Flood risk modeling utilizes geospatial data, historical weather patterns, and hydrological simulations to predict potential flood impacts and inform insurance underwriting decisions. Morbidity risk modeling focuses on analyzing patient health records, demographic factors, and lifestyle indicators to assess the likelihood of disease occurrence and healthcare costs. Explore expert insights to understand how these risk models transform insurance strategies and improve risk management.

Why it is important

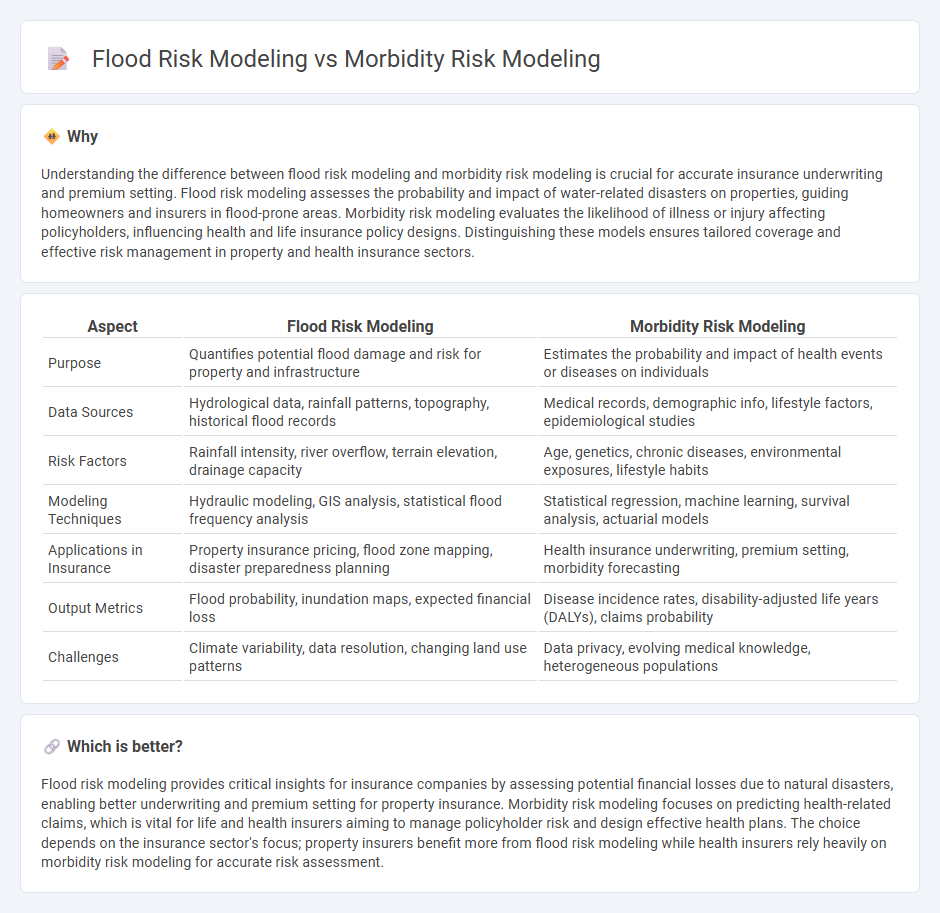

Understanding the difference between flood risk modeling and morbidity risk modeling is crucial for accurate insurance underwriting and premium setting. Flood risk modeling assesses the probability and impact of water-related disasters on properties, guiding homeowners and insurers in flood-prone areas. Morbidity risk modeling evaluates the likelihood of illness or injury affecting policyholders, influencing health and life insurance policy designs. Distinguishing these models ensures tailored coverage and effective risk management in property and health insurance sectors.

