Pandemic business interruption insurance covers financial losses resulting from disruptions caused by widespread infectious disease outbreaks, protecting businesses against revenue loss during shutdowns or reduced operations. Cyber risk insurance safeguards companies from damages due to cyberattacks, data breaches, and other digital threats, including costs related to data restoration, legal liabilities, and reputational harm. Discover the key differences and benefits of these critical insurance types to better protect your business in evolving risk environments.

Why it is important

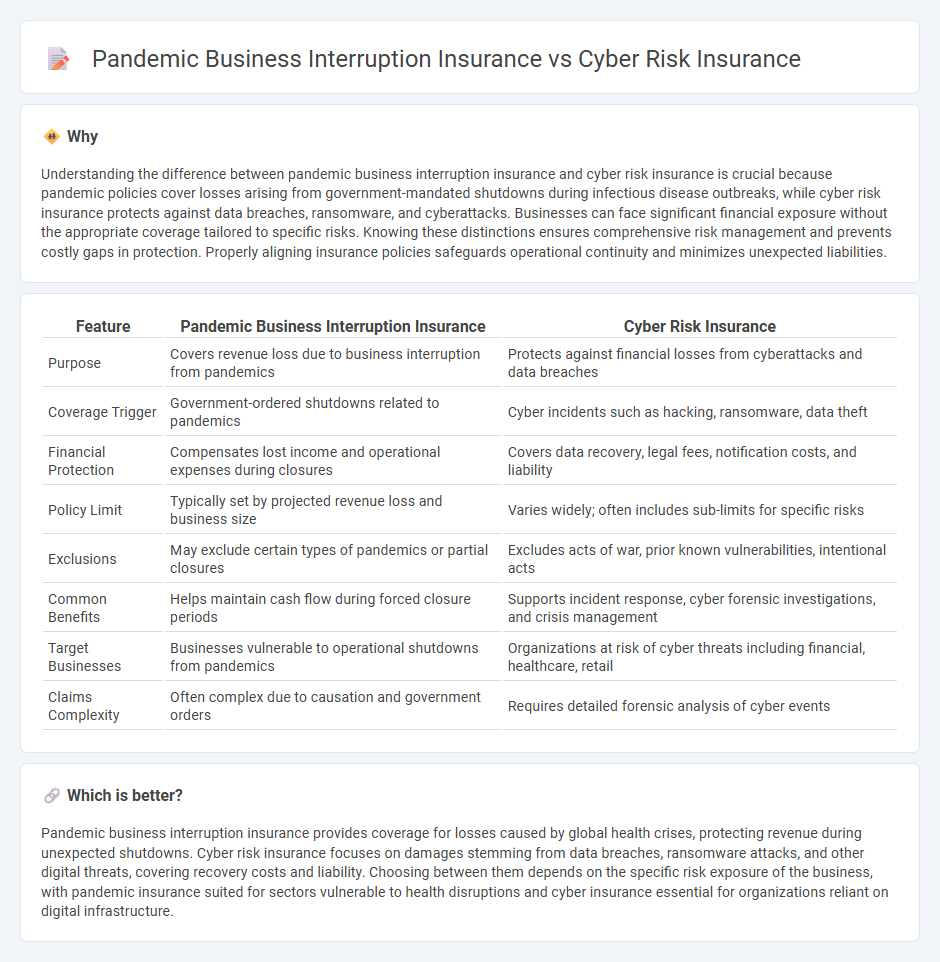

Understanding the difference between pandemic business interruption insurance and cyber risk insurance is crucial because pandemic policies cover losses arising from government-mandated shutdowns during infectious disease outbreaks, while cyber risk insurance protects against data breaches, ransomware, and cyberattacks. Businesses can face significant financial exposure without the appropriate coverage tailored to specific risks. Knowing these distinctions ensures comprehensive risk management and prevents costly gaps in protection. Properly aligning insurance policies safeguards operational continuity and minimizes unexpected liabilities.

