Flood insurance integration focuses on protecting properties from water damage caused by natural flooding events, addressing risks that are often excluded from standard policies. Boiler and machinery insurance integration targets coverage for mechanical breakdowns and operational failures in industrial equipment, ensuring business continuity. Explore how tailored insurance solutions can safeguard your assets against diverse hazards.

Why it is important

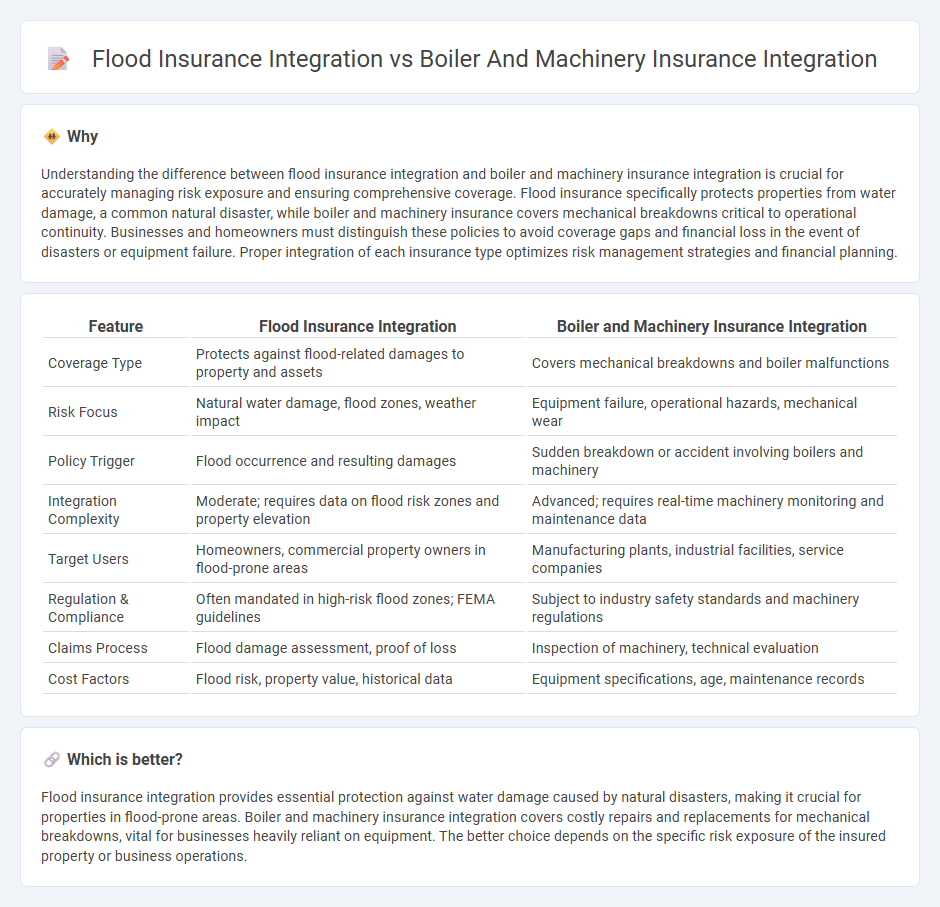

Understanding the difference between flood insurance integration and boiler and machinery insurance integration is crucial for accurately managing risk exposure and ensuring comprehensive coverage. Flood insurance specifically protects properties from water damage, a common natural disaster, while boiler and machinery insurance covers mechanical breakdowns critical to operational continuity. Businesses and homeowners must distinguish these policies to avoid coverage gaps and financial loss in the event of disasters or equipment failure. Proper integration of each insurance type optimizes risk management strategies and financial planning.

Comparison Table

| Feature | Flood Insurance Integration | Boiler and Machinery Insurance Integration |

|---|---|---|

| Coverage Type | Protects against flood-related damages to property and assets | Covers mechanical breakdowns and boiler malfunctions |

| Risk Focus | Natural water damage, flood zones, weather impact | Equipment failure, operational hazards, mechanical wear |

| Policy Trigger | Flood occurrence and resulting damages | Sudden breakdown or accident involving boilers and machinery |

| Integration Complexity | Moderate; requires data on flood risk zones and property elevation | Advanced; requires real-time machinery monitoring and maintenance data |

| Target Users | Homeowners, commercial property owners in flood-prone areas | Manufacturing plants, industrial facilities, service companies |

| Regulation & Compliance | Often mandated in high-risk flood zones; FEMA guidelines | Subject to industry safety standards and machinery regulations |

| Claims Process | Flood damage assessment, proof of loss | Inspection of machinery, technical evaluation |

| Cost Factors | Flood risk, property value, historical data | Equipment specifications, age, maintenance records |

Which is better?

Flood insurance integration provides essential protection against water damage caused by natural disasters, making it crucial for properties in flood-prone areas. Boiler and machinery insurance integration covers costly repairs and replacements for mechanical breakdowns, vital for businesses heavily reliant on equipment. The better choice depends on the specific risk exposure of the insured property or business operations.

Connection

Flood insurance integration enhances risk management by covering water damage, while boiler and machinery insurance integration protects against breakdowns of essential equipment. Both types of insurance are integral to comprehensive property coverage, minimizing financial losses from diverse hazards. Combining these policies streamlines claims processes and ensures seamless protection for physical assets in commercial and residential properties.

Key Terms

Equipment Breakdown Coverage

Boiler and machinery insurance integration primarily focuses on providing Equipment Breakdown Coverage that protects against unexpected mechanical failures, electrical surges, and pressure explosions, ensuring minimal downtime and costly repairs for businesses. Flood insurance integration, by contrast, specifically addresses damages due to water inundation from natural flooding events, which typically excludes mechanical breakdowns covered under equipment policies. Explore detailed comparisons and tailored policy options to optimize your risk management strategy.

Peril-Specific Exclusions

Boiler and machinery insurance integration typically excludes damages arising from perils such as flooding, emphasizing coverage tailored to equipment breakdown and mechanical failures. Flood insurance integration specifically addresses water damage caused by natural flood events, with explicit exclusions for mechanical or electrical breakdowns that are covered under boiler and machinery policies. Explore our comprehensive guide to understand how Peril-Specific Exclusions shape coverage strategies for these insurance types.

Claims Adjustment Process

Boiler and machinery insurance integration streamlines the claims adjustment process by involving specialized engineers who assess equipment breakdowns with technical precision, ensuring accurate damage evaluation and efficient repair cost estimation. Flood insurance integration, on the other hand, relies heavily on hydrological data and property damage assessments often complicated by widespread water impact and variable flood zones, leading to extended claim verification times. Explore more about how these insurance integrations optimize claims adjustment processes and reduce settlement delays.

Source and External Links

Boiler and Machinery Insurance - HUB International - Boiler and machinery insurance offers customizable coverage that protects businesses from physical damage and financial losses due to equipment breakdowns, including options for extra expense coverage to maintain operations post-failure.

Boiler & Machinery Insurance Coverage - Insureon - This insurance protects against costs from sudden machinery or equipment breakdowns and can be integrated as a standalone policy or added as an endorsement to existing business insurance policies such as commercial property or BOP.

Equipment Breakdown Insurance - Adjusters International - Boiler and machinery insurance is now commonly called equipment breakdown insurance, which covers physical loss, business interruption, extra expenses, and spoilage resulting from equipment failure, and includes inspection services for risk management.

dowidth.com

dowidth.com