Credit life insurance covers outstanding loan balances in case of policyholder's death, ensuring creditors receive payment without burdening beneficiaries. Endowment insurance combines savings with life coverage, paying a lump sum either on maturity or upon the insured's death, supporting long-term financial goals. Explore the key differences and benefits of credit life insurance versus endowment insurance to choose the best fit for your financial security.

Why it is important

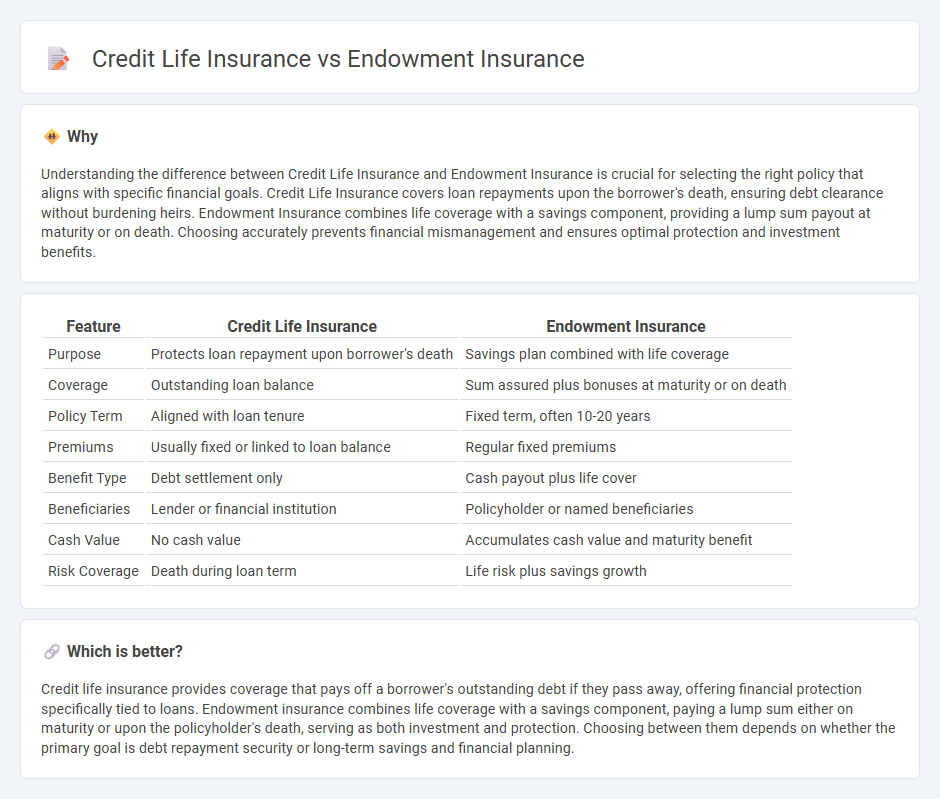

Understanding the difference between Credit Life Insurance and Endowment Insurance is crucial for selecting the right policy that aligns with specific financial goals. Credit Life Insurance covers loan repayments upon the borrower's death, ensuring debt clearance without burdening heirs. Endowment Insurance combines life coverage with a savings component, providing a lump sum payout at maturity or on death. Choosing accurately prevents financial mismanagement and ensures optimal protection and investment benefits.

Comparison Table

| Feature | Credit Life Insurance | Endowment Insurance |

|---|---|---|

| Purpose | Protects loan repayment upon borrower's death | Savings plan combined with life coverage |

| Coverage | Outstanding loan balance | Sum assured plus bonuses at maturity or on death |

| Policy Term | Aligned with loan tenure | Fixed term, often 10-20 years |

| Premiums | Usually fixed or linked to loan balance | Regular fixed premiums |

| Benefit Type | Debt settlement only | Cash payout plus life cover |

| Beneficiaries | Lender or financial institution | Policyholder or named beneficiaries |

| Cash Value | No cash value | Accumulates cash value and maturity benefit |

| Risk Coverage | Death during loan term | Life risk plus savings growth |

Which is better?

Credit life insurance provides coverage that pays off a borrower's outstanding debt if they pass away, offering financial protection specifically tied to loans. Endowment insurance combines life coverage with a savings component, paying a lump sum either on maturity or upon the policyholder's death, serving as both investment and protection. Choosing between them depends on whether the primary goal is debt repayment security or long-term savings and financial planning.

Connection

Credit life insurance and endowment insurance are connected through their shared focus on financial protection and savings. Credit life insurance pays off outstanding debts in the event of the policyholder's death, ensuring loan obligations do not burden beneficiaries, while endowment insurance combines life coverage with a savings component that matures after a specified term or upon death. Both policies provide security for families by managing financial liabilities and accumulating funds for future needs.

Key Terms

Maturity Benefit

Endowment insurance offers a maturity benefit that pays a lump sum if the policyholder survives the policy term, combining savings with insurance coverage. Credit life insurance primarily covers outstanding loan balances in case of death, with no maturity benefit paid to the policyholder. Explore the differences further to determine which policy best suits your financial goals and protection needs.

Policyholder

Endowment insurance provides policyholders with a savings component that matures with a lump sum payment, offering both financial protection and wealth accumulation. Credit life insurance specifically covers loan repayments by settling outstanding debt if the policyholder dies or becomes disabled, ensuring the borrower's obligations are met without burdening their family. Explore detailed comparisons to understand which policy best aligns with your financial goals and protection needs.

Debt Protection

Endowment insurance combines savings and life coverage, providing a lump sum at maturity or upon death, which can be used to repay outstanding debts and build financial security. Credit life insurance specifically targets debt protection by paying off a borrower's loan balance if they die or become incapacitated, ensuring lenders are reimbursed without burdening beneficiaries. Explore the key differences and benefits of each option to choose the best debt protection strategy for your financial needs.

Source and External Links

What is an Endowment Plan? Learn Benefits & How It Works - This webpage provides a beginner's guide to endowment plans, highlighting their benefits and how they combine life insurance with long-term savings.

What is Endowment Life Insurance? - This page explains endowment life insurance as a temporary policy that combines term life insurance with a savings component, offering a guaranteed payout.

Endowment Policy - This Wikipedia article describes an endowment policy as a life insurance contract designed to pay a lump sum after a specific term or on death, often used to repay loans like mortgages.

dowidth.com

dowidth.com