Flood insurance integration focuses on mitigating risks from water damage caused by natural disasters, while property insurance integration covers a broader range of perils including fire, theft, and liability. Differentiating these insurance types ensures comprehensive protection tailored to specific risks faced by homeowners and businesses. Discover how combining flood and property insurance integrations can optimize your coverage strategy.

Why it is important

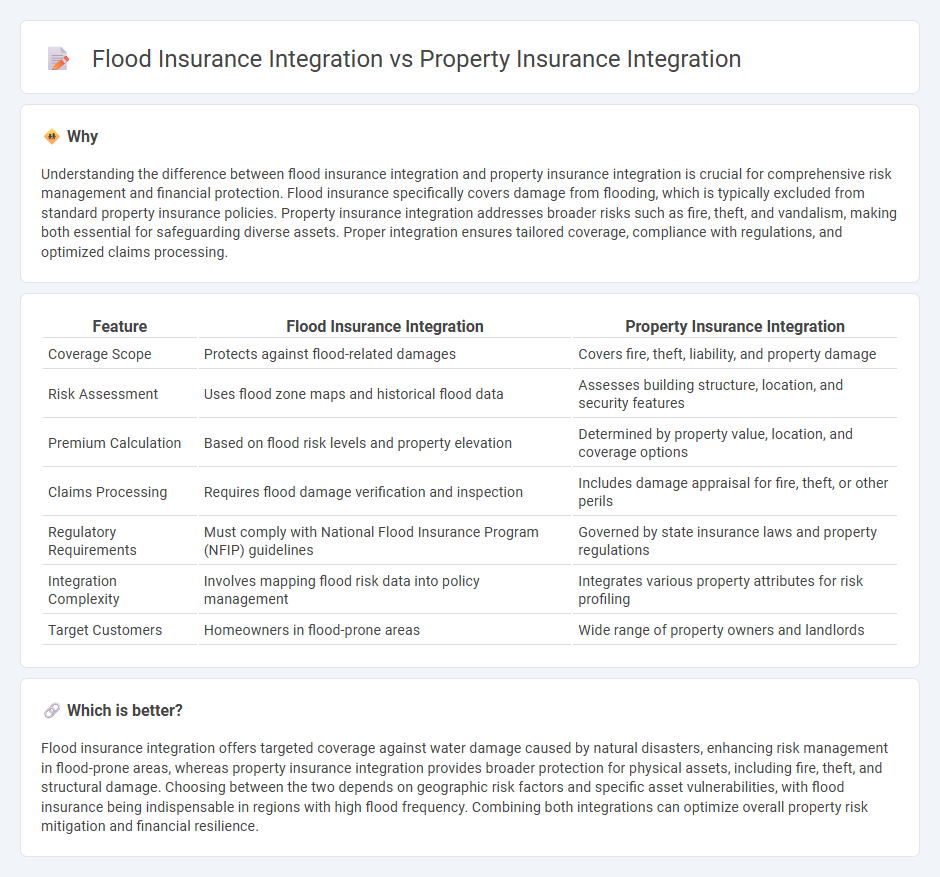

Understanding the difference between flood insurance integration and property insurance integration is crucial for comprehensive risk management and financial protection. Flood insurance specifically covers damage from flooding, which is typically excluded from standard property insurance policies. Property insurance integration addresses broader risks such as fire, theft, and vandalism, making both essential for safeguarding diverse assets. Proper integration ensures tailored coverage, compliance with regulations, and optimized claims processing.

Comparison Table

| Feature | Flood Insurance Integration | Property Insurance Integration |

|---|---|---|

| Coverage Scope | Protects against flood-related damages | Covers fire, theft, liability, and property damage |

| Risk Assessment | Uses flood zone maps and historical flood data | Assesses building structure, location, and security features |

| Premium Calculation | Based on flood risk levels and property elevation | Determined by property value, location, and coverage options |

| Claims Processing | Requires flood damage verification and inspection | Includes damage appraisal for fire, theft, or other perils |

| Regulatory Requirements | Must comply with National Flood Insurance Program (NFIP) guidelines | Governed by state insurance laws and property regulations |

| Integration Complexity | Involves mapping flood risk data into policy management | Integrates various property attributes for risk profiling |

| Target Customers | Homeowners in flood-prone areas | Wide range of property owners and landlords |

Which is better?

Flood insurance integration offers targeted coverage against water damage caused by natural disasters, enhancing risk management in flood-prone areas, whereas property insurance integration provides broader protection for physical assets, including fire, theft, and structural damage. Choosing between the two depends on geographic risk factors and specific asset vulnerabilities, with flood insurance being indispensable in regions with high flood frequency. Combining both integrations can optimize overall property risk mitigation and financial resilience.

Connection

Flood insurance integration enhances property insurance by addressing specific water damage risks not covered in standard policies, ensuring comprehensive protection for homeowners. Combining flood and property insurance data enables insurers to accurately assess risk profiles and offer tailored coverage options. This integration improves claims processing efficiency by streamlining validation and settlement for water-related damages.

Key Terms

**Property Insurance Integration:**

Property Insurance Integration streamlines coverage management by consolidating policies related to buildings, personal property, and liability into a unified platform, enhancing risk assessment and claim processing efficiency. This integration leverages data analytics and real-time updates to optimize premium calculations and tailor protection plans for diverse property types. Explore how Property Insurance Integration can safeguard your assets and simplify your insurance portfolio today.

Policyholder Data Synchronization

Property insurance integration focuses on synchronizing comprehensive policyholder data, including personal details, coverage limits, and claim histories, ensuring seamless communication between underwriting, billing, and claims systems. Flood insurance integration specifically emphasizes accurate mapping of flood risk zones and elevation data alongside policyholder information to enable precise risk assessment and premium calculation. Explore the benefits of advanced policyholder data synchronization in optimizing both property and flood insurance workflows.

Claims Management System

Property insurance integration within a Claims Management System ensures seamless processing of diverse risk claims, including fire, theft, and liability incidents, leveraging unified data for faster adjudication. Flood insurance integration, often regulated separately by entities like the National Flood Insurance Program (NFIP), requires specialized handling of flood-specific loss data and mitigation factors to accurately assess and expedite claims. Discover how incorporating targeted flood insurance modules enhances overall claims efficiency and compliance in property insurance systems.

Source and External Links

Home Insurance & Mortgage Integration | Progressive Partner - Progressive's Digital Mortgage Integration streamlines property insurance by embedding policy options during the mortgage process, allowing borrowers to view and purchase home insurance premiums seamlessly within the loan application workflow.

Why Should Integrate Property and Casualty Insurance - Milemarker - Integrating property insurance with financial advisory services helps mitigate clients' risks and provides a more complete financial strategy by combining asset growth with protection from unforeseen property damage or liability events.

Simplifying Your Insurance Experience - Integrated Insurance Solutions - Integrated insurance solutions offer a comprehensive platform that combines property insurance with other types like auto, life, and business insurance, enabling customers to manage multiple policies efficiently and potentially reduce costs through multi-policy discounts.

dowidth.com

dowidth.com