Reciprocal insurance is a risk-sharing arrangement where members mutually insure one another through an attorney-in-fact, spreading liabilities across a collective pool. Captive insurance involves a company creating its own licensed insurer to cover risks internally, often resulting in tailored policies and potential cost savings. Explore the distinctions further to determine which insurance model suits your business needs.

Why it is important

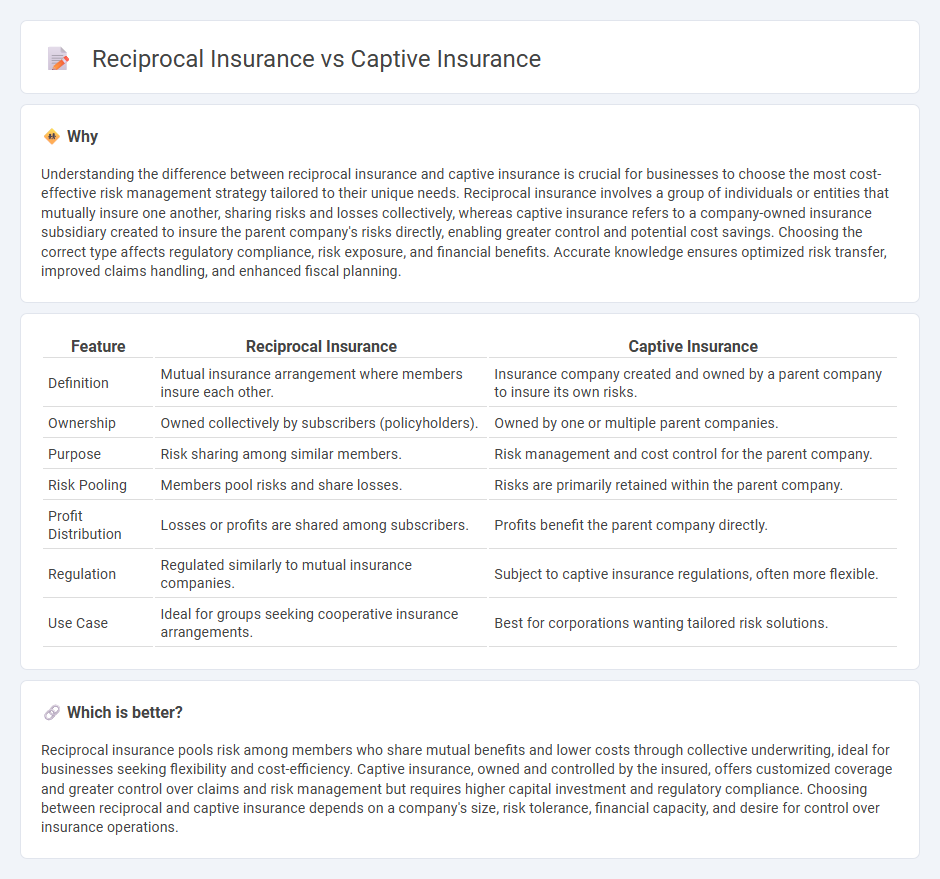

Understanding the difference between reciprocal insurance and captive insurance is crucial for businesses to choose the most cost-effective risk management strategy tailored to their unique needs. Reciprocal insurance involves a group of individuals or entities that mutually insure one another, sharing risks and losses collectively, whereas captive insurance refers to a company-owned insurance subsidiary created to insure the parent company's risks directly, enabling greater control and potential cost savings. Choosing the correct type affects regulatory compliance, risk exposure, and financial benefits. Accurate knowledge ensures optimized risk transfer, improved claims handling, and enhanced fiscal planning.

Comparison Table

| Feature | Reciprocal Insurance | Captive Insurance |

|---|---|---|

| Definition | Mutual insurance arrangement where members insure each other. | Insurance company created and owned by a parent company to insure its own risks. |

| Ownership | Owned collectively by subscribers (policyholders). | Owned by one or multiple parent companies. |

| Purpose | Risk sharing among similar members. | Risk management and cost control for the parent company. |

| Risk Pooling | Members pool risks and share losses. | Risks are primarily retained within the parent company. |

| Profit Distribution | Losses or profits are shared among subscribers. | Profits benefit the parent company directly. |

| Regulation | Regulated similarly to mutual insurance companies. | Subject to captive insurance regulations, often more flexible. |

| Use Case | Ideal for groups seeking cooperative insurance arrangements. | Best for corporations wanting tailored risk solutions. |

Which is better?

Reciprocal insurance pools risk among members who share mutual benefits and lower costs through collective underwriting, ideal for businesses seeking flexibility and cost-efficiency. Captive insurance, owned and controlled by the insured, offers customized coverage and greater control over claims and risk management but requires higher capital investment and regulatory compliance. Choosing between reciprocal and captive insurance depends on a company's size, risk tolerance, financial capacity, and desire for control over insurance operations.

Connection

Reciprocal insurance and captive insurance are connected as alternative risk management mechanisms enabling businesses to self-insure and share risks among members. Both structures aim to reduce reliance on traditional commercial insurers by pooling resources--reciprocal insurance through member exchanges using an attorney-in-fact, and captive insurance by creating a wholly-owned subsidiary insurer. This connection emphasizes tailored risk coverage, cost savings, and enhanced control over claims and underwriting processes.

Key Terms

Ownership structure

Captive insurance operates under a single parent company's ownership, allowing tailored risk management specifically for its owner's unique business exposures. Reciprocal insurance involves a group of subscribers who mutually share risks through an attorney-in-fact, distributing ownership and responsibilities among all members. Explore further to understand how ownership structure impacts control and risk allocation in these insurance models.

Risk sharing

Captive insurance involves a company creating its own insurance entity to cover its risks internally, offering greater control over risk management and cost savings. Reciprocal insurance operates on a risk-sharing principle where members exchange insurance contracts to share losses collectively, often reducing premiums through mutual cooperation. Explore the distinct risk-sharing mechanisms and benefits of each model to determine the best fit for your business needs.

Governance

Captive insurance entities are typically governed by a board of directors or owners who have direct control over operational and financial decisions, ensuring tailored risk management aligned with specific organizational needs. Reciprocal insurance exchanges operate under an attorney-in-fact, a managing entity appointed by subscribers, providing collective governance that balances the interests of all members within the reciprocal agreement. Explore the nuances of governance structures in captive and reciprocal insurance to understand how they impact risk control and compliance.

Source and External Links

Captive insurance - Wikipedia - Captive insurance is an alternative to self-insurance where insured parties create a licensed insurance company for their own benefit, enabling control over risk evaluation, premium setting, and potential profit return, with variations like single-parent, group, and sponsored captives.

What Is Captive Insurance? - A captive insurer is owned and controlled by its insureds, offering tailored coverage for difficult risks, pricing stability, and increased control over safety, loss control, and claims, often when commercial insurance is expensive or unavailable.

Captive Insurance | Alternative Risk Financing - Higginbotham - Captive insurance allows mid- to large-sized companies to create or join an insurance company to cover risks with direct market access, enhanced cost control, personalized risk management, and is typically structured as single-parent or group captives.

dowidth.com

dowidth.com