Behavioral policy pricing uses individual customer actions and behaviors to tailor insurance premiums, enhancing risk prediction accuracy. Experience-based pricing relies on historical claims data to set rates, emphasizing past losses and policyholder outcomes. Explore more to understand how these pricing methods impact insurance affordability and risk assessment.

Why it is important

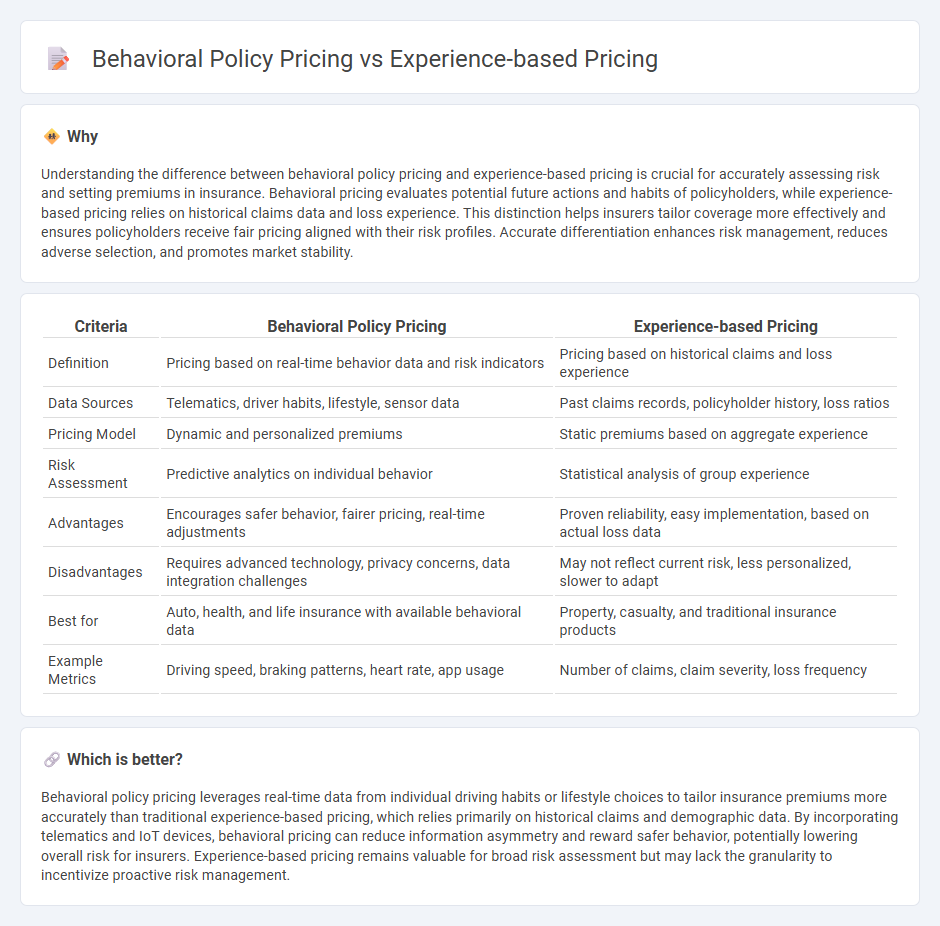

Understanding the difference between behavioral policy pricing and experience-based pricing is crucial for accurately assessing risk and setting premiums in insurance. Behavioral pricing evaluates potential future actions and habits of policyholders, while experience-based pricing relies on historical claims data and loss experience. This distinction helps insurers tailor coverage more effectively and ensures policyholders receive fair pricing aligned with their risk profiles. Accurate differentiation enhances risk management, reduces adverse selection, and promotes market stability.

Comparison Table

| Criteria | Behavioral Policy Pricing | Experience-based Pricing |

|---|---|---|

| Definition | Pricing based on real-time behavior data and risk indicators | Pricing based on historical claims and loss experience |

| Data Sources | Telematics, driver habits, lifestyle, sensor data | Past claims records, policyholder history, loss ratios |

| Pricing Model | Dynamic and personalized premiums | Static premiums based on aggregate experience |

| Risk Assessment | Predictive analytics on individual behavior | Statistical analysis of group experience |

| Advantages | Encourages safer behavior, fairer pricing, real-time adjustments | Proven reliability, easy implementation, based on actual loss data |

| Disadvantages | Requires advanced technology, privacy concerns, data integration challenges | May not reflect current risk, less personalized, slower to adapt |

| Best for | Auto, health, and life insurance with available behavioral data | Property, casualty, and traditional insurance products |

| Example Metrics | Driving speed, braking patterns, heart rate, app usage | Number of claims, claim severity, loss frequency |

Which is better?

Behavioral policy pricing leverages real-time data from individual driving habits or lifestyle choices to tailor insurance premiums more accurately than traditional experience-based pricing, which relies primarily on historical claims and demographic data. By incorporating telematics and IoT devices, behavioral pricing can reduce information asymmetry and reward safer behavior, potentially lowering overall risk for insurers. Experience-based pricing remains valuable for broad risk assessment but may lack the granularity to incentivize proactive risk management.

Connection

Behavioral policy pricing and Experience-based pricing are connected through their reliance on individual risk profiles to determine insurance premiums. Both methods utilize data-driven insights, with behavioral pricing analyzing policyholder actions and experience-based pricing focusing on historical claims data. This connection allows insurers to more accurately assess risk and tailor premiums for improved fairness and profitability.

Key Terms

Claims History

Experience-based pricing leverages historical claims data to set premiums accurately reflecting individual risk profiles, enhancing fairness and precision in insurance pricing. Behavioral policy pricing integrates policyholder behavior patterns, such as driving habits or payment timeliness, alongside claims history to tailor rates dynamically, promoting risk mitigation. Explore how combining claims history with behavioral data can optimize your pricing strategy further.

Risk Assessment

Experience-based pricing relies on historical loss data to estimate premiums, allowing insurers to adjust rates according to past claims frequency and severity. Behavioral policy pricing incorporates real-time customer data and risk-related behaviors, using predictive analytics to tailor prices dynamically based on individual risk profiles. Discover how integrating both approaches enhances risk assessment accuracy and optimizes premium strategies.

Predictive Analytics

Experience-based pricing relies on historical customer data and past transaction patterns to set prices, leveraging insights from customer loyalty and previous purchase behavior. Behavioral policy pricing incorporates real-time customer behavior and contextual factors using predictive analytics to dynamically adjust prices, optimizing for demand and maximizing revenue. Explore how predictive analytics can transform pricing strategies for enhanced profitability and customer engagement.

Source and External Links

How to use experience pricing to charge your customers based on ... - Experience-based pricing charges customers based on the overall value and emotional impact of the customer experience, emphasizing customer journey, personalization, and outcome-based models as key elements.

Experience-Based Pricing - KindlyLoud - This pricing method shifts focus from cost to the customer's emotional experience and perceived value, encouraging businesses to create unique, memorable experiences that justify higher prices and foster loyalty.

Experiential Economy Pricing Strategy | Iris Pricing Solutions - Experience-based pricing strategies in the experience economy leverage pricing power by analyzing consumer behavior and value drivers to maximize profits amid operational challenges, especially for industries like travel and live events.

dowidth.com

dowidth.com