Workers compensation carveouts separate specific employee injury risks from standard insurance policies, allowing businesses to manage claims more efficiently and potentially lower premiums. Captive insurance involves a company creating its own licensed insurance entity to underwrite risks, providing greater control over coverage and costs compared to traditional insurance models. Explore the differences and benefits of workers compensation carveouts versus captive insurance to determine the best risk management strategy for your business.

Why it is important

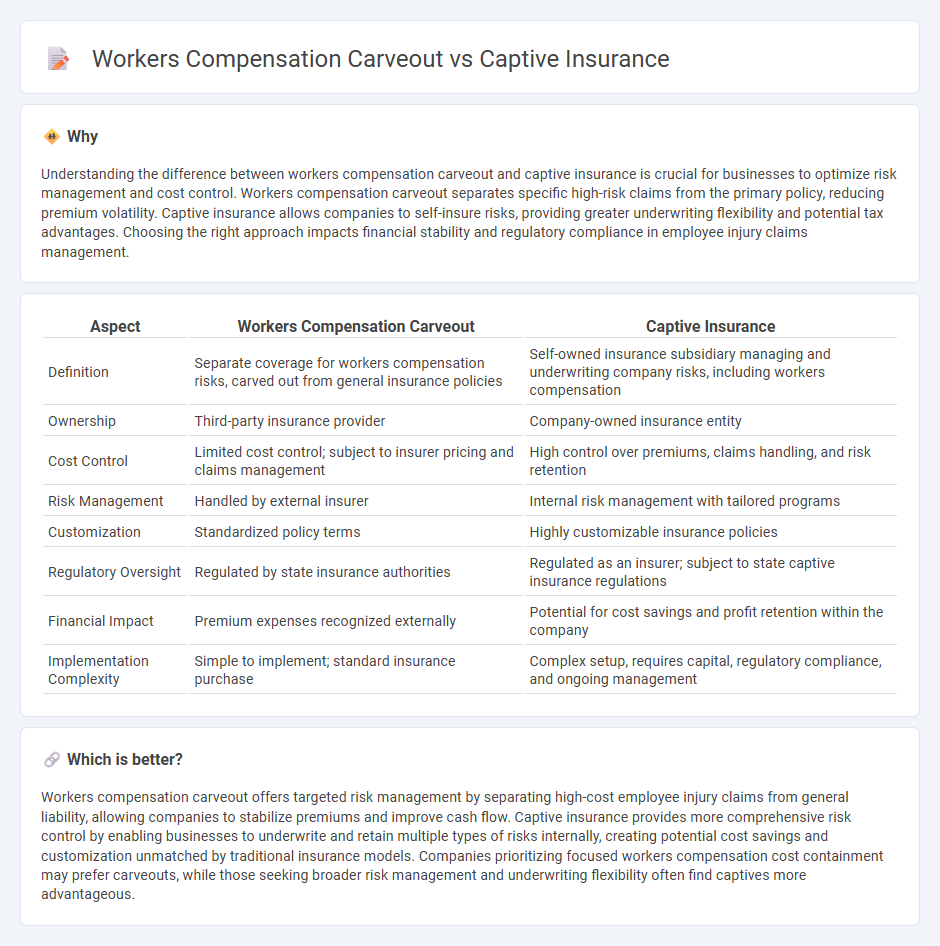

Understanding the difference between workers compensation carveout and captive insurance is crucial for businesses to optimize risk management and cost control. Workers compensation carveout separates specific high-risk claims from the primary policy, reducing premium volatility. Captive insurance allows companies to self-insure risks, providing greater underwriting flexibility and potential tax advantages. Choosing the right approach impacts financial stability and regulatory compliance in employee injury claims management.

Comparison Table

| Aspect | Workers Compensation Carveout | Captive Insurance |

|---|---|---|

| Definition | Separate coverage for workers compensation risks, carved out from general insurance policies | Self-owned insurance subsidiary managing and underwriting company risks, including workers compensation |

| Ownership | Third-party insurance provider | Company-owned insurance entity |

| Cost Control | Limited cost control; subject to insurer pricing and claims management | High control over premiums, claims handling, and risk retention |

| Risk Management | Handled by external insurer | Internal risk management with tailored programs |

| Customization | Standardized policy terms | Highly customizable insurance policies |

| Regulatory Oversight | Regulated by state insurance authorities | Regulated as an insurer; subject to state captive insurance regulations |

| Financial Impact | Premium expenses recognized externally | Potential for cost savings and profit retention within the company |

| Implementation Complexity | Simple to implement; standard insurance purchase | Complex setup, requires capital, regulatory compliance, and ongoing management |

Which is better?

Workers compensation carveout offers targeted risk management by separating high-cost employee injury claims from general liability, allowing companies to stabilize premiums and improve cash flow. Captive insurance provides more comprehensive risk control by enabling businesses to underwrite and retain multiple types of risks internally, creating potential cost savings and customization unmatched by traditional insurance models. Companies prioritizing focused workers compensation cost containment may prefer carveouts, while those seeking broader risk management and underwriting flexibility often find captives more advantageous.

Connection

Workers' compensation carveouts allow employers to remove specific high-risk claims from their primary insurance policy, reducing overall premiums and risk exposure. Captive insurance companies often provide coverage for these carveout claims, offering tailored risk management solutions and potential cost savings through retained underwriting profits. This connection enables businesses to optimize workers' compensation programs by combining targeted claim handling with captive risk financing.

Key Terms

Risk Retention

Captive insurance provides organizations with a strategic approach to risk retention by allowing them to self-insure specific liabilities, including workers' compensation carveouts, thereby reducing dependence on traditional insurance markets. Risk retention through captives enables customized coverage, enhanced control over claims management, and potential cost savings compared to standard workers' compensation policies. Discover how leveraging captive insurance for workers' compensation carveouts can optimize your enterprise risk management and financial stability.

Self-Insurance

Captive insurance offers organizations customized risk management by enabling them to self-insure specific liabilities, unlike workers compensation carveouts that isolate workers' comp risks for targeted funding and control. Self-insurance through captives enhances cost predictability, risk retention, and cash flow benefits while providing flexibility in claim management and regulatory compliance. Explore how adopting a captive insurance model can optimize your self-insurance strategy and improve financial outcomes.

Alternative Dispute Resolution

Captive insurance programs often include tailored Alternative Dispute Resolution (ADR) mechanisms to efficiently manage workers compensation carveouts, reducing litigation costs and expediting claim settlements. Utilizing mediation or arbitration within captive arrangements improves dispute outcomes by fostering collaborative resolutions between employers, insurers, and injured employees. Explore how integrating ADR in captive workers compensation carveouts can optimize claims management and risk control.

Source and External Links

Captive insurance - Wikipedia - Captive insurance is an alternative to self-insurance where a company establishes its own licensed insurance company to cover its specific risks, offering more control and potential tax benefits.

What Is Captive Insurance? - A captive insurer is an insurance company wholly owned and controlled by its insureds, providing tailored coverage, pricing stability, and greater control over claims and risk management services.

What is Captive Insurance? - Alliant Insurance Services - Captives allow corporations and groups to underwrite their own insurance, directly manage risk, access reinsurance markets, and potentially reduce reliance on traditional commercial insurers.

dowidth.com

dowidth.com