Short term rental insurance provides specialized coverage for property owners renting out their homes temporarily, protecting against property damage, liability claims, and loss of rental income. Umbrella insurance offers broader liability protection beyond the limits of existing policies, covering incidents like personal injury or major property claims that exceed standard policy thresholds. Discover how these insurance options can secure your assets and enhance your financial safety net.

Why it is important

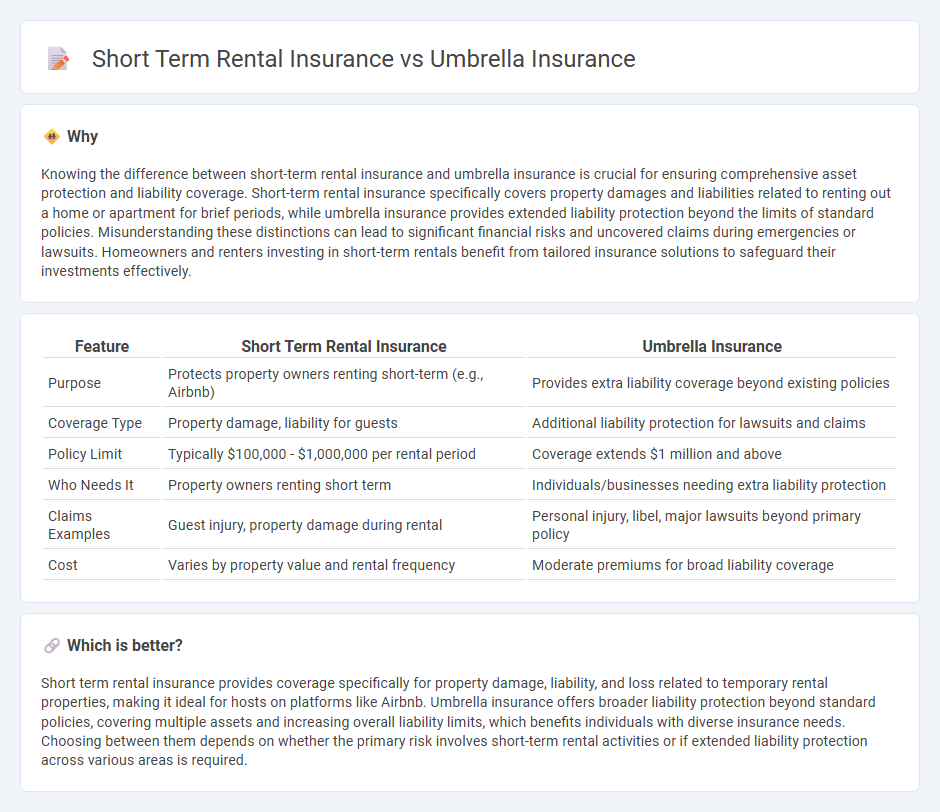

Knowing the difference between short-term rental insurance and umbrella insurance is crucial for ensuring comprehensive asset protection and liability coverage. Short-term rental insurance specifically covers property damages and liabilities related to renting out a home or apartment for brief periods, while umbrella insurance provides extended liability protection beyond the limits of standard policies. Misunderstanding these distinctions can lead to significant financial risks and uncovered claims during emergencies or lawsuits. Homeowners and renters investing in short-term rentals benefit from tailored insurance solutions to safeguard their investments effectively.

Comparison Table

| Feature | Short Term Rental Insurance | Umbrella Insurance |

|---|---|---|

| Purpose | Protects property owners renting short-term (e.g., Airbnb) | Provides extra liability coverage beyond existing policies |

| Coverage Type | Property damage, liability for guests | Additional liability protection for lawsuits and claims |

| Policy Limit | Typically $100,000 - $1,000,000 per rental period | Coverage extends $1 million and above |

| Who Needs It | Property owners renting short term | Individuals/businesses needing extra liability protection |

| Claims Examples | Guest injury, property damage during rental | Personal injury, libel, major lawsuits beyond primary policy |

| Cost | Varies by property value and rental frequency | Moderate premiums for broad liability coverage |

Which is better?

Short term rental insurance provides coverage specifically for property damage, liability, and loss related to temporary rental properties, making it ideal for hosts on platforms like Airbnb. Umbrella insurance offers broader liability protection beyond standard policies, covering multiple assets and increasing overall liability limits, which benefits individuals with diverse insurance needs. Choosing between them depends on whether the primary risk involves short-term rental activities or if extended liability protection across various areas is required.

Connection

Short term rental insurance covers property damage and liability risks for hosts, while umbrella insurance provides extended liability protection beyond underlying policy limits. Both policies work together to ensure comprehensive financial security by covering gaps in liability exposures from rental activities. Combining short term rental insurance with an umbrella policy minimizes the risk of out-of-pocket expenses from lawsuits or property damage claims.

Key Terms

Liability Coverage

Umbrella insurance provides broad liability coverage that extends beyond the limits of your existing policies, protecting against substantial claims such as bodily injury or property damage that exceed your primary insurance. Short term rental insurance specifically covers liabilities related to renting out property temporarily, including guest injuries and property damage during rental periods. Explore detailed comparisons to understand which coverage best suits your liability protection needs.

Policy Duration

Umbrella insurance provides broad liability coverage that extends beyond standard homeowner or auto policies, typically lasting as long as the main policy is active, offering continuous protection against large claims. Short term rental insurance specifically covers property and liability risks associated with rentals for brief periods, usually matching the rental duration from days to weeks. Explore the differences in policy duration and coverage options to choose the best insurance fit for your rental needs.

Coverage Exclusions

Umbrella insurance provides broad liability protection beyond standard policy limits but often excludes coverage for property used for commercial purposes, including short term rentals. Short term rental insurance specifically covers unique risks such as guest injuries and property damage during rental periods, yet it may exclude damages caused by long-term tenants or owner negligence. Explore detailed coverage exclusions between the two to determine the best protection for your rental property needs.

Source and External Links

Umbrella insurance - Wikipedia - Umbrella insurance is a form of liability insurance that provides coverage when liability exceeds the limits of other policies, such as auto or homeowners insurance, and can also cover certain losses excluded by those policies.

Umbrella policy: What is it and when do you need one? - Umbrella policies can protect your assets by paying large medical and repair bills that a court or your insurance company holds you responsible for, covering everyone in your household and providing additional liability protection beyond standard home or auto insurance limits.

Umbrella Insurance: What It Is & What It Covers | Allstate - Umbrella insurance offers extra liability coverage above the limits of your primary policies (like home or auto insurance), helping protect you against large and potentially catastrophic liability claims, such as bodily injury, personal injury, and property damage, but generally does not cover personal belongings, business losses, or intentional acts.

dowidth.com

dowidth.com