Pandemic business interruption insurance provides coverage for revenue loss due to government-mandated shutdowns or reduced operations caused by infectious disease outbreaks, whereas natural catastrophe insurance protects businesses against damages resulting from events like hurricanes, earthquakes, and floods. These specialized insurance policies address distinct risks, helping businesses mitigate financial impacts in scenarios that disrupt standard operations. Explore further to understand which coverage best suits your business needs.

Why it is important

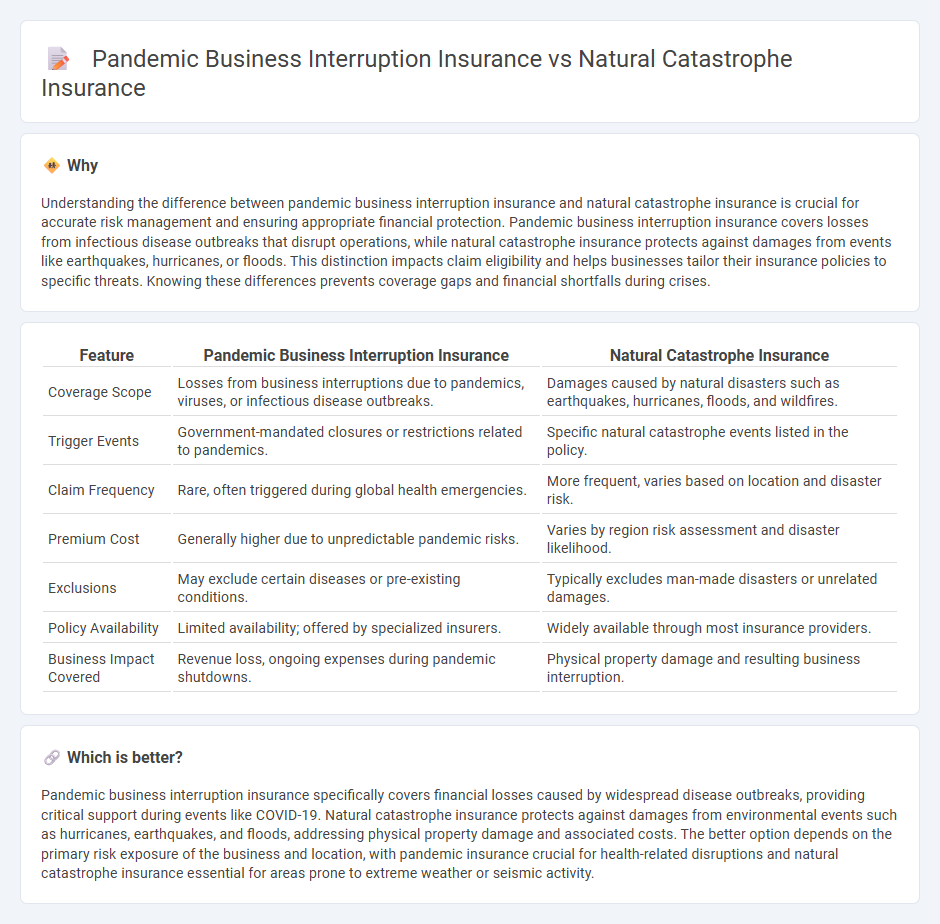

Understanding the difference between pandemic business interruption insurance and natural catastrophe insurance is crucial for accurate risk management and ensuring appropriate financial protection. Pandemic business interruption insurance covers losses from infectious disease outbreaks that disrupt operations, while natural catastrophe insurance protects against damages from events like earthquakes, hurricanes, or floods. This distinction impacts claim eligibility and helps businesses tailor their insurance policies to specific threats. Knowing these differences prevents coverage gaps and financial shortfalls during crises.

