On-demand insurance provides flexible, pay-as-you-go coverage for specific needs, offering users immediate protection without long-term commitments. Peer-to-peer insurance pools members together to share risks and reduce costs, fostering community-driven claims management and increased transparency. Discover how these innovative models are transforming the insurance landscape and which option suits your lifestyle best.

Why it is important

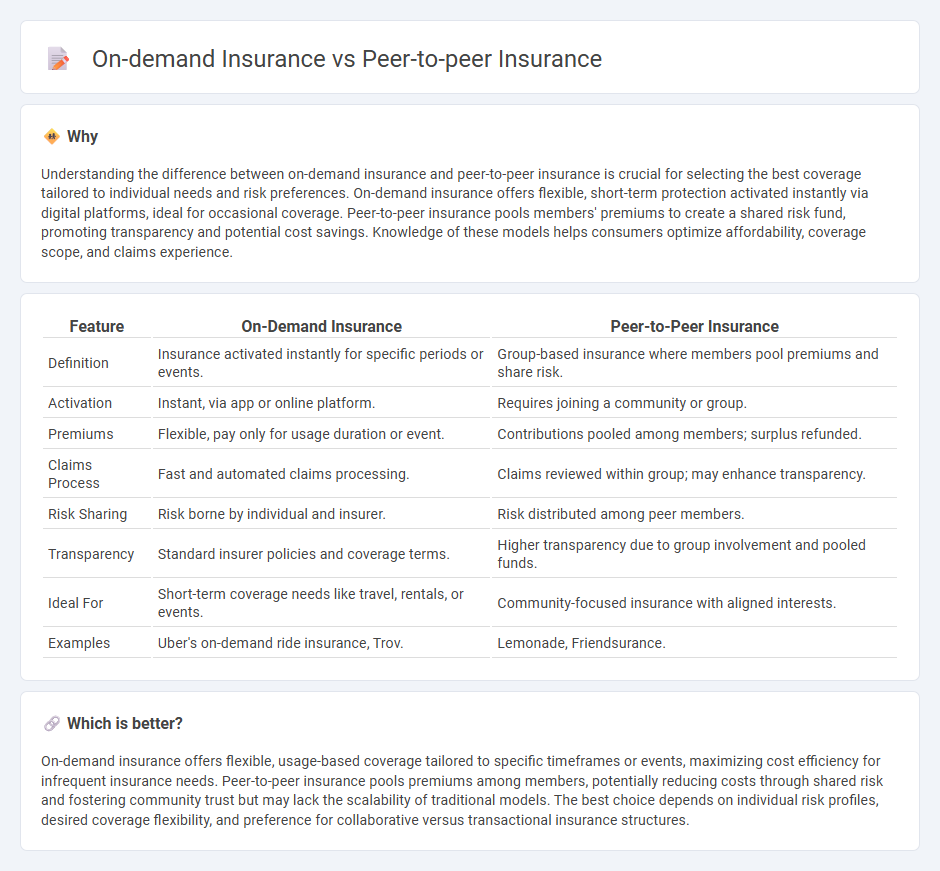

Understanding the difference between on-demand insurance and peer-to-peer insurance is crucial for selecting the best coverage tailored to individual needs and risk preferences. On-demand insurance offers flexible, short-term protection activated instantly via digital platforms, ideal for occasional coverage. Peer-to-peer insurance pools members' premiums to create a shared risk fund, promoting transparency and potential cost savings. Knowledge of these models helps consumers optimize affordability, coverage scope, and claims experience.

Comparison Table

| Feature | On-Demand Insurance | Peer-to-Peer Insurance |

|---|---|---|

| Definition | Insurance activated instantly for specific periods or events. | Group-based insurance where members pool premiums and share risk. |

| Activation | Instant, via app or online platform. | Requires joining a community or group. |

| Premiums | Flexible, pay only for usage duration or event. | Contributions pooled among members; surplus refunded. |

| Claims Process | Fast and automated claims processing. | Claims reviewed within group; may enhance transparency. |

| Risk Sharing | Risk borne by individual and insurer. | Risk distributed among peer members. |

| Transparency | Standard insurer policies and coverage terms. | Higher transparency due to group involvement and pooled funds. |

| Ideal For | Short-term coverage needs like travel, rentals, or events. | Community-focused insurance with aligned interests. |

| Examples | Uber's on-demand ride insurance, Trov. | Lemonade, Friendsurance. |

Which is better?

On-demand insurance offers flexible, usage-based coverage tailored to specific timeframes or events, maximizing cost efficiency for infrequent insurance needs. Peer-to-peer insurance pools premiums among members, potentially reducing costs through shared risk and fostering community trust but may lack the scalability of traditional models. The best choice depends on individual risk profiles, desired coverage flexibility, and preference for collaborative versus transactional insurance structures.

Connection

On-demand insurance and peer-to-peer insurance both leverage technology to offer flexible, customer-centric coverage models that reduce traditional insurer overhead. On-demand insurance provides coverage only when needed, while peer-to-peer insurance pools risk among groups of individuals, promoting transparency and potentially lower premiums. These innovative approaches utilize digital platforms and data analytics to create efficient, personalized insurance solutions.

Key Terms

Peer-to-Peer Insurance:

Peer-to-peer insurance leverages a decentralized community model where members pool premiums to cover claims, reducing reliance on traditional insurers and often lowering costs. This model enhances transparency and fosters trust by aligning the interests of policyholders who share similar risk profiles. Explore how peer-to-peer insurance revolutionizes risk sharing and empowers consumers with more control over their coverage options.

Risk Pooling

Peer-to-peer insurance leverages risk pooling by grouping members together who share similar risk profiles, allowing claims to be paid collectively from a shared pool contributed by peers, reducing overhead costs and enhancing transparency. On-demand insurance provides flexible, short-term coverage tailored to specific needs without a traditional risk pool, often relying on digital platforms and algorithms to assess and price individual risk dynamically. Explore how these innovative models transform risk management and customer experience in the insurance industry.

Member Contributions

Peer-to-peer insurance pools member contributions to create a shared risk fund, enhancing transparency and reducing reliance on traditional insurers. On-demand insurance collects premiums only for the coverage period needed, offering flexibility but often at higher costs due to short-term risk assessments. Explore how these models optimize member contributions to find the best fit for your insurance needs.

Source and External Links

Insurance Topics | Peer-to-Peer Insurance - Peer-to-peer (P2P) insurance allows a group of insured individuals to pool their capital, self-organize, and self-administer insurance, which creates transparency, control, and reduced costs by combining traditional risk pooling with modern technology and mutual trust among members.

Peer-to-peer insurance - Wikipedia - P2P insurance is a collaborative insurance model where participants gain greater control over their coverage, including forming risk pools, making decisions on the pool's funds, and even adjudicating claims, traditionally handled by carriers.

How Peer-to-Peer Insurance Works - The Actuary Magazine - Peer-to-peer insurance is a novel model that merges sharing economy principles and technology with insurance's mutual roots, where groups of participants pool funds to collectively manage and insure against shared risks without a traditional insurer.

dowidth.com

dowidth.com