Pet insurance covers veterinary expenses for illnesses, injuries, and routine care for cats, dogs, and other animals, offering financial protection against unexpected medical costs. Renters insurance safeguards personal belongings within a rental property and provides liability coverage for accidents or damages, ensuring peace of mind for tenants. Discover how both insurance types protect your assets and lifestyle by exploring their key benefits and differences.

Why it is important

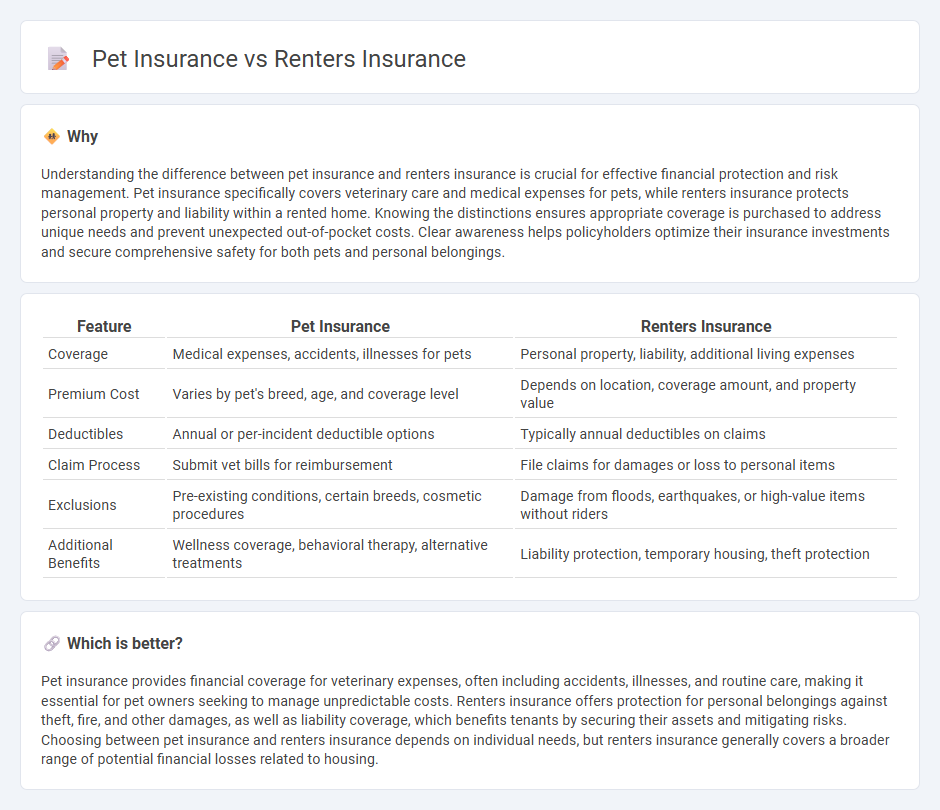

Understanding the difference between pet insurance and renters insurance is crucial for effective financial protection and risk management. Pet insurance specifically covers veterinary care and medical expenses for pets, while renters insurance protects personal property and liability within a rented home. Knowing the distinctions ensures appropriate coverage is purchased to address unique needs and prevent unexpected out-of-pocket costs. Clear awareness helps policyholders optimize their insurance investments and secure comprehensive safety for both pets and personal belongings.

Comparison Table

| Feature | Pet Insurance | Renters Insurance |

|---|---|---|

| Coverage | Medical expenses, accidents, illnesses for pets | Personal property, liability, additional living expenses |

| Premium Cost | Varies by pet's breed, age, and coverage level | Depends on location, coverage amount, and property value |

| Deductibles | Annual or per-incident deductible options | Typically annual deductibles on claims |

| Claim Process | Submit vet bills for reimbursement | File claims for damages or loss to personal items |

| Exclusions | Pre-existing conditions, certain breeds, cosmetic procedures | Damage from floods, earthquakes, or high-value items without riders |

| Additional Benefits | Wellness coverage, behavioral therapy, alternative treatments | Liability protection, temporary housing, theft protection |

Which is better?

Pet insurance provides financial coverage for veterinary expenses, often including accidents, illnesses, and routine care, making it essential for pet owners seeking to manage unpredictable costs. Renters insurance offers protection for personal belongings against theft, fire, and other damages, as well as liability coverage, which benefits tenants by securing their assets and mitigating risks. Choosing between pet insurance and renters insurance depends on individual needs, but renters insurance generally covers a broader range of potential financial losses related to housing.

Connection

Pet insurance and renters insurance are connected through their shared purpose of providing financial protection for renters, covering unexpected expenses related to pets and property damage, respectively. Both policies help mitigate risks for individuals living in rental properties by addressing potential pet-related liabilities and safeguarding personal belongings against theft or damage. Coordinating these insurances ensures comprehensive coverage for renters managing pet ownership and housing-related risks.

Key Terms

Personal Property Coverage

Renters insurance offers personal property coverage that protects belongings against risks like theft, fire, or vandalism, typically covering items such as furniture, electronics, and clothing. Pet insurance, on the other hand, does not cover personal property but focuses solely on veterinary expenses and medical care for pets. Explore more detailed comparisons to understand which insurance best suits your protection needs.

Liability Coverage

Liability coverage in renters insurance protects policyholders from financial losses due to property damage or bodily injury caused to others within the rented property, typically covering accidents like slips and falls. Pet insurance liability coverage, often called pet liability insurance, specifically safeguards owners against claims arising from injuries or damages caused by their pets, including bites or property destruction. Explore detailed comparisons to understand which insurance best fits your responsibility needs.

Veterinary Expenses

Veterinary expenses under renters insurance typically fall outside the policy's coverage, which mainly protects personal property and liability related to the rental unit. Pet insurance specifically covers veterinary costs, including illness, injury, and sometimes routine care, making it essential for managing pet-related health expenses. Explore detailed comparisons to understand which insurance best suits your financial protection needs against veterinary bills.

Source and External Links

GEICO Renters Insurance - Renters insurance protects your personal belongings against risks like fire, theft, vandalism, water damage, and visitor injuries, offering affordable, personalized coverage beyond what a landlord's insurance covers.

eRenterPlan Insurance for Renters - Renters insurance covers personal property, liability, water damage, pet damage, and more, typically starting around $15-20 per month, with benefits like actual replacement cost coverage and no rate increases after claims.

State Farm Renters Insurance - State Farm offers renters insurance to protect your possessions such as electronics and furniture, with options to bundle with auto insurance for significant savings and an easy online quote process.

dowidth.com

dowidth.com