Comparison Table

| Feature | Pandemic Business Interruption Insurance | Natural Catastrophe Insurance |

|---|---|---|

| Coverage Scope | Losses from business interruptions due to pandemics, viruses, or infectious disease outbreaks. | Damages caused by natural disasters such as earthquakes, hurricanes, floods, and wildfires. |

| Trigger Events | Government-mandated closures or restrictions related to pandemics. | Specific natural catastrophe events listed in the policy. |

| Claim Frequency | Rare, often triggered during global health emergencies. | More frequent, varies based on location and disaster risk. |

| Premium Cost | Generally higher due to unpredictable pandemic risks. | Varies by region risk assessment and disaster likelihood. |

| Exclusions | May exclude certain diseases or pre-existing conditions. | Typically excludes man-made disasters or unrelated damages. |

| Policy Availability | Limited availability; offered by specialized insurers. | Widely available through most insurance providers. |

| Business Impact Covered | Revenue loss, ongoing expenses during pandemic shutdowns. | Physical property damage and resulting business interruption. |

Which is better?

Pandemic business interruption insurance specifically covers financial losses caused by widespread disease outbreaks, providing critical support during events like COVID-19. Natural catastrophe insurance protects against damages from environmental events such as hurricanes, earthquakes, and floods, addressing physical property damage and associated costs. The better option depends on the primary risk exposure of the business and location, with pandemic insurance crucial for health-related disruptions and natural catastrophe insurance essential for areas prone to extreme weather or seismic activity.

Connection

Pandemic business interruption insurance and natural catastrophe insurance both provide financial protection against unforeseen disruptions that threaten business continuity. These insurance policies cover losses stemming from large-scale events, such as pandemics or natural disasters like hurricanes and earthquakes, ensuring businesses can manage risks associated with operational shutdowns. Risk assessment models for both types increasingly incorporate climate change and global health data to improve coverage accuracy and resilience planning.

Key Terms

**Natural Catastrophe Insurance:**

Natural Catastrophe Insurance provides financial protection against losses from events such as hurricanes, earthquakes, floods, and wildfires, covering physical damages to property and infrastructure. This insurance typically includes coverage for structural repairs, business interruption due to physical damage, and debris removal, with premiums influenced by geographic risk and historical data. Explore the key differences and benefits of natural catastrophe coverage compared to pandemic business interruption insurance to optimize your risk management strategy.

Perils (e.g., earthquake, flood, hurricane)

Natural catastrophe insurance primarily covers damages caused by perils such as earthquakes, floods, and hurricanes, protecting physical assets from environmental disasters. Pandemic business interruption insurance focuses on losses stemming from infectious disease outbreaks, covering operational disruptions rather than physical damage. Explore further to understand how each policy addresses specific risks and coverage scopes.

Catastrophe Modeling

Catastrophe modeling for natural catastrophe insurance utilizes satellite data, historical loss information, and stochastic event simulation to estimate potential damage from hurricanes, earthquakes, and floods, enabling precise risk assessment and premium calculation. Pandemic business interruption insurance, however, relies on epidemiological models, infection rate projections, and logistic regression analyses to evaluate economic impact from viral outbreaks, despite challenges in modeling widespread and prolonged disruptions. Explore more about how advanced catastrophe modeling techniques shape risk management in diverse insurance sectors.

Source and External Links

Innovative Natural Disaster & Catastrophe Insurance | Swiss Re - Swiss Re offers tailored natural catastrophe insurance solutions using parametric indices to minimize financial impacts by identifying and covering assets exposed to natural disasters, with coverage available for up to five years and risk mitigation tools included

Natural catastrophe insurance of Iceland - Island.is - Iceland's public institution insures buildings and critical municipal infrastructure against natural disasters, requiring mandatory coverage alongside fire insurance and managing claims with specific reporting and assessment procedures

Offering Superior Catastrophe Insurance | Poulton Associates, LLC - Poulton Associates provides a private Natural Catastrophe Insurance Program (NCIP) that offers broader flood coverage than the US National Flood Insurance Program (NFIP), including contents coverage, higher limits, and additional living expenses

dowidth.com

dowidth.com