Parametric insurance offers payouts based on predefined triggers such as weather events, providing fast and transparent compensation without damage assessments. Microinsurance targets low-income populations with affordable, accessible policies tailored for specific risks like health or crop failure. Explore more to understand how these innovative insurance models address diverse financial protection needs.

Why it is important

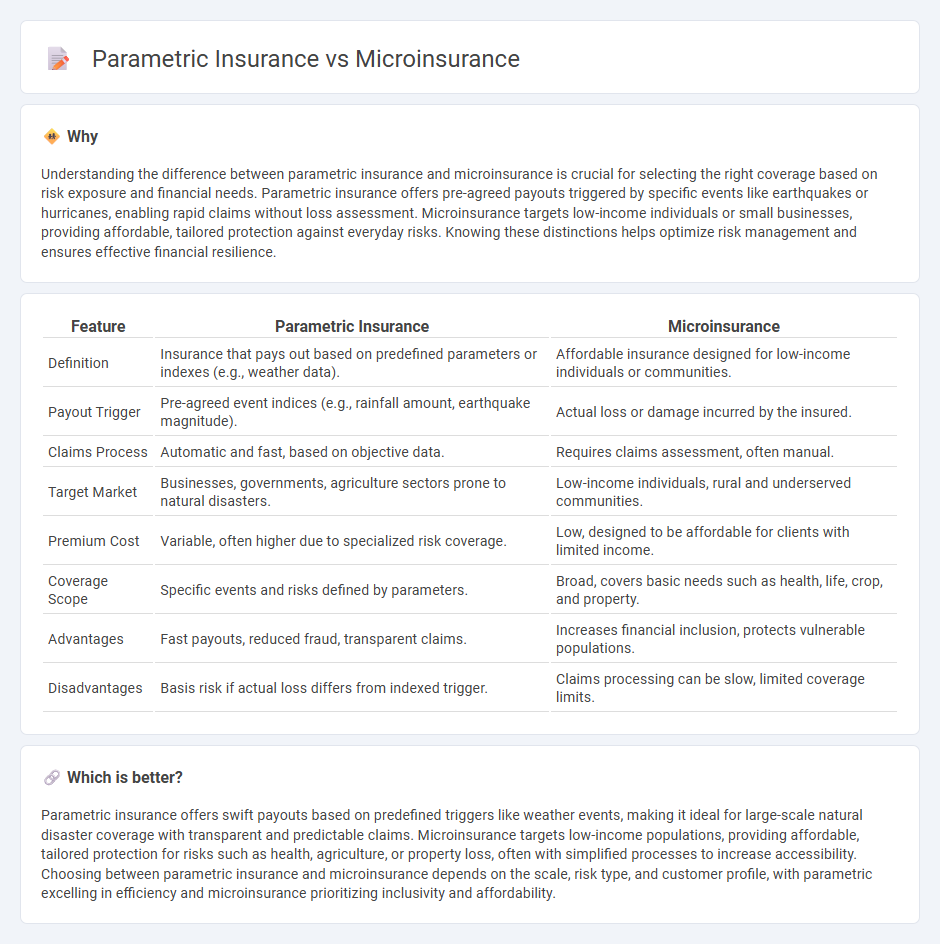

Understanding the difference between parametric insurance and microinsurance is crucial for selecting the right coverage based on risk exposure and financial needs. Parametric insurance offers pre-agreed payouts triggered by specific events like earthquakes or hurricanes, enabling rapid claims without loss assessment. Microinsurance targets low-income individuals or small businesses, providing affordable, tailored protection against everyday risks. Knowing these distinctions helps optimize risk management and ensures effective financial resilience.

Comparison Table

| Feature | Parametric Insurance | Microinsurance |

|---|---|---|

| Definition | Insurance that pays out based on predefined parameters or indexes (e.g., weather data). | Affordable insurance designed for low-income individuals or communities. |

| Payout Trigger | Pre-agreed event indices (e.g., rainfall amount, earthquake magnitude). | Actual loss or damage incurred by the insured. |

| Claims Process | Automatic and fast, based on objective data. | Requires claims assessment, often manual. |

| Target Market | Businesses, governments, agriculture sectors prone to natural disasters. | Low-income individuals, rural and underserved communities. |

| Premium Cost | Variable, often higher due to specialized risk coverage. | Low, designed to be affordable for clients with limited income. |

| Coverage Scope | Specific events and risks defined by parameters. | Broad, covers basic needs such as health, life, crop, and property. |

| Advantages | Fast payouts, reduced fraud, transparent claims. | Increases financial inclusion, protects vulnerable populations. |

| Disadvantages | Basis risk if actual loss differs from indexed trigger. | Claims processing can be slow, limited coverage limits. |

Which is better?

Parametric insurance offers swift payouts based on predefined triggers like weather events, making it ideal for large-scale natural disaster coverage with transparent and predictable claims. Microinsurance targets low-income populations, providing affordable, tailored protection for risks such as health, agriculture, or property loss, often with simplified processes to increase accessibility. Choosing between parametric insurance and microinsurance depends on the scale, risk type, and customer profile, with parametric excelling in efficiency and microinsurance prioritizing inclusivity and affordability.

Connection

Parametric insurance and microinsurance are interconnected by their focus on accessibility and efficiency for underserved populations. Parametric insurance uses predefined triggers such as weather data to provide rapid payouts without loss assessment, which aligns with microinsurance's goal of offering affordable coverage to low-income individuals. Both types of insurance leverage technology and data-driven solutions to reduce costs and enhance the speed of claim settlements in regions prone to natural disasters.

Key Terms

**Microinsurance:**

Microinsurance provides affordable, low-premium coverage tailored to low-income individuals often excluded from traditional insurance markets, addressing risks like health, agriculture, and property loss. It emphasizes accessibility, simplified claims processes, and community-based models to enhance financial inclusion and resilience among vulnerable populations. Explore more about how microinsurance empowers underserved communities with essential risk protection.

Low premiums

Microinsurance offers affordable premiums tailored for low-income individuals, providing essential coverage with minimal financial strain. Parametric insurance also features low premiums but relies on predefined triggers for quick, transparent payouts, reducing administrative costs and claim delays. Explore more to understand which option best suits your risk management needs.

Targeted populations

Microinsurance targets low-income individuals, providing affordable coverage for basic risks such as health, life, and property. Parametric insurance focuses on specific, measurable events like weather triggers, offering quick payouts primarily to farmers and vulnerable communities affected by natural disasters. Explore how these distinct insurance models cater to diverse populations and their unique needs.

Source and External Links

Microinsurance - Wikipedia - Microinsurance is a form of insurance designed to protect low-income people against specific risks through affordable premium payments, featuring low coverage limits and tailored to the financial capacities of the insured.

Background on: microinsurance and emerging markets | III - Microinsurance provides low-cost insurance products aimed at individuals in developing countries typically excluded from traditional coverage, offering protection with smaller premiums often linked to small loans.

Microinsurance | Insurance | Milliman - Microinsurance is designed to be accessible and appropriate for low-income families in terms of price, coverage, and delivery, aiming to protect vulnerable populations from risks like health issues, natural disasters, and death.

dowidth.com

dowidth.com