Pet insurance platforms specialize in coverage options tailored for veterinary care, including accidents, illnesses, and routine treatments, offering customizable plans to manage unexpected pet health expenses efficiently. Life insurance platforms focus on providing financial security through term life, whole life, and universal life policies designed to support beneficiaries in the event of the policyholder's death. Explore detailed comparisons and choose the best insurance platform that fits your specific protection needs.

Why it is important

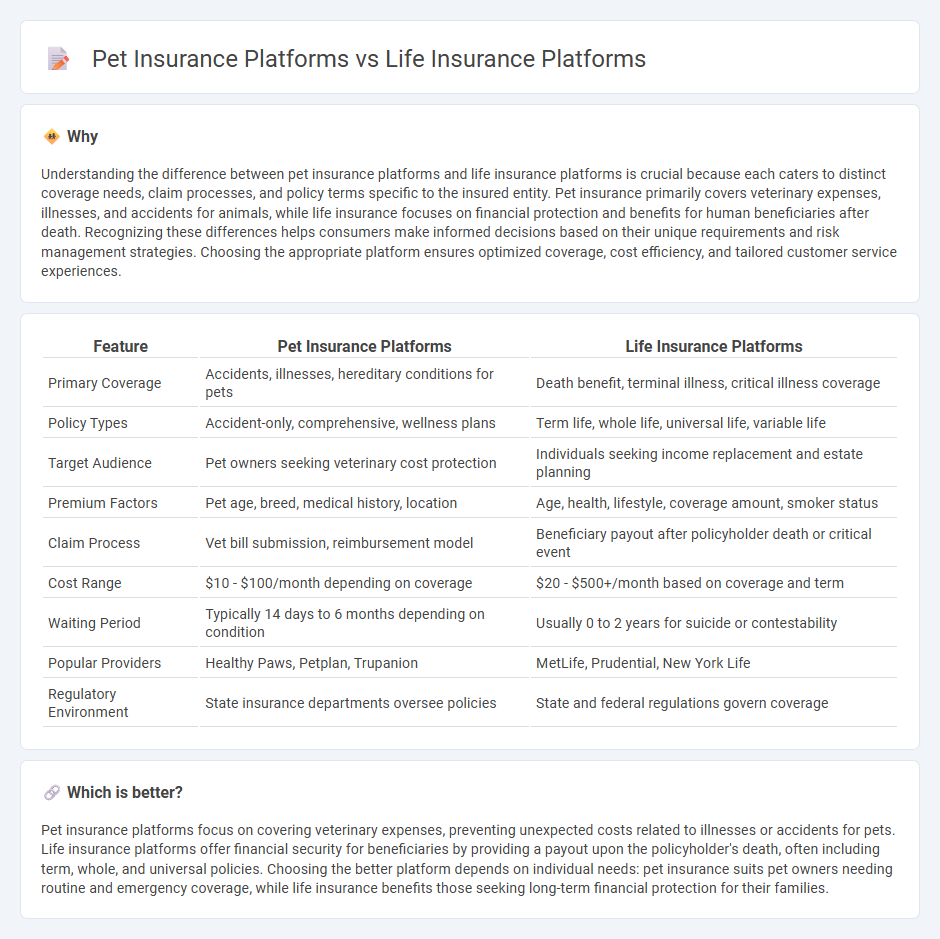

Understanding the difference between pet insurance platforms and life insurance platforms is crucial because each caters to distinct coverage needs, claim processes, and policy terms specific to the insured entity. Pet insurance primarily covers veterinary expenses, illnesses, and accidents for animals, while life insurance focuses on financial protection and benefits for human beneficiaries after death. Recognizing these differences helps consumers make informed decisions based on their unique requirements and risk management strategies. Choosing the appropriate platform ensures optimized coverage, cost efficiency, and tailored customer service experiences.

Comparison Table

| Feature | Pet Insurance Platforms | Life Insurance Platforms |

|---|---|---|

| Primary Coverage | Accidents, illnesses, hereditary conditions for pets | Death benefit, terminal illness, critical illness coverage |

| Policy Types | Accident-only, comprehensive, wellness plans | Term life, whole life, universal life, variable life |

| Target Audience | Pet owners seeking veterinary cost protection | Individuals seeking income replacement and estate planning |

| Premium Factors | Pet age, breed, medical history, location | Age, health, lifestyle, coverage amount, smoker status |

| Claim Process | Vet bill submission, reimbursement model | Beneficiary payout after policyholder death or critical event |

| Cost Range | $10 - $100/month depending on coverage | $20 - $500+/month based on coverage and term |

| Waiting Period | Typically 14 days to 6 months depending on condition | Usually 0 to 2 years for suicide or contestability |

| Popular Providers | Healthy Paws, Petplan, Trupanion | MetLife, Prudential, New York Life |

| Regulatory Environment | State insurance departments oversee policies | State and federal regulations govern coverage |

Which is better?

Pet insurance platforms focus on covering veterinary expenses, preventing unexpected costs related to illnesses or accidents for pets. Life insurance platforms offer financial security for beneficiaries by providing a payout upon the policyholder's death, often including term, whole, and universal policies. Choosing the better platform depends on individual needs: pet insurance suits pet owners needing routine and emergency coverage, while life insurance benefits those seeking long-term financial protection for their families.

Connection

Pet insurance platforms and life insurance platforms share a common foundation in risk assessment, underwriting, and claims management, leveraging data analytics to optimize policy pricing and customer experience. Both platforms utilize digital tools and AI-driven insights to evaluate health histories, predict potential claims, and streamline the insurance process from application to settlement. Integration of customer data across these platforms enhances personalized offerings, improves cross-selling opportunities, and supports comprehensive financial protection strategies for policyholders and their pets.

Key Terms

**Life Insurance Platforms:**

Life insurance platforms specialize in offering tailored policies that secure financial stability for beneficiaries through term, whole, or universal life options. These platforms leverage advanced underwriting algorithms and data analytics to provide personalized quotes and streamline the application process. Explore further to understand how life insurance platforms can safeguard your family's future with optimized coverage solutions.

Underwriting

Life insurance platforms employ advanced data analytics and risk assessment models to underwrite policies based on age, health history, and lifestyle factors, whereas pet insurance platforms focus on breed-specific risks, pets' medical histories, and preventive care routines. Underwriting in pet insurance often accounts for hereditary conditions and veterinary trends unique to different animal types, providing tailored coverage options. Explore how underwriting innovations are shaping both industries to better manage risk and offer personalized coverage.

Beneficiary

Life insurance platforms prioritize beneficiaries by enabling policyholders to designate individuals or entities who receive financial benefits upon the insured's death, often including flexible payout options and contingent beneficiaries. Pet insurance platforms, however, concentrate on reimbursing pet owners for veterinary expenses rather than establishing beneficiaries, as coverage benefits are tied directly to the pet's medical care. Explore further to understand how beneficiary features differ fundamentally between life and pet insurance platforms.

Source and External Links

12 Best Life Insurance Policy Administration Systems (2025) - Whatfix - Lists leading policy administration platforms like Accenture ALIP and Life.io Empower, which offer end-to-end policy management, automated workflows, and self-service features for both insurers and customers.

Best Life Insurance Policy Administration Systems - G2 - Compares a broad range of solutions including LexisNexis, CyberLife, and INSTANDA, providing platforms for policy creation, administration, automation, and analytics tailored to life, annuity, and pension products.

iPipeline | Software for life insurance, annuities & wealth - Delivers end-to-end digital solutions for carriers and distributors, enabling efficient automation from quote to commission with industry-leading data integration and workflow improvements.

dowidth.com

dowidth.com