Pet health insurance covers veterinary expenses, including accidents, illnesses, and routine care, protecting pets and managing unexpected medical costs. Business insurance safeguards companies against risks such as liability, property damage, and employee-related incidents, ensuring financial stability and continuity. Explore the distinct benefits and coverage options of pet health insurance versus business insurance to make informed decisions.

Why it is important

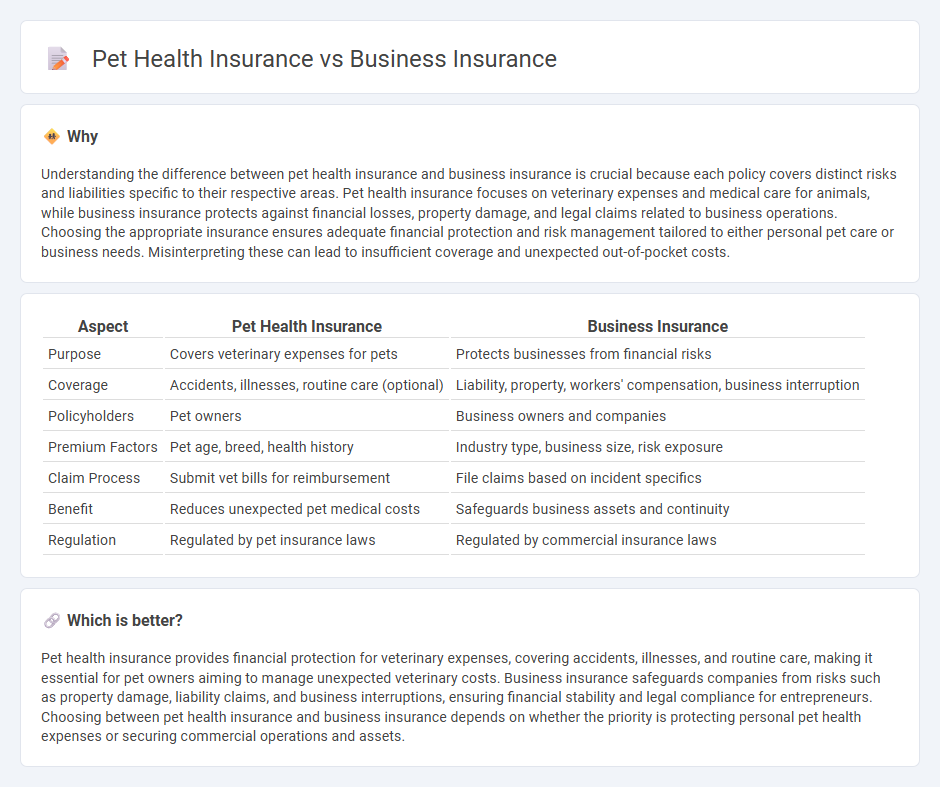

Understanding the difference between pet health insurance and business insurance is crucial because each policy covers distinct risks and liabilities specific to their respective areas. Pet health insurance focuses on veterinary expenses and medical care for animals, while business insurance protects against financial losses, property damage, and legal claims related to business operations. Choosing the appropriate insurance ensures adequate financial protection and risk management tailored to either personal pet care or business needs. Misinterpreting these can lead to insufficient coverage and unexpected out-of-pocket costs.

Comparison Table

| Aspect | Pet Health Insurance | Business Insurance |

|---|---|---|

| Purpose | Covers veterinary expenses for pets | Protects businesses from financial risks |

| Coverage | Accidents, illnesses, routine care (optional) | Liability, property, workers' compensation, business interruption |

| Policyholders | Pet owners | Business owners and companies |

| Premium Factors | Pet age, breed, health history | Industry type, business size, risk exposure |

| Claim Process | Submit vet bills for reimbursement | File claims based on incident specifics |

| Benefit | Reduces unexpected pet medical costs | Safeguards business assets and continuity |

| Regulation | Regulated by pet insurance laws | Regulated by commercial insurance laws |

Which is better?

Pet health insurance provides financial protection for veterinary expenses, covering accidents, illnesses, and routine care, making it essential for pet owners aiming to manage unexpected veterinary costs. Business insurance safeguards companies from risks such as property damage, liability claims, and business interruptions, ensuring financial stability and legal compliance for entrepreneurs. Choosing between pet health insurance and business insurance depends on whether the priority is protecting personal pet health expenses or securing commercial operations and assets.

Connection

Pet health insurance and business insurance both involve risk management strategies aimed at minimizing financial losses. Businesses offering pet-related services often require pet health insurance coverage to assure clients of responsible care, while business insurance covers operational risks. Integrating pet health insurance with business insurance policies enhances overall protection for veterinary clinics, pet boarding facilities, and pet retail companies.

Key Terms

**Business Insurance:**

Business insurance protects companies against financial losses from risks such as property damage, liability claims, and employee-related incidents, ensuring operational continuity. It encompasses various policies including general liability, workers' compensation, and commercial property insurance tailored to specific industries. Discover comprehensive strategies and coverage options to safeguard your business effectively.

Liability Coverage

Business insurance includes liability coverage that protects companies from claims related to bodily injury, property damage, and legal defense costs. Pet health insurance primarily covers veterinary expenses for illnesses and accidents, lacking liability protection for pet-related damages. Explore detailed comparisons to choose the right coverage for your needs.

Property Damage

Business insurance covers property damage for commercial assets, including buildings, equipment, and inventory, ensuring protection against risks like fire, theft, and natural disasters. Pet health insurance primarily focuses on veterinary expenses and does not cover property damage related to pets. Explore detailed coverage differences to make informed decisions for both business and pet protection.

Source and External Links

Business Insurance - Provides news and resources for business executives managing corporate insurance and self-insurance programs.

Progressive Commercial - Offers business insurance quotes to protect small businesses from financial losses due to accidents, property damage, and professional claims.

NEXT Insurance - Provides business insurance to help protect small businesses, self-employed workers, and other types of businesses from liabilities and property damage.

dowidth.com

dowidth.com