Natural catastrophe bonds provide investors with exposure to losses from specific disasters, transferring risk from insurers to capital markets. Industry loss warranties offer coverage triggered by aggregated industry losses exceeding a predefined threshold, protecting insurers against widespread catastrophe impacts. Explore the differences between these innovative insurance solutions to optimize risk management strategies.

Why it is important

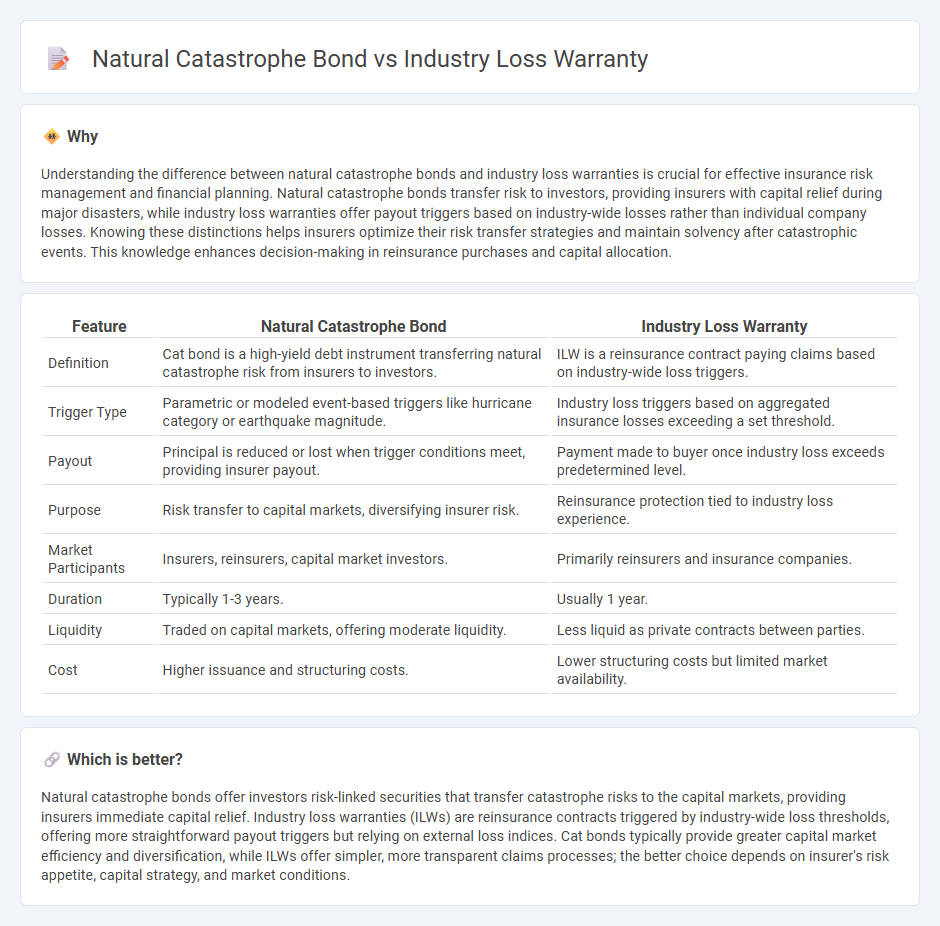

Understanding the difference between natural catastrophe bonds and industry loss warranties is crucial for effective insurance risk management and financial planning. Natural catastrophe bonds transfer risk to investors, providing insurers with capital relief during major disasters, while industry loss warranties offer payout triggers based on industry-wide losses rather than individual company losses. Knowing these distinctions helps insurers optimize their risk transfer strategies and maintain solvency after catastrophic events. This knowledge enhances decision-making in reinsurance purchases and capital allocation.

