Natural catastrophe bonds transfer specific disaster risks to capital markets, offering investors returns linked to event outcomes with defined loss triggers. Finite risk insurance provides insurers limited risk exposure through multi-year, aggregate stop-loss covers that balance risk and capital management. Explore the features and benefits of these innovative risk transfer solutions to determine which fits your insurance strategy.

Why it is important

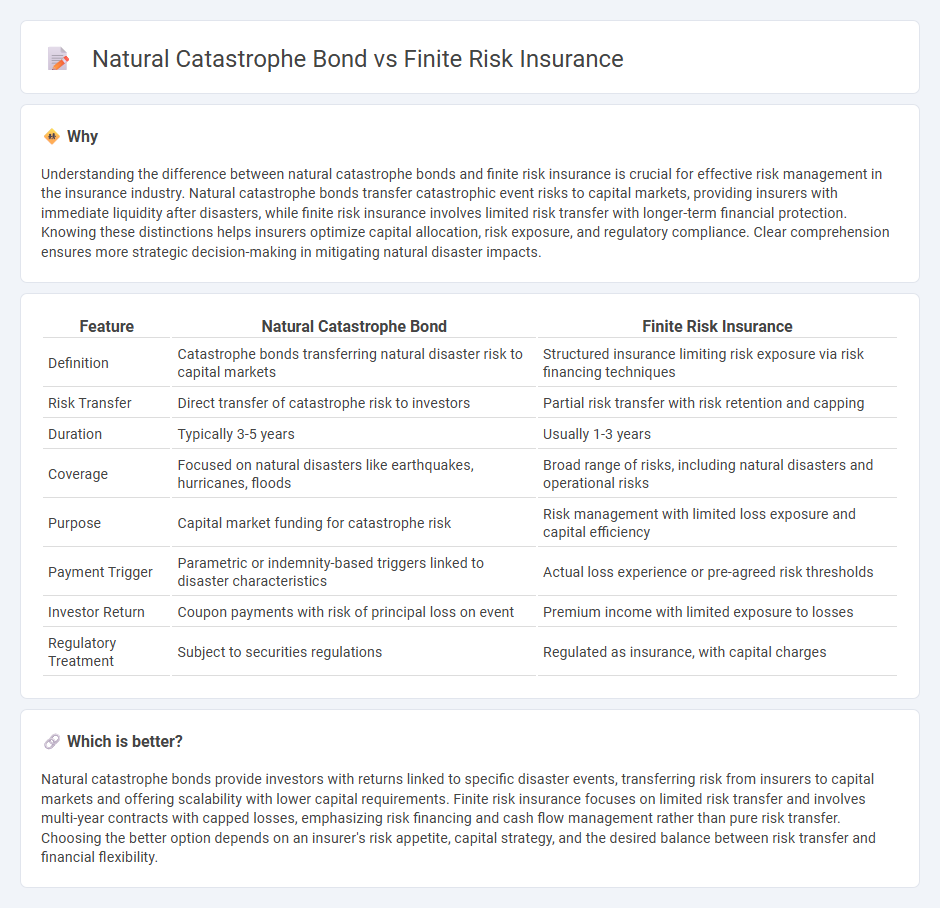

Understanding the difference between natural catastrophe bonds and finite risk insurance is crucial for effective risk management in the insurance industry. Natural catastrophe bonds transfer catastrophic event risks to capital markets, providing insurers with immediate liquidity after disasters, while finite risk insurance involves limited risk transfer with longer-term financial protection. Knowing these distinctions helps insurers optimize capital allocation, risk exposure, and regulatory compliance. Clear comprehension ensures more strategic decision-making in mitigating natural disaster impacts.

Comparison Table

| Feature | Natural Catastrophe Bond | Finite Risk Insurance |

|---|---|---|

| Definition | Catastrophe bonds transferring natural disaster risk to capital markets | Structured insurance limiting risk exposure via risk financing techniques |

| Risk Transfer | Direct transfer of catastrophe risk to investors | Partial risk transfer with risk retention and capping |

| Duration | Typically 3-5 years | Usually 1-3 years |

| Coverage | Focused on natural disasters like earthquakes, hurricanes, floods | Broad range of risks, including natural disasters and operational risks |

| Purpose | Capital market funding for catastrophe risk | Risk management with limited loss exposure and capital efficiency |

| Payment Trigger | Parametric or indemnity-based triggers linked to disaster characteristics | Actual loss experience or pre-agreed risk thresholds |

| Investor Return | Coupon payments with risk of principal loss on event | Premium income with limited exposure to losses |

| Regulatory Treatment | Subject to securities regulations | Regulated as insurance, with capital charges |

Which is better?

Natural catastrophe bonds provide investors with returns linked to specific disaster events, transferring risk from insurers to capital markets and offering scalability with lower capital requirements. Finite risk insurance focuses on limited risk transfer and involves multi-year contracts with capped losses, emphasizing risk financing and cash flow management rather than pure risk transfer. Choosing the better option depends on an insurer's risk appetite, capital strategy, and the desired balance between risk transfer and financial flexibility.

Connection

Natural catastrophe bonds transfer catastrophe risk from insurers to capital market investors, providing upfront capital to cover potential losses from events like hurricanes or earthquakes. Finite risk insurance involves limited risk transfer with risk-sharing measures between insurers and reinsurers, often used alongside catastrophe bonds to manage exposure and capital efficiently. Both instruments form part of integrated risk financing strategies to enhance insurer solvency and optimize risk capital allocation.

Key Terms

Finite Risk Insurance:

Finite risk insurance offers specialized risk transfer with limited coverage periods and fixed premiums, providing greater predictability for insurers managing long-term liabilities. Unlike natural catastrophe bonds, which are market-linked and pay out based on predefined catastrophe triggers, finite risk insurance focuses on blending traditional insurance and financial elements to optimize capital management. Explore the benefits and mechanisms of finite risk insurance in depth to enhance your risk mitigation strategies.

Risk Retention

Finite risk insurance limits an insurer's maximum loss exposure by capping retained risks through structured contracts, which integrate risk sharing with reinsurance layers. Natural catastrophe bonds transfer defined disaster risks to capital markets, allowing issuers to retain initial risk levels but shift potential large losses to bond investors. Explore more about risk retention strategies and their impact on capital management in these financial instruments.

Limited Risk Transfer

Finite risk insurance offers limited risk transfer by blending risk financing and risk management, typically capping insurer losses and allowing policyholders to retain a portion of the risk. Natural catastrophe bonds transfer risk to capital markets by incorporating parametric triggers that enable issuers to access funds only under specific disaster conditions, thus fully transferring catastrophic risk off-balance sheet. Explore further to understand the nuances and applications of limited risk transfer mechanisms in disaster risk financing.

Source and External Links

Finite Risk Insurance - IRMI - Finite risk insurance is an insurance contract that shifts risk for a stated number of years, often with a commutation feature and profit sharing.

Finite Risk Insurance - Wikipedia - Finite risk insurance is an alternative risk transfer product that involves multi-year contracts, often with conservative risk assessment and profit sharing between insurer and insured.

Finite Risk Reinsurance - III - Finite risk reinsurance is a form of reinsurance that involves multi-year contracts, incorporating time value of money, and focuses on risk financing rather than traditional risk transfer.

dowidth.com

dowidth.com