Pay per mile insurance calculates premiums based on the exact number of miles driven, offering cost savings for low-mileage drivers and promoting fuel efficiency. Comprehensive car insurance provides extensive coverage, protecting against damages from accidents, theft, natural disasters, and vandalism regardless of mileage. Explore the benefits and suitability of each insurance type to find the best option for your driving habits.

Why it is important

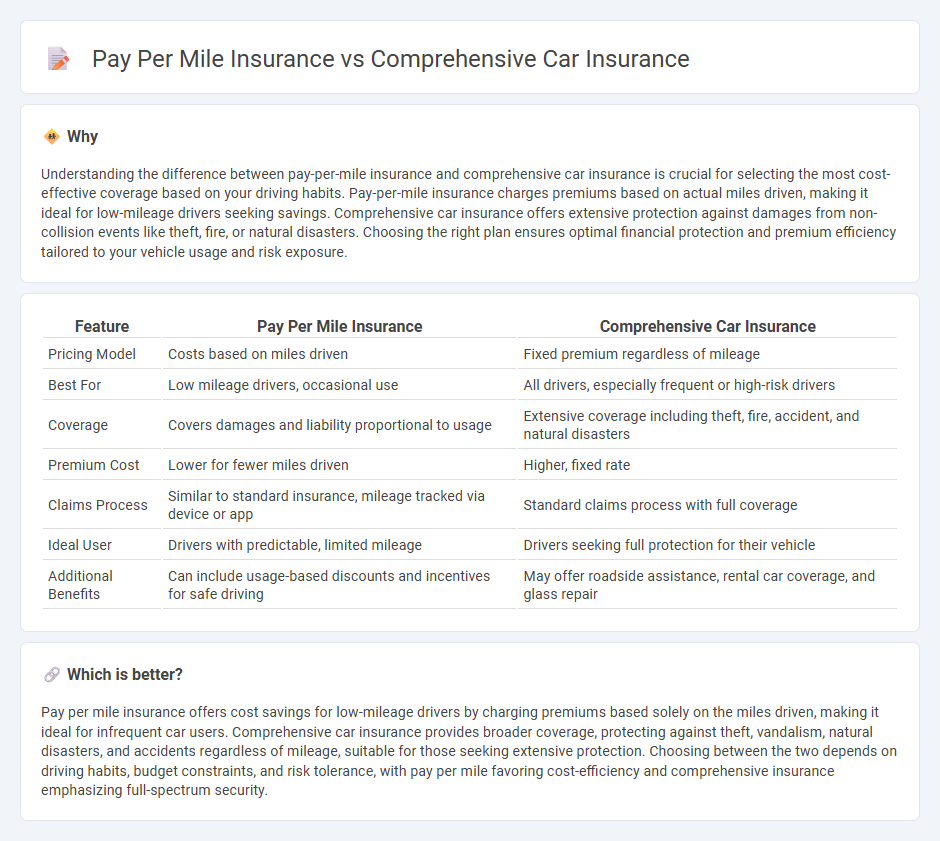

Understanding the difference between pay-per-mile insurance and comprehensive car insurance is crucial for selecting the most cost-effective coverage based on your driving habits. Pay-per-mile insurance charges premiums based on actual miles driven, making it ideal for low-mileage drivers seeking savings. Comprehensive car insurance offers extensive protection against damages from non-collision events like theft, fire, or natural disasters. Choosing the right plan ensures optimal financial protection and premium efficiency tailored to your vehicle usage and risk exposure.

Comparison Table

| Feature | Pay Per Mile Insurance | Comprehensive Car Insurance |

|---|---|---|

| Pricing Model | Costs based on miles driven | Fixed premium regardless of mileage |

| Best For | Low mileage drivers, occasional use | All drivers, especially frequent or high-risk drivers |

| Coverage | Covers damages and liability proportional to usage | Extensive coverage including theft, fire, accident, and natural disasters |

| Premium Cost | Lower for fewer miles driven | Higher, fixed rate |

| Claims Process | Similar to standard insurance, mileage tracked via device or app | Standard claims process with full coverage |

| Ideal User | Drivers with predictable, limited mileage | Drivers seeking full protection for their vehicle |

| Additional Benefits | Can include usage-based discounts and incentives for safe driving | May offer roadside assistance, rental car coverage, and glass repair |

Which is better?

Pay per mile insurance offers cost savings for low-mileage drivers by charging premiums based solely on the miles driven, making it ideal for infrequent car users. Comprehensive car insurance provides broader coverage, protecting against theft, vandalism, natural disasters, and accidents regardless of mileage, suitable for those seeking extensive protection. Choosing between the two depends on driving habits, budget constraints, and risk tolerance, with pay per mile favoring cost-efficiency and comprehensive insurance emphasizing full-spectrum security.

Connection

Pay per mile insurance calculates premiums based on the actual distance driven, offering cost savings for low-mileage drivers, while comprehensive car insurance covers damages beyond collisions, such as theft, vandalism, and natural disasters. Combining pay per mile insurance with comprehensive coverage ensures drivers pay proportionally for road usage while maintaining protection against non-collision risks. This hybrid approach optimizes cost efficiency and full-spectrum vehicle protection.

Key Terms

Coverage Scope

Comprehensive car insurance offers extensive coverage for a wide range of incidents, including theft, vandalism, natural disasters, and collision damage, providing full-scale protection regardless of mileage. Pay-per-mile insurance calculates premiums based on actual miles driven, ideal for low-mileage drivers seeking cost efficiency but with coverage typically limited to basic liability and physical damage. Explore detailed comparisons to determine which insurance aligns best with your driving habits and protection needs.

Premium Calculation

Comprehensive car insurance premiums are primarily calculated based on factors such as vehicle value, driver history, location, and coverage limits, resulting in a fixed monthly or annual cost. Pay-per-mile insurance calculates premiums by combining a low base rate with a variable per-mile charge, directly correlating costs with actual driving distance. Explore more to understand which premium calculation model fits your driving habits and budget.

Mileage Tracking

Comprehensive car insurance covers damage from accidents, theft, and natural disasters, while pay per mile insurance charges premiums based on actual miles driven, tracked via GPS or odometer readings. Mileage tracking in pay per mile plans offers potential savings for low-mileage drivers by linking premiums directly to usage, ensuring fair pricing and reducing unnecessary costs. Discover how choosing the right mileage tracking insurance can optimize your coverage and save money.

Source and External Links

What Is Comprehensive Car Insurance Coverage? - AAA - Comprehensive car insurance covers damage to your vehicle from non-collision events like theft, weather, or vandalism, providing financial relief for repairs or replacement but does not cover medical expenses or liability for other vehicles.

What is comprehensive auto insurance coverage? - Progressive - Comprehensive insurance is optional and covers vehicle damage from fire, vandalism, theft, weather events, and animal collisions, but it excludes damage from collisions with other vehicles or objects.

Comprehensive coverage - Allstate Car Insurance - This coverage protects your car against various non-collision damages including storms, theft, vandalism, and animal damage, with average costs ranging between $100 to $300 per year depending on factors like location and car value.

dowidth.com

dowidth.com