Microinsurance provides affordable coverage tailored for low-income individuals, offering protection against specific risks like health emergencies, crop failures, or natural disasters. Commercial insurance targets businesses and high-net-worth individuals, delivering comprehensive policies that cover a wide range of assets, liabilities, and risks with higher premiums. Explore detailed comparisons to understand which insurance solution best suits your needs.

Why it is important

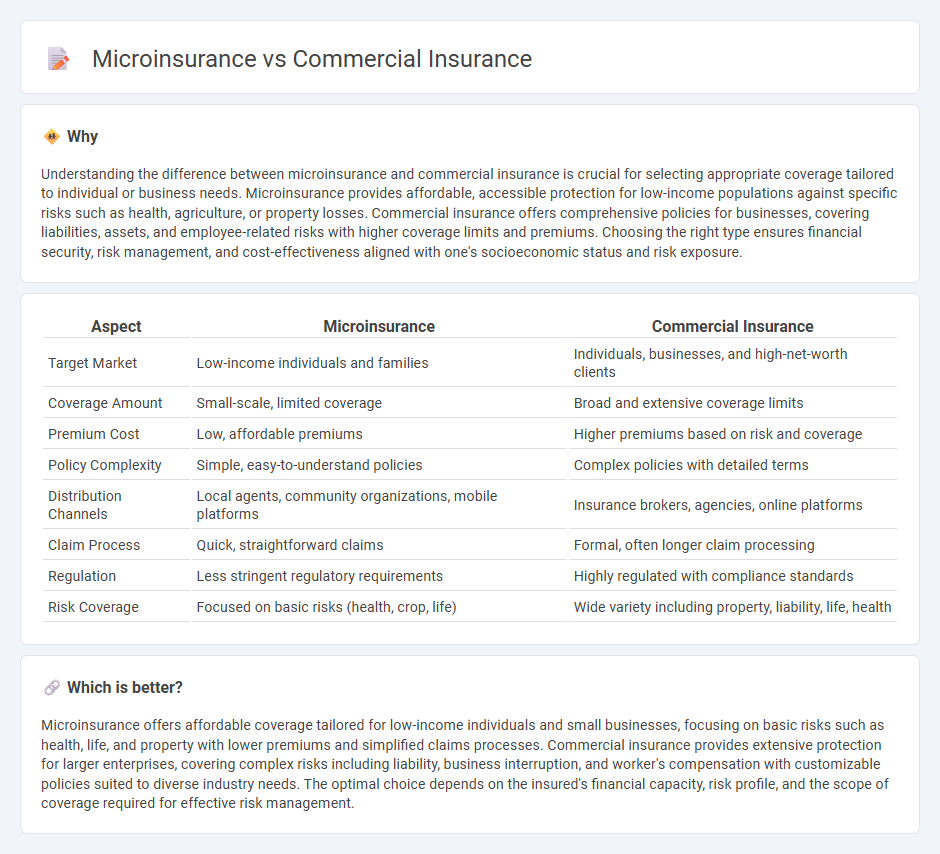

Understanding the difference between microinsurance and commercial insurance is crucial for selecting appropriate coverage tailored to individual or business needs. Microinsurance provides affordable, accessible protection for low-income populations against specific risks such as health, agriculture, or property losses. Commercial insurance offers comprehensive policies for businesses, covering liabilities, assets, and employee-related risks with higher coverage limits and premiums. Choosing the right type ensures financial security, risk management, and cost-effectiveness aligned with one's socioeconomic status and risk exposure.

Comparison Table

| Aspect | Microinsurance | Commercial Insurance |

|---|---|---|

| Target Market | Low-income individuals and families | Individuals, businesses, and high-net-worth clients |

| Coverage Amount | Small-scale, limited coverage | Broad and extensive coverage limits |

| Premium Cost | Low, affordable premiums | Higher premiums based on risk and coverage |

| Policy Complexity | Simple, easy-to-understand policies | Complex policies with detailed terms |

| Distribution Channels | Local agents, community organizations, mobile platforms | Insurance brokers, agencies, online platforms |

| Claim Process | Quick, straightforward claims | Formal, often longer claim processing |

| Regulation | Less stringent regulatory requirements | Highly regulated with compliance standards |

| Risk Coverage | Focused on basic risks (health, crop, life) | Wide variety including property, liability, life, health |

Which is better?

Microinsurance offers affordable coverage tailored for low-income individuals and small businesses, focusing on basic risks such as health, life, and property with lower premiums and simplified claims processes. Commercial insurance provides extensive protection for larger enterprises, covering complex risks including liability, business interruption, and worker's compensation with customizable policies suited to diverse industry needs. The optimal choice depends on the insured's financial capacity, risk profile, and the scope of coverage required for effective risk management.

Connection

Microinsurance and commercial insurance are connected through their shared goal of risk management tailored to different market segments: microinsurance targets low-income individuals with affordable, simplified coverage, while commercial insurance serves businesses with comprehensive policies for complex risks. Both utilize actuarial data and underwriting principles to assess and price risk accurately, ensuring financial protection and stability. The growth of microinsurance expands the insurance market base, potentially leading to increased demand for commercial insurance products as small businesses scale.

Key Terms

Risk Pooling

Risk pooling in commercial insurance involves aggregating premiums from a large number of policyholders to cover substantial and diverse risks, often targeting businesses and high-value assets. Microinsurance utilizes risk pooling on a smaller scale, concentrating on low-income individuals or communities with limited premium contributions designed to protect against specific, everyday risks. Explore more to understand how risk pooling impacts coverage, scalability, and affordability in both insurance models.

Premium Structure

Commercial insurance typically features high premiums based on extensive risk assessment, tailored to large-scale business needs and asset values. Microinsurance offers significantly lower premiums, structured to provide affordable coverage for low-income individuals or small enterprises with simplified underwriting processes. Explore the key differences in premium structures to determine which insurance model best suits your financial risk management needs.

Coverage Limits

Commercial insurance typically offers high coverage limits suited for large-scale business risks, protecting assets like property, liability, and business interruption with substantial financial backing. Microinsurance provides lower coverage limits designed to meet the needs of low-income individuals or small businesses, offering affordable protection against risks such as health issues, crop failure, or property damage. Explore the differences in coverage limits to determine which insurance solution aligns best with your specific risk management needs.

Source and External Links

Zurich North America Insurance - Offers a variety of commercial insurance types, including property, casualty, and workers' compensation to protect businesses from various risks.

Nationwide Commercial Insurance - Provides tailored coverages across industries such as workers' compensation, commercial packaged solutions, and agribusiness insurance.

Chubb Commercial Insurance - Offers industry-specific solutions for businesses of all sizes, leveraging expertise in 30 specialized industry practices.

dowidth.com

dowidth.com