Digital health insurance offers comprehensive coverage with integration of telemedicine services and digital claims management, providing convenience and continuous health benefits. Short-term health insurance provides temporary, limited coverage designed for gaps in standard insurance but often excludes pre-existing conditions and preventive care. Explore the differences to determine which option best suits your healthcare needs.

Why it is important

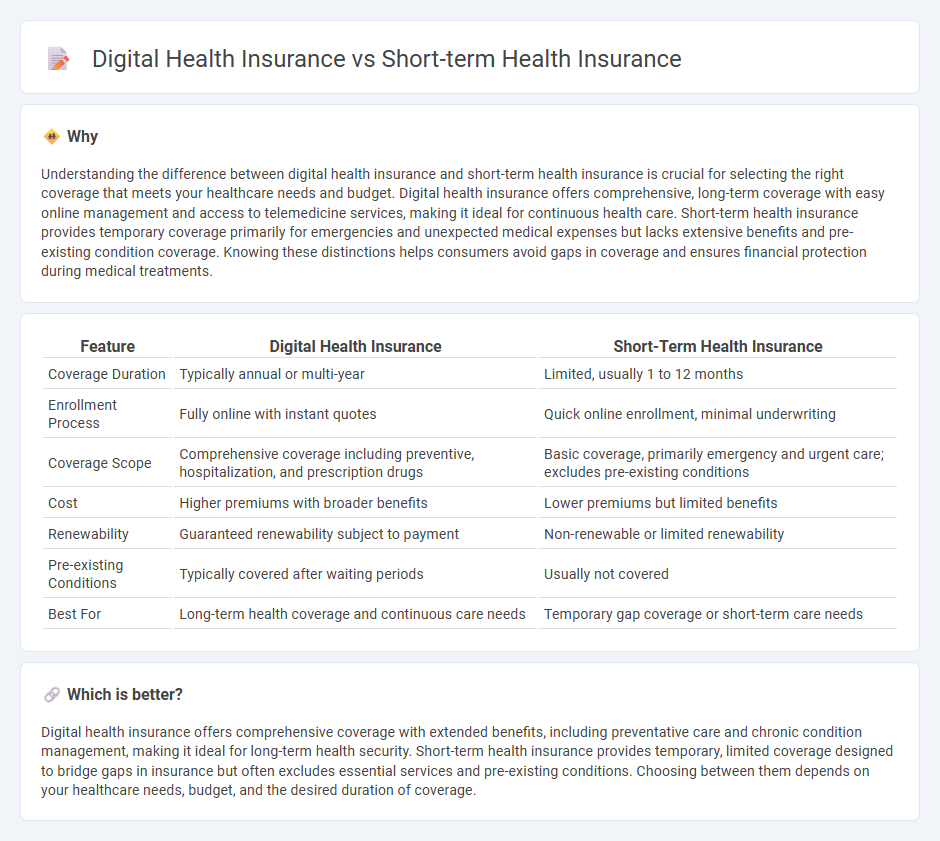

Understanding the difference between digital health insurance and short-term health insurance is crucial for selecting the right coverage that meets your healthcare needs and budget. Digital health insurance offers comprehensive, long-term coverage with easy online management and access to telemedicine services, making it ideal for continuous health care. Short-term health insurance provides temporary coverage primarily for emergencies and unexpected medical expenses but lacks extensive benefits and pre-existing condition coverage. Knowing these distinctions helps consumers avoid gaps in coverage and ensures financial protection during medical treatments.

Comparison Table

| Feature | Digital Health Insurance | Short-Term Health Insurance |

|---|---|---|

| Coverage Duration | Typically annual or multi-year | Limited, usually 1 to 12 months |

| Enrollment Process | Fully online with instant quotes | Quick online enrollment, minimal underwriting |

| Coverage Scope | Comprehensive coverage including preventive, hospitalization, and prescription drugs | Basic coverage, primarily emergency and urgent care; excludes pre-existing conditions |

| Cost | Higher premiums with broader benefits | Lower premiums but limited benefits |

| Renewability | Guaranteed renewability subject to payment | Non-renewable or limited renewability |

| Pre-existing Conditions | Typically covered after waiting periods | Usually not covered |

| Best For | Long-term health coverage and continuous care needs | Temporary gap coverage or short-term care needs |

Which is better?

Digital health insurance offers comprehensive coverage with extended benefits, including preventative care and chronic condition management, making it ideal for long-term health security. Short-term health insurance provides temporary, limited coverage designed to bridge gaps in insurance but often excludes essential services and pre-existing conditions. Choosing between them depends on your healthcare needs, budget, and the desired duration of coverage.

Connection

Digital health insurance leverages technology to provide quick, accessible policies often ideal for short-term health coverage needs. Short-term health insurance offers temporary protection during gaps in standard insurance, aligning with digital platforms that facilitate rapid enrollment and instant policy issuance. This integration enhances user experience by combining convenience, flexibility, and immediate access to medical benefits.

Key Terms

Coverage Duration

Short-term health insurance typically offers coverage lasting from one month up to 12 months, designed for temporary gaps in health insurance such as between jobs or waiting periods for other plans. Digital health insurance leverages technology to provide flexible, on-demand coverage that can be adjusted or renewed instantly, often catering to individual needs with real-time policy management. Explore more about how coverage duration impacts your insurance choice.

Policy Issuance Process

Short-term health insurance typically involves a faster policy issuance process, often completed within minutes or hours due to limited underwriting and standardized plans. Digital health insurance platforms leverage advanced algorithms and automated systems to streamline policy issuance, offering instant approvals and personalized coverage options. Explore how each approach impacts your access to timely healthcare coverage and ease of application.

Benefit Scope

Short-term health insurance typically offers limited coverage focused on essential and emergency care, providing financial relief during brief gaps in standard insurance. Digital health insurance leverages technology to expand benefit scope, offering personalized plans with access to telemedicine, wellness programs, and comprehensive preventive care. Explore more to understand how these options align with your healthcare needs.

Source and External Links

Short Term Health Insurance | eHealth - Provides temporary, limited coverage for 30-90 days (varies by state) to bridge gaps when you are between permanent health plans, with quick approval but generally excludes pre-existing conditions and many ACA-mandated benefits.

What is Short Term Health Insurance? | Cigna Healthcare - Offers temporary medical coverage for situations like being between jobs or outside enrollment periods, with benefits that vary by plan and insurer and do not have to meet ACA minimum essential coverage requirements.

Short term health insurance | Individuals & families | UnitedHealthcare - Delivers quick, flexible coverage lasting 1-12 months to fill coverage gaps, with fast application, deductible options, and access to a large provider network, suitable for those ineligible for ACA Special Enrollment.

dowidth.com

dowidth.com