Earthquake microinsurance offers targeted financial protection against property damage and livelihood disruption caused by seismic events, typically providing rapid payouts to affected low-income households. Funeral microinsurance focuses on covering end-of-life expenses, easing the financial burden on families during bereavement with affordable premiums and straightforward claim processes. Explore the distinct benefits and coverage options of earthquake versus funeral microinsurance to find the best fit for your needs.

Why it is important

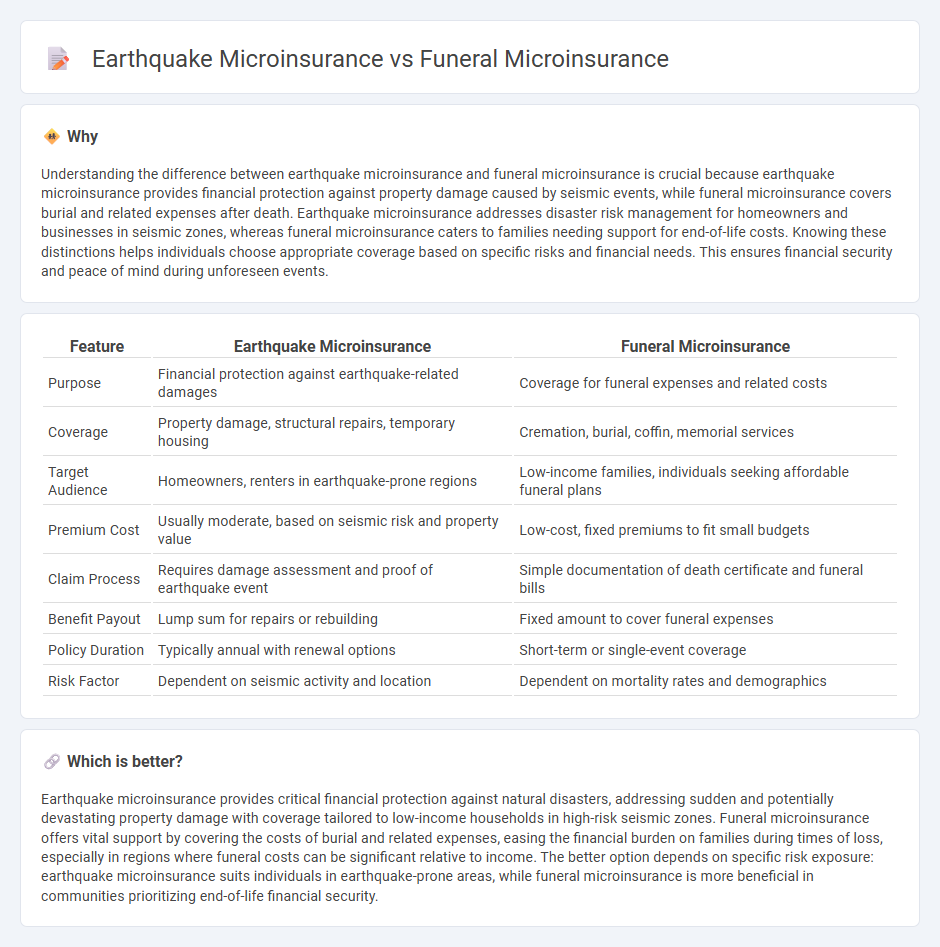

Understanding the difference between earthquake microinsurance and funeral microinsurance is crucial because earthquake microinsurance provides financial protection against property damage caused by seismic events, while funeral microinsurance covers burial and related expenses after death. Earthquake microinsurance addresses disaster risk management for homeowners and businesses in seismic zones, whereas funeral microinsurance caters to families needing support for end-of-life costs. Knowing these distinctions helps individuals choose appropriate coverage based on specific risks and financial needs. This ensures financial security and peace of mind during unforeseen events.

Comparison Table

| Feature | Earthquake Microinsurance | Funeral Microinsurance |

|---|---|---|

| Purpose | Financial protection against earthquake-related damages | Coverage for funeral expenses and related costs |

| Coverage | Property damage, structural repairs, temporary housing | Cremation, burial, coffin, memorial services |

| Target Audience | Homeowners, renters in earthquake-prone regions | Low-income families, individuals seeking affordable funeral plans |

| Premium Cost | Usually moderate, based on seismic risk and property value | Low-cost, fixed premiums to fit small budgets |

| Claim Process | Requires damage assessment and proof of earthquake event | Simple documentation of death certificate and funeral bills |

| Benefit Payout | Lump sum for repairs or rebuilding | Fixed amount to cover funeral expenses |

| Policy Duration | Typically annual with renewal options | Short-term or single-event coverage |

| Risk Factor | Dependent on seismic activity and location | Dependent on mortality rates and demographics |

Which is better?

Earthquake microinsurance provides critical financial protection against natural disasters, addressing sudden and potentially devastating property damage with coverage tailored to low-income households in high-risk seismic zones. Funeral microinsurance offers vital support by covering the costs of burial and related expenses, easing the financial burden on families during times of loss, especially in regions where funeral costs can be significant relative to income. The better option depends on specific risk exposure: earthquake microinsurance suits individuals in earthquake-prone areas, while funeral microinsurance is more beneficial in communities prioritizing end-of-life financial security.

Connection

Earthquake microinsurance and funeral microinsurance both provide targeted financial protection to low-income households facing specific risks. Earthquake microinsurance covers damages caused by seismic events, reducing economic vulnerability, while funeral microinsurance ensures funds for burial expenses, alleviating financial stress after a death. Together, these microinsurance products enhance community resilience by addressing distinct yet interconnected disaster-related and life event costs.

Key Terms

**Funeral Microinsurance:**

Funeral microinsurance provides affordable coverage specifically designed to cover funeral expenses, offering financial relief to low-income families during times of bereavement. It usually includes benefits such as lump-sum cash payouts to help cover burial and related costs, making it distinct from earthquake microinsurance, which is aimed at disaster recovery for property damage. Explore more about how funeral microinsurance protects families from unexpected expenses and promotes financial security.

Beneficiary

Funeral microinsurance primarily benefits the family or nominated beneficiaries by providing financial support to cover funeral expenses, alleviating immediate economic burdens during bereavement. Earthquake microinsurance extends protection to policyholders and their families by compensating for property damage and loss, ensuring recovery aid post-disaster. Explore detailed comparisons to understand how each policy secures beneficiary interests uniquely.

Sum Assured

Funeral microinsurance typically offers a lower Sum Assured ranging between $200 to $1,000, designed to cover immediate burial and funeral expenses, while earthquake microinsurance provides higher coverage limits often from $1,000 to $10,000 to address structural damages and personal losses caused by seismic events. The Sum Assured in earthquake microinsurance reflects the significant potential costs of property repair and loss of livelihood, contrasting with the more predictable, fixed costs covered by funeral microinsurance. Explore detailed coverage options and benefits to determine which microinsurance product best suits your specific risk and financial protection needs.

Source and External Links

Micro-insurance opportunity for the funeral industry - Discusses how micro-insurance is tailored to meet the needs of lower-income households, particularly in the funeral industry, with risk-only benefits and quick claim settlements.

Last Expense Cover - Offers a microinsurance plan providing quick payouts for funeral costs, with coverage ranging from Kshs 50,000 to Kshs 500,000.

Funeral Insurance Microinsurance Paper - Examines the role and value of funeral insurance for low-income consumers, highlighting its prevalence and importance in managing funeral expenses.

dowidth.com

dowidth.com