Credit life insurance pays off outstanding debts if the policyholder dies, ensuring financial obligations are settled without burdening beneficiaries. Disability insurance provides income replacement when the insured is unable to work due to illness or injury, maintaining financial stability during recovery. Explore the differences between these essential protections to find the best fit for your financial security needs.

Why it is important

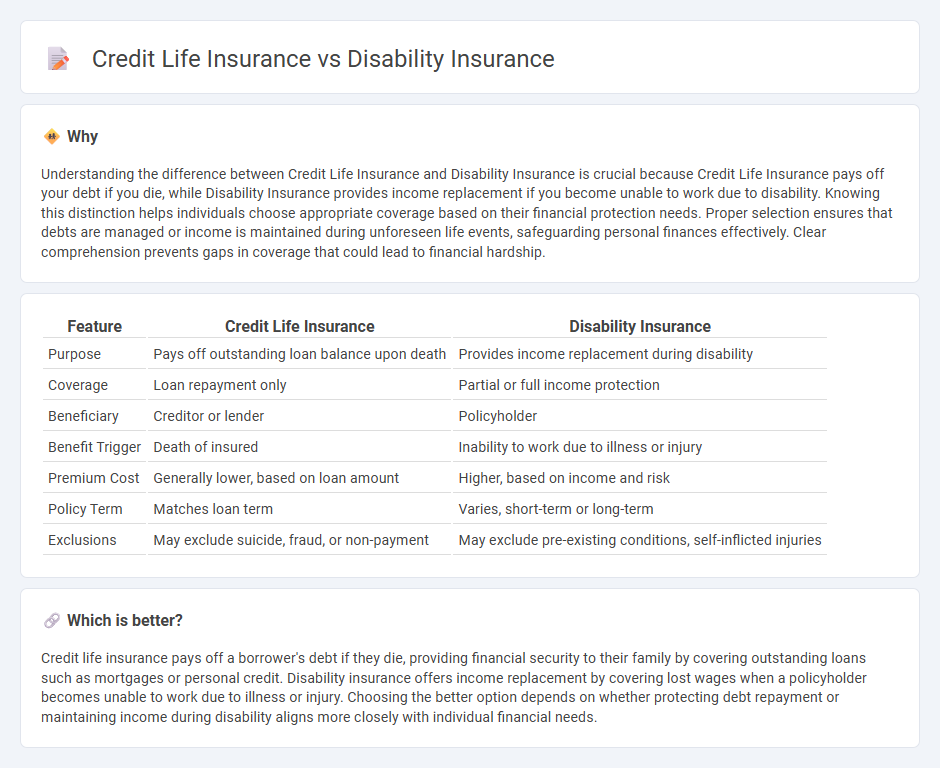

Understanding the difference between Credit Life Insurance and Disability Insurance is crucial because Credit Life Insurance pays off your debt if you die, while Disability Insurance provides income replacement if you become unable to work due to disability. Knowing this distinction helps individuals choose appropriate coverage based on their financial protection needs. Proper selection ensures that debts are managed or income is maintained during unforeseen life events, safeguarding personal finances effectively. Clear comprehension prevents gaps in coverage that could lead to financial hardship.

Comparison Table

| Feature | Credit Life Insurance | Disability Insurance |

|---|---|---|

| Purpose | Pays off outstanding loan balance upon death | Provides income replacement during disability |

| Coverage | Loan repayment only | Partial or full income protection |

| Beneficiary | Creditor or lender | Policyholder |

| Benefit Trigger | Death of insured | Inability to work due to illness or injury |

| Premium Cost | Generally lower, based on loan amount | Higher, based on income and risk |

| Policy Term | Matches loan term | Varies, short-term or long-term |

| Exclusions | May exclude suicide, fraud, or non-payment | May exclude pre-existing conditions, self-inflicted injuries |

Which is better?

Credit life insurance pays off a borrower's debt if they die, providing financial security to their family by covering outstanding loans such as mortgages or personal credit. Disability insurance offers income replacement by covering lost wages when a policyholder becomes unable to work due to illness or injury. Choosing the better option depends on whether protecting debt repayment or maintaining income during disability aligns more closely with individual financial needs.

Connection

Credit life insurance and disability insurance both protect borrowers by covering loan payments in case of unforeseen events. Credit life insurance pays off the loan balance if the insured dies, while disability insurance covers monthly loan payments if the borrower becomes disabled and unable to work. These policies reduce financial risk for lenders and ensure continued loan repayment despite the borrower's life or health changes.

Key Terms

Beneficiary

Disability insurance provides income replacement to the policyholder if they become unable to work due to illness or injury, directly supporting the insured rather than a third party. Credit life insurance, however, pays off the outstanding loan balance upon the policyholder's death, with the beneficiary typically being the lender rather than the insured or their family. Explore the differences in beneficiary designations and protections further to determine which coverage best suits your financial needs.

Premium

Disability insurance premiums are based on factors such as occupation, age, health status, and benefit amount, typically providing long-term income protection. Credit life insurance premiums are generally lower and linked to the loan amount and term, designed to pay off outstanding debts in case of death. Explore detailed comparisons to determine which premium structure suits your financial needs best.

Underwriting

Disability insurance underwriting assesses an applicant's medical history, occupation, and lifestyle to determine risk and premium rates, often requiring detailed health exams or questionnaires. Credit life insurance underwriting primarily evaluates the borrower's creditworthiness and loan amount, with less emphasis on personal health but sometimes includes basic health screening. Explore our comprehensive guide to understand the key underwriting differences between disability insurance and credit life insurance.

Source and External Links

Disability Insurance - A form of insurance that protects earned income against disabilities, maintaining financial stability by replacing a portion of lost income due to illness or injury.

Guardian Disability Insurance - Provides affordable plans for individuals and businesses to replace income if sickness or injury prevents working, offering long-term protection.

SSDI and SSI Benefits - Government programs offering financial assistance through Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) for those with disabilities or aged 65 and over.

dowidth.com

dowidth.com