Buy now insurance offers immediate coverage with flexible payment plans, allowing policyholders to tailor premiums over time for better cash flow management. Single premium insurance involves paying a lump sum upfront, providing lifelong coverage without the need for future payments or renewals. Explore the differences to determine which insurance option aligns best with your financial goals and coverage needs.

Why it is important

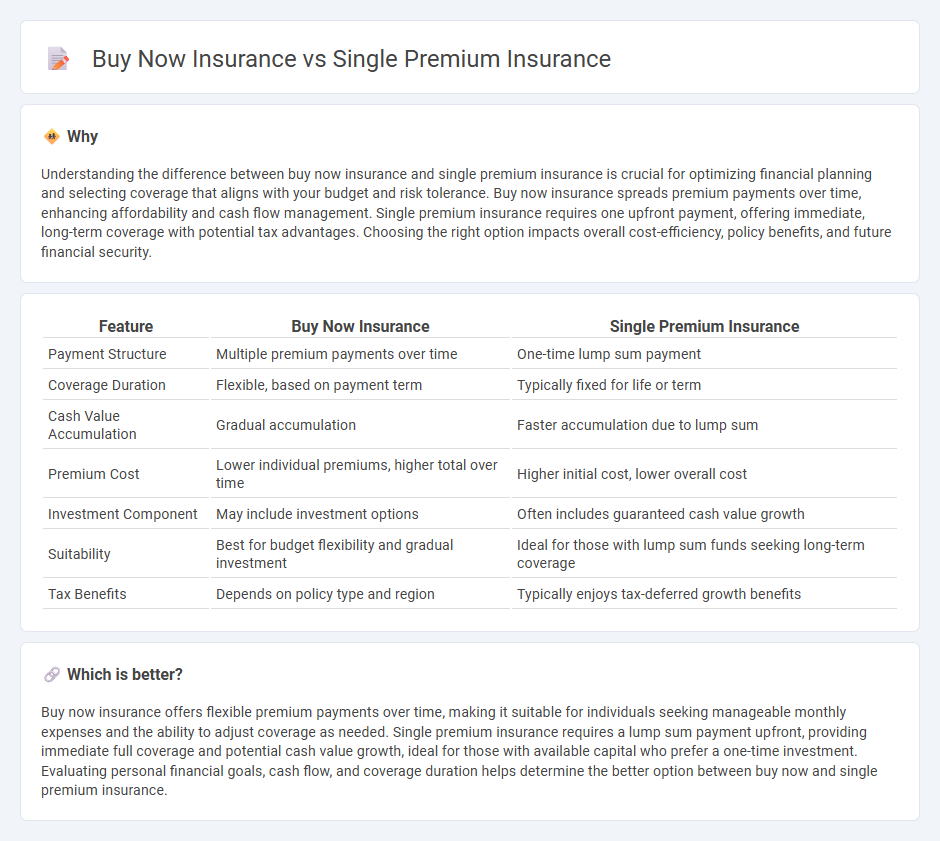

Understanding the difference between buy now insurance and single premium insurance is crucial for optimizing financial planning and selecting coverage that aligns with your budget and risk tolerance. Buy now insurance spreads premium payments over time, enhancing affordability and cash flow management. Single premium insurance requires one upfront payment, offering immediate, long-term coverage with potential tax advantages. Choosing the right option impacts overall cost-efficiency, policy benefits, and future financial security.

Comparison Table

| Feature | Buy Now Insurance | Single Premium Insurance |

|---|---|---|

| Payment Structure | Multiple premium payments over time | One-time lump sum payment |

| Coverage Duration | Flexible, based on payment term | Typically fixed for life or term |

| Cash Value Accumulation | Gradual accumulation | Faster accumulation due to lump sum |

| Premium Cost | Lower individual premiums, higher total over time | Higher initial cost, lower overall cost |

| Investment Component | May include investment options | Often includes guaranteed cash value growth |

| Suitability | Best for budget flexibility and gradual investment | Ideal for those with lump sum funds seeking long-term coverage |

| Tax Benefits | Depends on policy type and region | Typically enjoys tax-deferred growth benefits |

Which is better?

Buy now insurance offers flexible premium payments over time, making it suitable for individuals seeking manageable monthly expenses and the ability to adjust coverage as needed. Single premium insurance requires a lump sum payment upfront, providing immediate full coverage and potential cash value growth, ideal for those with available capital who prefer a one-time investment. Evaluating personal financial goals, cash flow, and coverage duration helps determine the better option between buy now and single premium insurance.

Connection

Buy now insurance and single premium insurance are connected through their upfront payment structure, where policyholders pay a lump sum at the outset to secure coverage. Both options provide immediate financial protection and often offer simplified underwriting processes compared to traditional policies. This connection enhances convenience and financial planning by eliminating ongoing premium payments over the policy term.

Key Terms

Premium Payment Structure

Single premium insurance requires a one-time lump-sum payment that fully covers the policy, eliminating the need for future premiums and offering immediate coverage. Buy now insurance typically involves ongoing premium payments spread over the policy term, providing flexibility in payment but potentially resulting in higher total costs. Discover how these premium payment structures impact your long-term financial planning and coverage by exploring detailed comparisons.

Cash Value Accumulation

Single premium insurance offers immediate cash value accumulation due to the lump-sum payment, enhancing long-term growth and financial security. Buy now insurance typically involves ongoing premium payments, which may slow the buildup of cash value but provide flexibility in payment structure. Explore the advantages of each policy type to optimize your cash value growth strategy.

Coverage Duration

Single premium insurance offers coverage for a fixed period or lifetime after a one-time lump sum payment, ensuring long-term financial security without ongoing premiums. Buy now insurance typically features shorter coverage durations with premiums paid in installments, providing flexibility but often resulting in higher total costs. Explore detailed comparisons to understand which coverage duration aligns best with your financial goals.

Source and External Links

What is Single Premium Life Insurance? - Single premium life insurance is a policy that requires a one-time, lump-sum payment for lifelong coverage without ongoing premiums.

Single Premium Life Insurance - This type of insurance provides guaranteed lifetime coverage and cash value growth with a single upfront payment.

Single Premium Life Insurance - State Farm offers a single premium whole life policy that provides lifetime protection with only one payment required.

dowidth.com

dowidth.com