Comparison Table

| Feature | Natural Catastrophe Bond | Industry Loss Warranty |

|---|---|---|

| Definition | Cat bond is a high-yield debt instrument transferring natural catastrophe risk from insurers to investors. | ILW is a reinsurance contract paying claims based on industry-wide loss triggers. |

| Trigger Type | Parametric or modeled event-based triggers like hurricane category or earthquake magnitude. | Industry loss triggers based on aggregated insurance losses exceeding a set threshold. |

| Payout | Principal is reduced or lost when trigger conditions meet, providing insurer payout. | Payment made to buyer once industry loss exceeds predetermined level. |

| Purpose | Risk transfer to capital markets, diversifying insurer risk. | Reinsurance protection tied to industry loss experience. |

| Market Participants | Insurers, reinsurers, capital market investors. | Primarily reinsurers and insurance companies. |

| Duration | Typically 1-3 years. | Usually 1 year. |

| Liquidity | Traded on capital markets, offering moderate liquidity. | Less liquid as private contracts between parties. |

| Cost | Higher issuance and structuring costs. | Lower structuring costs but limited market availability. |

Which is better?

Natural catastrophe bonds offer investors risk-linked securities that transfer catastrophe risks to the capital markets, providing insurers immediate capital relief. Industry loss warranties (ILWs) are reinsurance contracts triggered by industry-wide loss thresholds, offering more straightforward payout triggers but relying on external loss indices. Cat bonds typically provide greater capital market efficiency and diversification, while ILWs offer simpler, more transparent claims processes; the better choice depends on insurer's risk appetite, capital strategy, and market conditions.

Connection

Natural catastrophe bonds and industry loss warranties are financial instruments designed to transfer insurance risk from insurers to capital markets, providing protection against significant losses from natural disasters such as hurricanes or earthquakes. Both tools enable insurers to manage exposure by triggering payouts based on predefined loss thresholds or parametric events, effectively stabilizing financial performance after catastrophic incidents. These risk transfer mechanisms enhance market capacity and improve liquidity in the insurance industry by attracting alternative capital sources.

Key Terms

Trigger Mechanism

Industry loss warranties (ILWs) activate payouts based on industry-wide loss figures, serving as parametric triggers tied to aggregate insurance losses reported by third parties. Natural catastrophe bonds (cat bonds) utilize predefined event parameters such as earthquake magnitude or hurricane wind speed, relying on modeled or actual seismic or meteorological data to determine payout triggers. Explore the distinct trigger mechanisms and practical implications of ILWs versus cat bonds to optimize risk management strategies.

Payout Structure

Industry loss warranties (ILWs) trigger payouts based on the insurance industry's aggregate losses exceeding a predefined threshold, offering a straightforward, event-linked indemnity mechanism. Natural catastrophe bonds (cat bonds) provide structured payouts tied to specific parametric triggers like wind speed or earthquake magnitude, enabling faster loss estimation and reduced moral hazard. Explore detailed comparisons to understand which payout structure aligns best with your risk management strategy.

Risk Transfer

Industry Loss Warranties (ILWs) offer insurers protection by triggering payments based on predefined industry-wide loss thresholds, providing efficient risk transfer from catastrophic events. Natural Catastrophe Bonds transfer insurer risk to capital markets via investor-funded bonds that pay out upon the occurrence of specified natural disasters, diversifying risk beyond traditional reinsurance. Explore how these innovative financial instruments optimize risk management strategies in the insurance sector.

Source and External Links

Industry loss warranty - Wikipedia - Industry loss warranties (ILWs) are reinsurance contracts where protection is purchased based on total losses to the entire insurance industry from a single event exceeding a predefined threshold (trigger), rather than the buyer's own losses, offering a payout up to a specified limit.

What are industry loss warranties (or ILW's)? - Artemis.bm - ILWs are reinsurance or derivative contracts paid out if industry-wide insured losses exceed a set trigger, with variations including live cat (during an event) and dead cat (post-event) contracts, often involving reinsurers or hedge funds as protection writers.

Industry Loss Warranties (ILW) - Turker Broker - ILWs are insurance-linked securities financing rare catastrophic risks like hurricanes or earthquakes, triggered by an industry loss index where payout depends on combined industry losses surpassing a predetermined threshold with options for occurrence or aggregate event triggers.

dowidth.com

dowidth.com