Embedded insurance integrates coverage seamlessly within the purchase of products or services, offering convenience and tailored protection at the point of sale. Direct-to-consumer insurance bypasses traditional intermediaries, providing customers with personalized policies and often lower premiums through online platforms. Explore the distinct benefits and applications of each insurance model to determine the best fit for your needs.

Why it is important

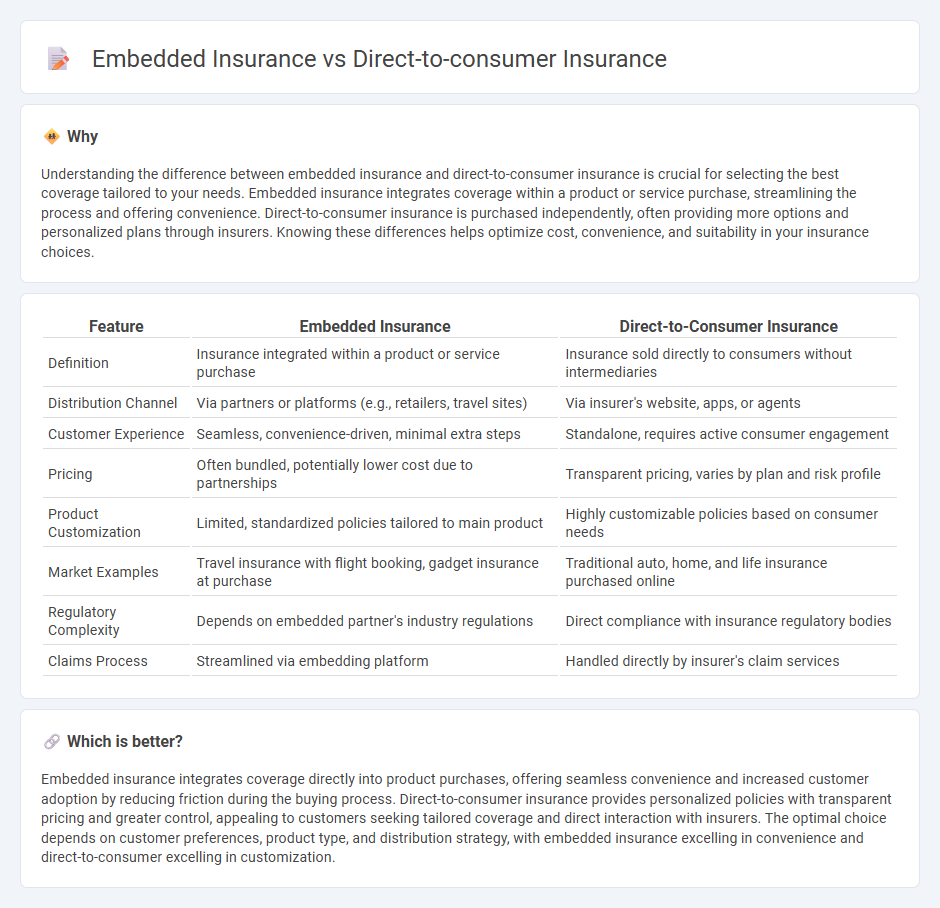

Understanding the difference between embedded insurance and direct-to-consumer insurance is crucial for selecting the best coverage tailored to your needs. Embedded insurance integrates coverage within a product or service purchase, streamlining the process and offering convenience. Direct-to-consumer insurance is purchased independently, often providing more options and personalized plans through insurers. Knowing these differences helps optimize cost, convenience, and suitability in your insurance choices.

Comparison Table

| Feature | Embedded Insurance | Direct-to-Consumer Insurance |

|---|---|---|

| Definition | Insurance integrated within a product or service purchase | Insurance sold directly to consumers without intermediaries |

| Distribution Channel | Via partners or platforms (e.g., retailers, travel sites) | Via insurer's website, apps, or agents |

| Customer Experience | Seamless, convenience-driven, minimal extra steps | Standalone, requires active consumer engagement |

| Pricing | Often bundled, potentially lower cost due to partnerships | Transparent pricing, varies by plan and risk profile |

| Product Customization | Limited, standardized policies tailored to main product | Highly customizable policies based on consumer needs |

| Market Examples | Travel insurance with flight booking, gadget insurance at purchase | Traditional auto, home, and life insurance purchased online |

| Regulatory Complexity | Depends on embedded partner's industry regulations | Direct compliance with insurance regulatory bodies |

| Claims Process | Streamlined via embedding platform | Handled directly by insurer's claim services |

Which is better?

Embedded insurance integrates coverage directly into product purchases, offering seamless convenience and increased customer adoption by reducing friction during the buying process. Direct-to-consumer insurance provides personalized policies with transparent pricing and greater control, appealing to customers seeking tailored coverage and direct interaction with insurers. The optimal choice depends on customer preferences, product type, and distribution strategy, with embedded insurance excelling in convenience and direct-to-consumer excelling in customization.

Connection

Embedded insurance integrates coverage options seamlessly into the purchase of products or services, enhancing customer convenience and trust. Direct-to-consumer insurance leverages digital platforms to offer personalized policies without intermediaries, driving efficiency and cost savings. Both models prioritize streamlined user experiences and data-driven customization, revolutionizing how insurance is accessed and purchased.

Key Terms

Distribution Channel

Direct-to-consumer insurance leverages digital platforms, enabling providers to sell policies directly to customers without intermediaries, increasing convenience and reducing costs. Embedded insurance integrates coverage seamlessly into the purchase of products or services, such as adding travel insurance at the point of booking a flight, enhancing user experience through contextual relevance. Discover how these distribution channels transform insurance accessibility and customer engagement.

Customer Touchpoint

Direct-to-consumer insurance offers customers a streamlined experience through dedicated channels such as company websites and mobile apps, enabling personalized control over policy choices and claims. Embedded insurance integrates coverage seamlessly into the purchase journey of related products or services, such as travel bookings or electronics sales, minimizing friction and enhancing convenience at critical decision points. Explore the strategic differences in customer touchpoints to understand how these models reshape engagement and satisfaction in insurance.

Product Integration

Direct-to-consumer insurance offers personalized policies directly through digital platforms, emphasizing user control and streamlined purchasing processes. Embedded insurance integrates coverage seamlessly within third-party products or services, enhancing convenience and contextual relevance for consumers. Explore how these models transform customer experience and drive innovation in the insurance industry.

Source and External Links

The Future of Direct-to-Consumer Insurance Sales - Covenir - Direct-to-consumer (D2C) insurance bypasses brokers and agents, allowing insurers to sell directly to policyholders, offering cost savings and improved customer experiences by reducing intermediaries and operational costs.

How Direct to Consumer Insurance Works - WaterStreet Company - D2C insurance lets customers purchase coverage directly from the insurer's website, enhancing product development through direct customer data and improving customer experiences via controlled sales processes and digital tools.

Optimize direct-to-consumer insurance for faster, smarter decisions - Adoption of AI and automation in D2C insurance models enables faster decision-making, personalized service, and seamless digital customer experiences by streamlining policy lifecycle processes from purchase to claims and renewals.

dowidth.com

dowidth.com