation insurance covers non-refundable deposits and additional expenses if you must cancel or postpone due to circumstances like vendor bankruptcy, illness, extreme weather, or military deployment, with policies starting as low as $130 and coverage available up to 14 days before the event.

dowidth.com

dowidth.com