Comparison Table

| Feature | Pandemic Business Interruption Insurance | Cyber Risk Insurance |

|---|---|---|

| Purpose | Covers revenue loss due to business interruption from pandemics | Protects against financial losses from cyberattacks and data breaches |

| Coverage Trigger | Government-ordered shutdowns related to pandemics | Cyber incidents such as hacking, ransomware, data theft |

| Financial Protection | Compensates lost income and operational expenses during closures | Covers data recovery, legal fees, notification costs, and liability |

| Policy Limit | Typically set by projected revenue loss and business size | Varies widely; often includes sub-limits for specific risks |

| Exclusions | May exclude certain types of pandemics or partial closures | Excludes acts of war, prior known vulnerabilities, intentional acts |

| Common Benefits | Helps maintain cash flow during forced closure periods | Supports incident response, cyber forensic investigations, and crisis management |

| Target Businesses | Businesses vulnerable to operational shutdowns from pandemics | Organizations at risk of cyber threats including financial, healthcare, retail |

| Claims Complexity | Often complex due to causation and government orders | Requires detailed forensic analysis of cyber events |

Which is better?

Pandemic business interruption insurance provides coverage for losses caused by global health crises, protecting revenue during unexpected shutdowns. Cyber risk insurance focuses on damages stemming from data breaches, ransomware attacks, and other digital threats, covering recovery costs and liability. Choosing between them depends on the specific risk exposure of the business, with pandemic insurance suited for sectors vulnerable to health disruptions and cyber insurance essential for organizations reliant on digital infrastructure.

Connection

Pandemic business interruption insurance and cyber risk insurance both address emerging threats that disrupt organizational operations and financial stability. Business interruption insurance covers losses from pandemic-related shutdowns, while cyber risk insurance protects against data breaches and digital attacks that can halt business processes. Integrating these insurance types helps companies manage complex risks in an increasingly interconnected and digital-dependent environment.

Key Terms

**Cyber Risk Insurance:**

Cyber risk insurance protects businesses against financial losses resulting from cyberattacks, data breaches, and ransomware incidents, covering costs such as legal fees, notification expenses, and system restoration. This insurance is critical for companies relying on digital infrastructure, as cyber threats continue to escalate in frequency and sophistication. Discover how cyber risk insurance can safeguard your business from evolving digital threats.

Data Breach

Cyber risk insurance specifically covers financial losses resulting from data breaches, including expenses related to notification, legal fees, and restoration of compromised information systems. Pandemic business interruption insurance typically excludes data breach events, focusing instead on losses due to operational shutdowns caused by health crises. Explore more to understand the distinct protections these policies provide for data breach incidents.

Ransomware

Cyber risk insurance specifically covers financial losses from ransomware attacks, including extortion payments and system recovery costs, while pandemic business interruption insurance primarily addresses revenue loss due to government-mandated closures or supply chain disruptions. Ransomware has become a critical threat vector, prompting businesses to prioritize cyber risk insurance for comprehensive coverage against data breaches and operational downtime. Explore more about tailoring your insurance strategy to mitigate ransomware threats effectively.

Source and External Links

Cyber Insurance: What You Need to Consider Before Purchasing a ... - Cyber risk insurance, also known as cyber liability insurance, helps organizations mitigate financial exposure from cyber incidents by covering data recovery, business interruption, extortion, legal penalties, and other related costs.

5 Types of Cyber Insurance Coverage and What to Watch Out For - Cyber insurance policies typically offer first-party coverage to pay for direct breach expenses and third-party coverage for lawsuits or claims resulting from the breach of customer data.

Data Breach and Cyber Liability Insurance - The Hartford Insurance - Cyber insurance protects businesses from technology-related risks with policies such as data breach insurance for small businesses and more comprehensive cyber liability insurance for larger businesses covering legal, recovery, extortion, and regulatory costs.

dowidth.com

dowidth.com