Social prescribing insurance covers non-medical interventions such as community activities and wellness programs aimed at improving mental and physical health, reducing healthcare costs indirectly. Critical illness insurance provides lump-sum financial support upon diagnosis of severe diseases like cancer, heart attack, or stroke, addressing direct treatment expenses and income loss. Explore the key differences and benefits of social prescribing insurance versus critical illness insurance to determine the best coverage for your needs.

Why it is important

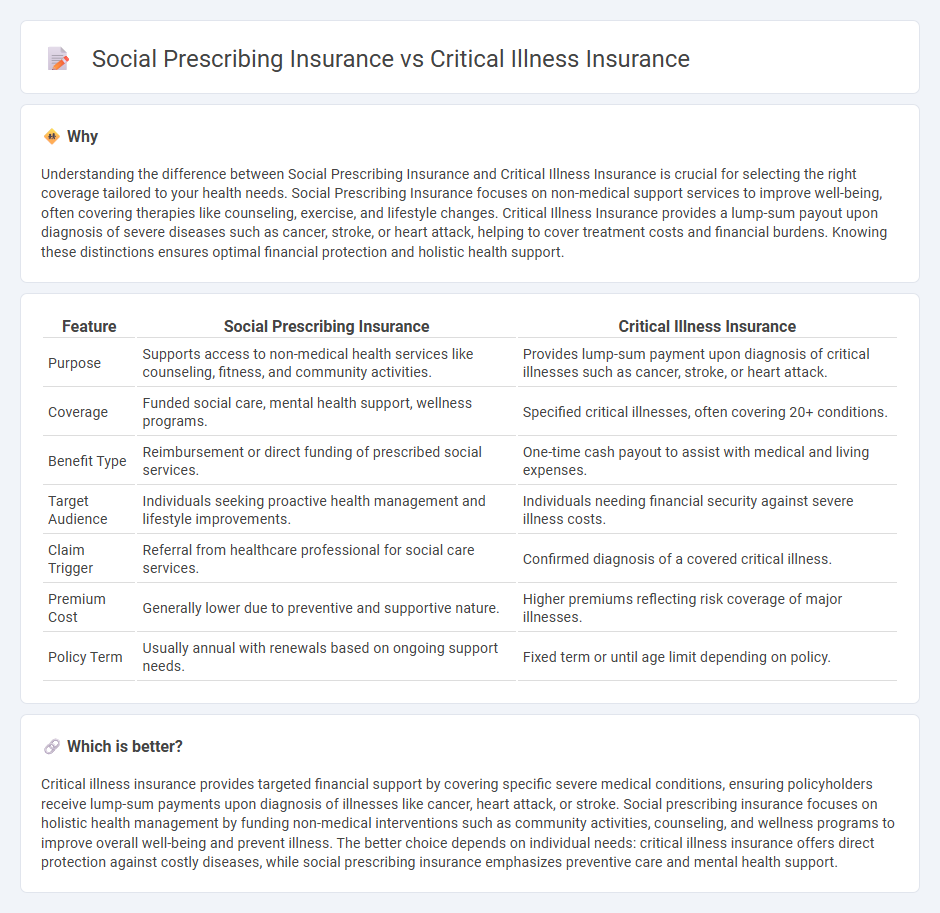

Understanding the difference between Social Prescribing Insurance and Critical Illness Insurance is crucial for selecting the right coverage tailored to your health needs. Social Prescribing Insurance focuses on non-medical support services to improve well-being, often covering therapies like counseling, exercise, and lifestyle changes. Critical Illness Insurance provides a lump-sum payout upon diagnosis of severe diseases such as cancer, stroke, or heart attack, helping to cover treatment costs and financial burdens. Knowing these distinctions ensures optimal financial protection and holistic health support.

Comparison Table

| Feature | Social Prescribing Insurance | Critical Illness Insurance |

|---|---|---|

| Purpose | Supports access to non-medical health services like counseling, fitness, and community activities. | Provides lump-sum payment upon diagnosis of critical illnesses such as cancer, stroke, or heart attack. |

| Coverage | Funded social care, mental health support, wellness programs. | Specified critical illnesses, often covering 20+ conditions. |

| Benefit Type | Reimbursement or direct funding of prescribed social services. | One-time cash payout to assist with medical and living expenses. |

| Target Audience | Individuals seeking proactive health management and lifestyle improvements. | Individuals needing financial security against severe illness costs. |

| Claim Trigger | Referral from healthcare professional for social care services. | Confirmed diagnosis of a covered critical illness. |

| Premium Cost | Generally lower due to preventive and supportive nature. | Higher premiums reflecting risk coverage of major illnesses. |

| Policy Term | Usually annual with renewals based on ongoing support needs. | Fixed term or until age limit depending on policy. |

Which is better?

Critical illness insurance provides targeted financial support by covering specific severe medical conditions, ensuring policyholders receive lump-sum payments upon diagnosis of illnesses like cancer, heart attack, or stroke. Social prescribing insurance focuses on holistic health management by funding non-medical interventions such as community activities, counseling, and wellness programs to improve overall well-being and prevent illness. The better choice depends on individual needs: critical illness insurance offers direct protection against costly diseases, while social prescribing insurance emphasizes preventive care and mental health support.

Connection

Social prescribing insurance supports holistic health approaches by covering services such as mental health counseling and lifestyle coaching, which can reduce the risk factors associated with critical illnesses. Critical illness insurance provides financial protection against severe medical conditions like cancer or heart disease, often linked to lifestyle and social determinants of health addressed by social prescribing. Integrating these insurance types promotes comprehensive care and risk mitigation, enhancing overall patient outcomes.

Key Terms

Covered conditions

Critical illness insurance typically covers a predefined list of severe health conditions such as cancer, heart attack, stroke, and major organ transplants, offering lump-sum payments upon diagnosis. Social prescribing insurance focuses more on holistic health management by funding non-medical interventions like exercise programs, mental health support, and community services to improve overall well-being. Explore the distinctions and benefits of each insurance type for a comprehensive understanding of coverage options.

Preventive interventions

Critical illness insurance provides financial coverage for severe health conditions after diagnosis, primarily focusing on treatment costs, while social prescribing insurance emphasizes preventive interventions by supporting lifestyle modifications and community resources to reduce the incidence of chronic diseases. Preventive measures under social prescribing insurance include mental health support, physical activity programs, and nutritional guidance, aiming to lower long-term healthcare expenses and improve quality of life. Explore how integrating social prescribing with traditional critical illness insurance can enhance preventive care and overall health outcomes.

Payout structure

Critical illness insurance provides a lump sum payout or structured payments upon diagnosis of specified diseases, ensuring immediate financial support during medical emergencies. Social prescribing insurance typically focuses on covering costs related to lifestyle and community-based interventions, with payouts aimed at promoting long-term wellness rather than immediate medical expenses. Explore more to understand which payout structure aligns best with your healthcare and financial needs.

Source and External Links

Critical Illness Insurance - Anthem - Provides supplemental insurance coverage for major illnesses, offering lump sum payments or monthly benefits to help with additional health expenses.

Critical Illness Insurance - Wikipedia - Offers a lump sum cash payment if the policyholder is diagnosed with specific critical illnesses listed in the policy, often requiring a survival period.

Critical Illness Insurance Plans | MetLife - Helps alleviate financial burdens by providing a lump-sum payment to cover expenses related to critical illnesses, focusing on recovery rather than financial stress.

dowidth.com

dowidth.com