Pay-as-you-drive insurance calculates premiums based on the exact miles driven, offering personalized and potentially lower costs for low-mileage drivers compared to traditional car insurance, which charges fixed rates regardless of driving habits. This usage-based model leverages telematics technology to track driving behavior, enhancing risk assessment accuracy and promoting safer driving. Explore the benefits and considerations of pay-as-you-drive versus traditional insurance to determine the best fit for your driving needs.

Why it is important

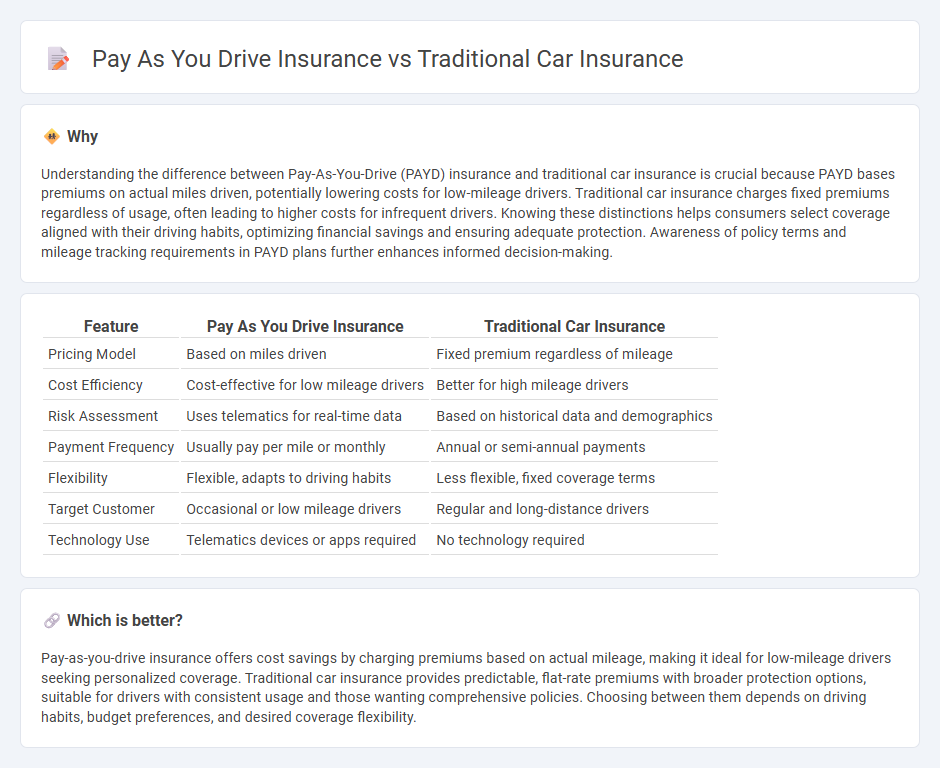

Understanding the difference between Pay-As-You-Drive (PAYD) insurance and traditional car insurance is crucial because PAYD bases premiums on actual miles driven, potentially lowering costs for low-mileage drivers. Traditional car insurance charges fixed premiums regardless of usage, often leading to higher costs for infrequent drivers. Knowing these distinctions helps consumers select coverage aligned with their driving habits, optimizing financial savings and ensuring adequate protection. Awareness of policy terms and mileage tracking requirements in PAYD plans further enhances informed decision-making.

Comparison Table

| Feature | Pay As You Drive Insurance | Traditional Car Insurance |

|---|---|---|

| Pricing Model | Based on miles driven | Fixed premium regardless of mileage |

| Cost Efficiency | Cost-effective for low mileage drivers | Better for high mileage drivers |

| Risk Assessment | Uses telematics for real-time data | Based on historical data and demographics |

| Payment Frequency | Usually pay per mile or monthly | Annual or semi-annual payments |

| Flexibility | Flexible, adapts to driving habits | Less flexible, fixed coverage terms |

| Target Customer | Occasional or low mileage drivers | Regular and long-distance drivers |

| Technology Use | Telematics devices or apps required | No technology required |

Which is better?

Pay-as-you-drive insurance offers cost savings by charging premiums based on actual mileage, making it ideal for low-mileage drivers seeking personalized coverage. Traditional car insurance provides predictable, flat-rate premiums with broader protection options, suitable for drivers with consistent usage and those wanting comprehensive policies. Choosing between them depends on driving habits, budget preferences, and desired coverage flexibility.

Connection

Pay-as-you-drive insurance and traditional car insurance both provide financial protection against vehicle-related risks, but differ in premium calculation methods. Pay-as-you-drive insurance bases premiums on actual miles driven, promoting cost efficiency and low mileage savings, while traditional policies typically use fixed rates determined by factors like age, driving history, and vehicle type. Both models aim to cover liability, collision, and comprehensive risks, aligning on protecting policyholders from potential financial loss due to accidents or damage.

Key Terms

Premium calculation

Traditional car insurance premiums are primarily calculated based on fixed factors such as the driver's age, driving history, vehicle type, and location, resulting in a set annual or semi-annual payment. Pay-as-you-drive insurance determines premiums based on actual mileage and driving behavior tracked via telematics devices, offering cost savings for low-mileage drivers. Explore more details on how premium calculations impact your insurance costs and benefits.

Mileage tracking

Traditional car insurance typically relies on fixed premiums based on estimated annual mileage, driver profile, and vehicle type, often lacking precise tracking of actual miles driven. Pay-as-you-drive (PAYD) insurance uses telematics or GPS devices to monitor real-time mileage, enabling personalized rates that reflect actual usage and driving behavior. Explore the benefits and technology behind PAYD insurance for cost-effective coverage tailored to your driving habits.

Risk assessment

Traditional car insurance relies on broad risk assessment metrics such as age, driving history, and vehicle type to determine premiums, often resulting in fixed rates regardless of actual driving behavior. Pay-as-you-drive (PAYD) insurance utilizes telematics technology to monitor real-time data like mileage, speed, and driving patterns, offering personalized premiums that reflect actual risk exposure. Explore detailed comparisons to understand how PAYD insurance can provide more accurate and fair risk-based pricing.

Source and External Links

What Is Classic Car Insurance & How Does It Work? - Progressive - While not traditional car insurance, this article compares classic car insurance to regular auto insurance, highlighting key differences.

Collector & Classic Car Insurance - GEICO - Similar to traditional car insurance but tailored for collector vehicles, offering liability and collision coverage based on agreed value.

Classic & Collector Car Insurance - Nationwide - Provides specialized insurance for collector cars, differing from traditional insurance in coverage and usage allowances.

dowidth.com

dowidth.com