Weather index insurance uses measurable climate variables like rainfall or temperature to provide payouts based on predefined weather thresholds, reducing the need for individual loss assessments. Microinsurance offers affordable, scalable coverage tailored to low-income individuals, protecting against various risks such as health issues, natural disasters, or crop failure. Explore more to understand which insurance model suits specific needs and environments.

Why it is important

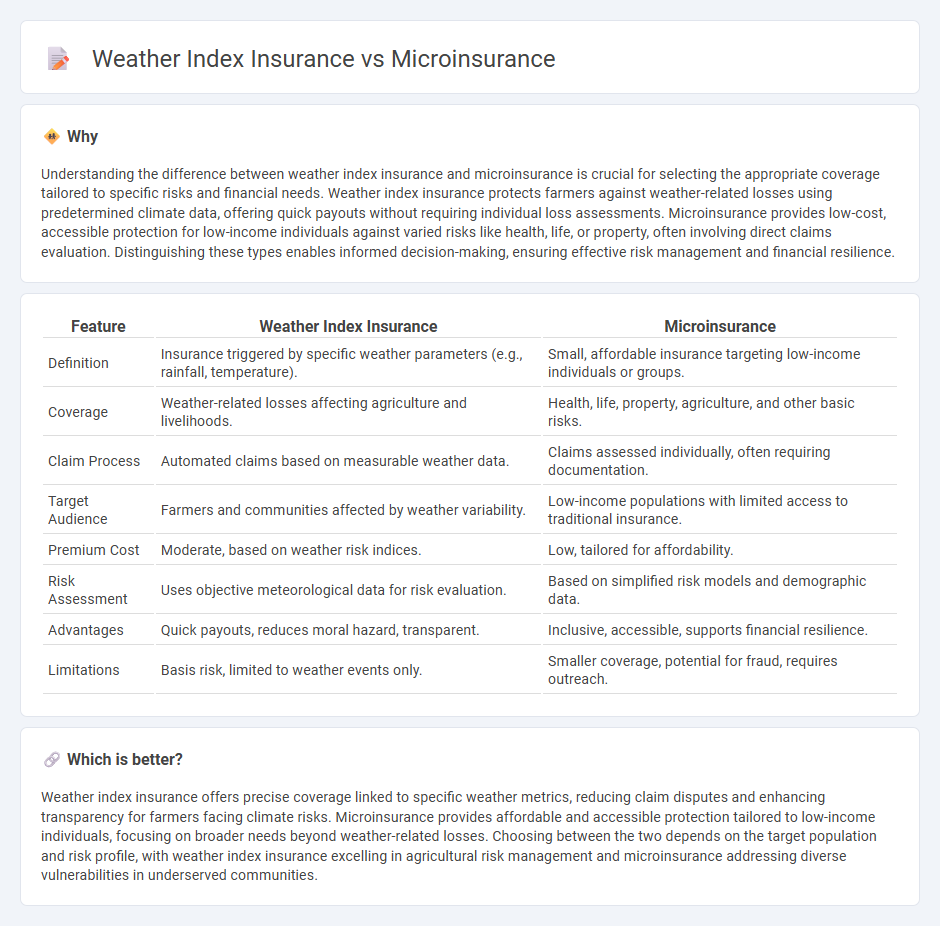

Understanding the difference between weather index insurance and microinsurance is crucial for selecting the appropriate coverage tailored to specific risks and financial needs. Weather index insurance protects farmers against weather-related losses using predetermined climate data, offering quick payouts without requiring individual loss assessments. Microinsurance provides low-cost, accessible protection for low-income individuals against varied risks like health, life, or property, often involving direct claims evaluation. Distinguishing these types enables informed decision-making, ensuring effective risk management and financial resilience.

Comparison Table

| Feature | Weather Index Insurance | Microinsurance |

|---|---|---|

| Definition | Insurance triggered by specific weather parameters (e.g., rainfall, temperature). | Small, affordable insurance targeting low-income individuals or groups. |

| Coverage | Weather-related losses affecting agriculture and livelihoods. | Health, life, property, agriculture, and other basic risks. |

| Claim Process | Automated claims based on measurable weather data. | Claims assessed individually, often requiring documentation. |

| Target Audience | Farmers and communities affected by weather variability. | Low-income populations with limited access to traditional insurance. |

| Premium Cost | Moderate, based on weather risk indices. | Low, tailored for affordability. |

| Risk Assessment | Uses objective meteorological data for risk evaluation. | Based on simplified risk models and demographic data. |

| Advantages | Quick payouts, reduces moral hazard, transparent. | Inclusive, accessible, supports financial resilience. |

| Limitations | Basis risk, limited to weather events only. | Smaller coverage, potential for fraud, requires outreach. |

Which is better?

Weather index insurance offers precise coverage linked to specific weather metrics, reducing claim disputes and enhancing transparency for farmers facing climate risks. Microinsurance provides affordable and accessible protection tailored to low-income individuals, focusing on broader needs beyond weather-related losses. Choosing between the two depends on the target population and risk profile, with weather index insurance excelling in agricultural risk management and microinsurance addressing diverse vulnerabilities in underserved communities.

Connection

Weather index insurance and microinsurance are connected through their shared goal of providing financial protection to vulnerable populations against specific risks such as climate variability and natural disasters. Weather index insurance uses measurable weather parameters like rainfall or temperature indices to trigger payouts, making it an efficient tool within microinsurance schemes targeted at low-income farmers. This integration enhances risk management by reducing claim verification costs and improving timely compensation in climate-sensitive sectors.

Key Terms

Premiums

Microinsurance premiums are generally low and tailored to low-income populations, offering affordable protection against specific risks. Weather index insurance premiums depend on predefined weather indices, such as rainfall or temperature, often resulting in more transparent and objective pricing. Explore the differences in premiums to understand which insurance model best fits your financial protection needs.

Risk Assessment

Microinsurance provides personalized risk assessment by evaluating individual or household-level vulnerabilities, leveraging detailed data on income, health, and asset exposure. Weather index insurance assesses risk through objective, location-based climate indicators such as rainfall or temperature thresholds, minimizing moral hazard and reducing administrative costs. Explore more to understand how these approaches can enhance tailored risk protection strategies.

Payout Trigger

Microinsurance uses individual claims data and loss assessments to determine payouts, offering personalized financial protection based on actual damages incurred. Weather index insurance relies on predefined weather parameters, such as rainfall or temperature thresholds, triggering payments automatically without individual loss verification, reducing administrative costs and enabling faster disbursements. Explore the differences in payout triggers to understand which insurance model best suits your risk management needs.

Source and External Links

Microinsurance - Wikipedia - Microinsurance is a financial arrangement offering low-income people protection against specific risks through affordable premium payments proportional to the risk, characterized by low premiums and low coverage limits, often distributed via various channels including microfinance institutions and insurance agents specialized in these products.

Background on: microinsurance and emerging markets | III - Microinsurance provides low-cost insurance products tailored for individuals in developing countries not covered by traditional insurance, often bundled with small loans and distributed through microfinance and humanitarian organizations, protecting low-income populations against financial losses from risks like health, crops, or livestock.

Microinsurance | Insurance | Milliman | Worldwide - Microinsurance is designed specifically for low-income families with affordable pricing, appropriate coverage, and accessible delivery methods to guard against risks such as poor health, natural disasters, and death, supported by initiatives from specialized consulting firms and development agencies worldwide.

dowidth.com

dowidth.com