Microinsurance targets low-income individuals by offering affordable coverage with simplified policies tailored to specific risks like health or agriculture. Property insurance provides broader protection for valuable assets such as homes and commercial buildings against damages from fire, theft, or natural disasters. Explore the key differences and benefits of microinsurance versus property insurance to determine the best fit for your needs.

Why it is important

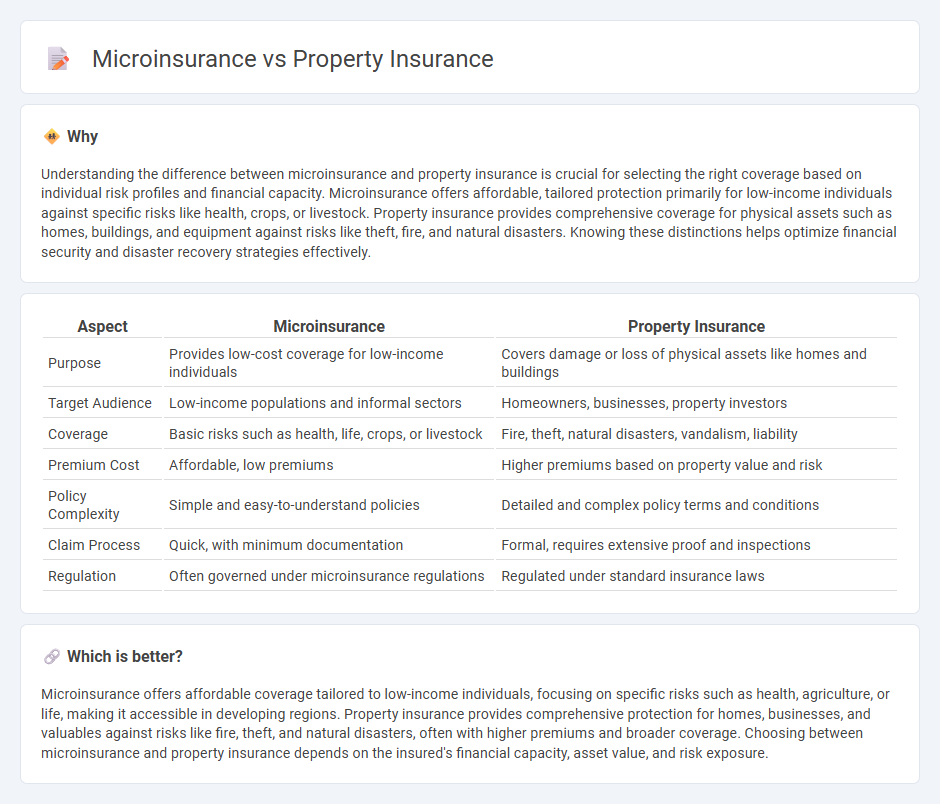

Understanding the difference between microinsurance and property insurance is crucial for selecting the right coverage based on individual risk profiles and financial capacity. Microinsurance offers affordable, tailored protection primarily for low-income individuals against specific risks like health, crops, or livestock. Property insurance provides comprehensive coverage for physical assets such as homes, buildings, and equipment against risks like theft, fire, and natural disasters. Knowing these distinctions helps optimize financial security and disaster recovery strategies effectively.

Comparison Table

| Aspect | Microinsurance | Property Insurance |

|---|---|---|

| Purpose | Provides low-cost coverage for low-income individuals | Covers damage or loss of physical assets like homes and buildings |

| Target Audience | Low-income populations and informal sectors | Homeowners, businesses, property investors |

| Coverage | Basic risks such as health, life, crops, or livestock | Fire, theft, natural disasters, vandalism, liability |

| Premium Cost | Affordable, low premiums | Higher premiums based on property value and risk |

| Policy Complexity | Simple and easy-to-understand policies | Detailed and complex policy terms and conditions |

| Claim Process | Quick, with minimum documentation | Formal, requires extensive proof and inspections |

| Regulation | Often governed under microinsurance regulations | Regulated under standard insurance laws |

Which is better?

Microinsurance offers affordable coverage tailored to low-income individuals, focusing on specific risks such as health, agriculture, or life, making it accessible in developing regions. Property insurance provides comprehensive protection for homes, businesses, and valuables against risks like fire, theft, and natural disasters, often with higher premiums and broader coverage. Choosing between microinsurance and property insurance depends on the insured's financial capacity, asset value, and risk exposure.

Connection

Microinsurance and property insurance intersect by providing tailored risk protection for low-income individuals and small-scale property owners. Microinsurance offers affordable coverage for specific risks such as house damage or loss of personal assets, complementing traditional property insurance that covers broader property risks. This connection enhances financial resilience and disaster recovery for vulnerable populations through accessible, scalable insurance solutions.

Key Terms

**Property Insurance:**

Property insurance provides comprehensive coverage for physical assets such as homes, buildings, and personal belongings against risks like fire, theft, and natural disasters, typically involving higher premiums and detailed policy terms. It is designed for individuals and businesses seeking extensive protection and financial security in case of significant property damage or loss. Explore the key benefits and policy options of property insurance to determine the best fit for your asset protection needs.

Replacement Cost

Property insurance typically covers the replacement cost of damaged or destroyed assets, ensuring policyholders receive the amount needed to repair or replace property without deduction for depreciation. Microinsurance offers similar protection but is designed for low-income individuals, with lower premiums and limited coverage amounts tailored to affordable risk management. Explore how Replacement Cost impacts affordability and protection in both insurance types for better financial planning.

Deductible

Property insurance typically involves higher deductibles, requiring policyholders to pay a significant amount out-of-pocket before coverage begins, which helps reduce premium costs for larger assets. Microinsurance offers lower deductibles tailored to low-income individuals, making it more accessible and providing quicker financial relief after minor losses. Explore the key differences in deductible structures and benefits between these insurance types to better protect your assets.

Source and External Links

Homeowners Insurance - Online Quotes - Travelers offers homeowners insurance that covers the structure of the home, personal belongings, and legal liabilities.

Homeowners Insurance - Get a Home Insurance Quote - Liberty Mutual provides customizable homeowners insurance with various coverage options tailored to individual needs.

Homeowners Insurance: Get a free quote today - State Farm - State Farm offers comprehensive homeowners insurance that protects homes and property from various hazards and includes options for discounts.

dowidth.com

dowidth.com