Comparison Table

| Aspect | Flood Risk Modeling | Morbidity Risk Modeling |

|---|---|---|

| Purpose | Quantifies potential flood damage and risk for property and infrastructure | Estimates the probability and impact of health events or diseases on individuals |

| Data Sources | Hydrological data, rainfall patterns, topography, historical flood records | Medical records, demographic info, lifestyle factors, epidemiological studies |

| Risk Factors | Rainfall intensity, river overflow, terrain elevation, drainage capacity | Age, genetics, chronic diseases, environmental exposures, lifestyle habits |

| Modeling Techniques | Hydraulic modeling, GIS analysis, statistical flood frequency analysis | Statistical regression, machine learning, survival analysis, actuarial models |

| Applications in Insurance | Property insurance pricing, flood zone mapping, disaster preparedness planning | Health insurance underwriting, premium setting, morbidity forecasting |

| Output Metrics | Flood probability, inundation maps, expected financial loss | Disease incidence rates, disability-adjusted life years (DALYs), claims probability |

| Challenges | Climate variability, data resolution, changing land use patterns | Data privacy, evolving medical knowledge, heterogeneous populations |

Which is better?

Flood risk modeling provides critical insights for insurance companies by assessing potential financial losses due to natural disasters, enabling better underwriting and premium setting for property insurance. Morbidity risk modeling focuses on predicting health-related claims, which is vital for life and health insurers aiming to manage policyholder risk and design effective health plans. The choice depends on the insurance sector's focus; property insurers benefit more from flood risk modeling while health insurers rely heavily on morbidity risk modeling for accurate risk assessment.

Connection

Flood risk modeling and morbidity risk modeling intersect through their focus on environmental and health risk assessment, particularly in disaster-prone regions. Accurate flood risk models inform public health strategies by predicting waterborne disease outbreaks and injury patterns, which are critical components of morbidity risk models. Integrating these models enhances insurance underwriting precision, enabling more effective risk mitigation and tailored coverage for flood-related health impacts.

Key Terms

**Morbidity risk modeling:**

Morbidity risk modeling predicts the likelihood of disease occurrence by analyzing demographic, genetic, environmental, and lifestyle data to identify vulnerable populations and inform public health interventions. Advanced statistical techniques and machine learning algorithms enhance accuracy by integrating electronic health records, epidemiological data, and real-time health monitoring. Discover more about how morbidity risk modeling transforms healthcare planning and disease prevention strategies.

Incidence Rate

Morbidity risk modeling focuses on predicting the incidence rate of diseases within specific populations, using healthcare data, demographic factors, and environmental influences. Flood risk modeling evaluates the probability and severity of flood events by analyzing hydrological data, weather patterns, and geographic vulnerability, with no direct application to incidence rates. Discover more about how incidence rates shape risk modeling applications across different fields.

Underwriting

Morbidity risk modeling quantifies the likelihood and severity of health-related claims, incorporating demographic data, medical history, and lifestyle factors to enhance underwriting precision. Flood risk modeling evaluates geographic, hydrological, and structural vulnerabilities to predict flood occurrence and potential damage, crucial for property insurance underwriting. Discover detailed methodologies and applications in underwriting risk assessment to improve decision-making accuracy.

Source and External Links

Predictive Modeling of Morbidity and Mortality - This study explores predictive models for morbidity and mortality, highlighting the importance of recent clinical data in predicting patient outcomes.

Life Risk Models - These models account for dynamic changes in mortality and morbidity risk, incorporating factors such as lifestyle and socioeconomic status.

Mortality Risk Prediction Models - Discusses the use of mortality risk models to evaluate ICU performance and improve quality of care.

Multimorbidity and Mortality Models - These models are used to predict complications from invasive procedures, ensuring accurate risk assessment for decision-making.

Predictive Modeling in Healthcare - Focuses on predicting patient outcomes using recent clinical data, especially for those at high risk of mortality.

Mortality Projection Models - Uses stochastic approaches to project mortality risks based on individual health data and lifestyle factors.

Methods of Assessing Mortality Risk - Discusses the evolution of mortality risk models, including the use of logistic regression and expert variable selection.

Predictive Modeling Techniques - Explores the use of logistic regression and XGBoost models for predicting morbidity and mortality.

Life Risk Modeling Techniques - Incorporates stochastic modeling to provide detailed mortality projections over time.

dowidth.com

dowidth.com