Insurtech sandbox environments enable insurance startups to test innovative products and services under relaxed regulatory conditions, fostering agility and market entry. Regulatory technology (RegTech) focuses on leveraging advanced software and automation to ensure compliance, risk management, and reporting accuracy within the insurance sector. Explore how these technologies transform insurance regulation and innovation by diving deeper into their unique roles and benefits.

Why it is important

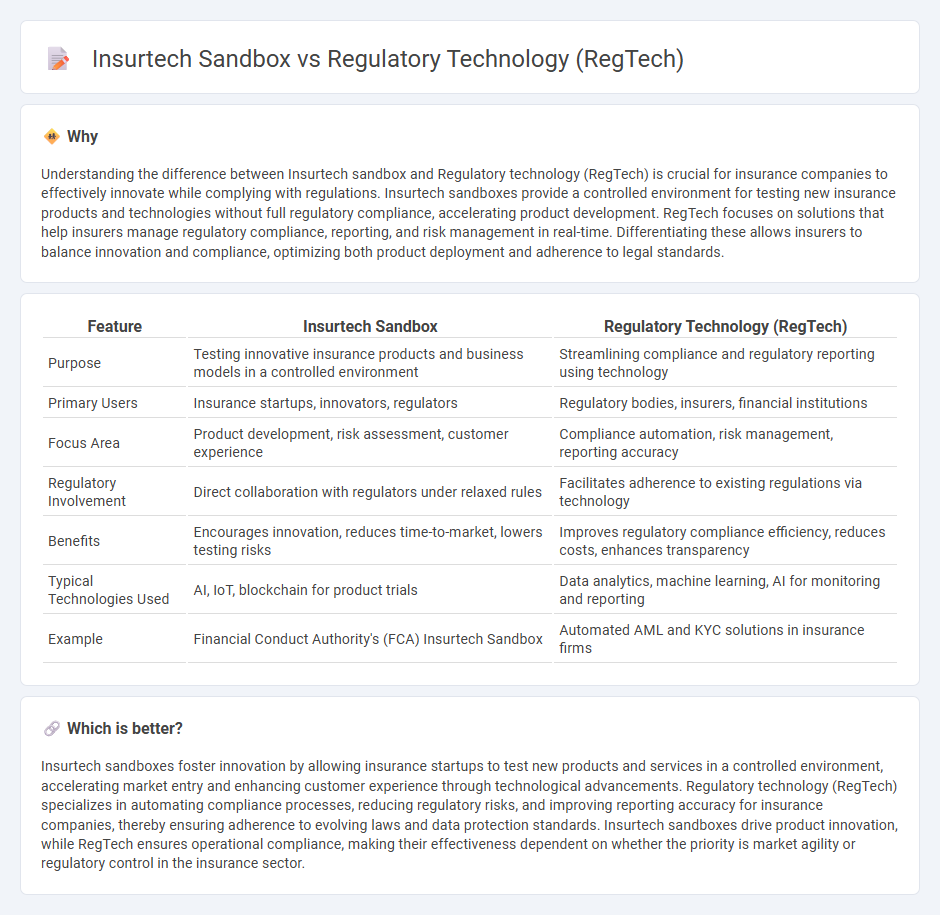

Understanding the difference between Insurtech sandbox and Regulatory technology (RegTech) is crucial for insurance companies to effectively innovate while complying with regulations. Insurtech sandboxes provide a controlled environment for testing new insurance products and technologies without full regulatory compliance, accelerating product development. RegTech focuses on solutions that help insurers manage regulatory compliance, reporting, and risk management in real-time. Differentiating these allows insurers to balance innovation and compliance, optimizing both product deployment and adherence to legal standards.

Comparison Table

| Feature | Insurtech Sandbox | Regulatory Technology (RegTech) |

|---|---|---|

| Purpose | Testing innovative insurance products and business models in a controlled environment | Streamlining compliance and regulatory reporting using technology |

| Primary Users | Insurance startups, innovators, regulators | Regulatory bodies, insurers, financial institutions |

| Focus Area | Product development, risk assessment, customer experience | Compliance automation, risk management, reporting accuracy |

| Regulatory Involvement | Direct collaboration with regulators under relaxed rules | Facilitates adherence to existing regulations via technology |

| Benefits | Encourages innovation, reduces time-to-market, lowers testing risks | Improves regulatory compliance efficiency, reduces costs, enhances transparency |

| Typical Technologies Used | AI, IoT, blockchain for product trials | Data analytics, machine learning, AI for monitoring and reporting |

| Example | Financial Conduct Authority's (FCA) Insurtech Sandbox | Automated AML and KYC solutions in insurance firms |

Which is better?

Insurtech sandboxes foster innovation by allowing insurance startups to test new products and services in a controlled environment, accelerating market entry and enhancing customer experience through technological advancements. Regulatory technology (RegTech) specializes in automating compliance processes, reducing regulatory risks, and improving reporting accuracy for insurance companies, thereby ensuring adherence to evolving laws and data protection standards. Insurtech sandboxes drive product innovation, while RegTech ensures operational compliance, making their effectiveness dependent on whether the priority is market agility or regulatory control in the insurance sector.

Connection

Insurtech sandbox environments facilitate innovation by allowing insurance startups to test new products and services under regulatory supervision. Regulatory technology (RegTech) supports these frameworks by automating compliance processes and enhancing risk management for both insurers and regulators. Together, Insurtech sandboxes and RegTech streamline product development while ensuring adherence to insurance regulations, accelerating market entry and improving consumer protection.

Key Terms

Compliance Monitoring

Regulatory technology (RegTech) enhances compliance monitoring by automating regulatory reporting and real-time risk assessment for financial institutions, ensuring adherence to evolving regulations with higher accuracy and efficiency. Insurtech sandboxes provide a controlled environment for insurance companies to test innovative compliance monitoring solutions without the risk of regulatory penalties, fostering innovation in regulatory practices. Explore how RegTech and insurtech sandboxes transform compliance monitoring to stay ahead in the dynamic regulatory landscape.

Innovation Testing

Regulatory technology (RegTech) streamlines compliance through automation, harnessing AI and blockchain to reduce regulatory costs and enhance transparency. Insurtech sandboxes provide a controlled environment for insurers to test innovative products and business models without full regulatory obligations, accelerating market entry and risk assessment. Explore how these tools reshape financial services through safer, faster innovation cycles.

Regulatory Framework

Regulatory technology (RegTech) enhances compliance by automating regulations and streamlining reporting processes within the financial sector, ensuring real-time adherence to evolving legal requirements. Insurtech sandboxes provide a controlled environment for insurance startups to test innovative products under regulatory oversight, fostering collaboration between regulators and innovators without compromising consumer protection. Explore how these frameworks reshape the insurance landscape and drive innovation while maintaining regulatory integrity.

Source and External Links

Regulatory Technology - Wikipedia - Regulatory technology, or RegTech, uses information technology to enhance regulatory and compliance processes in heavily regulated industries like finance.

RegTech: What Is It and Why Use It? (+ Examples) - This webpage provides an overview of RegTech, explaining its functions in regulatory monitoring, reporting, compliance, and risk management.

What is Regulatory Technology (RegTech)? - RegTech is a subset of FinTech that leverages technology to simplify regulatory compliance, offering solutions for automation and data-driven insights.

dowidth.com

dowidth.com