Behavioral policy pricing adjusts insurance premiums based on individual policyholder behavior, leveraging data analytics to predict risk more accurately. Self-insurance involves a company or individual assuming the financial risk of loss directly, rather than transferring it to an insurer, often leading to cost savings but higher exposure. Explore in-depth insights to understand which approach aligns best with your risk management strategy.

Why it is important

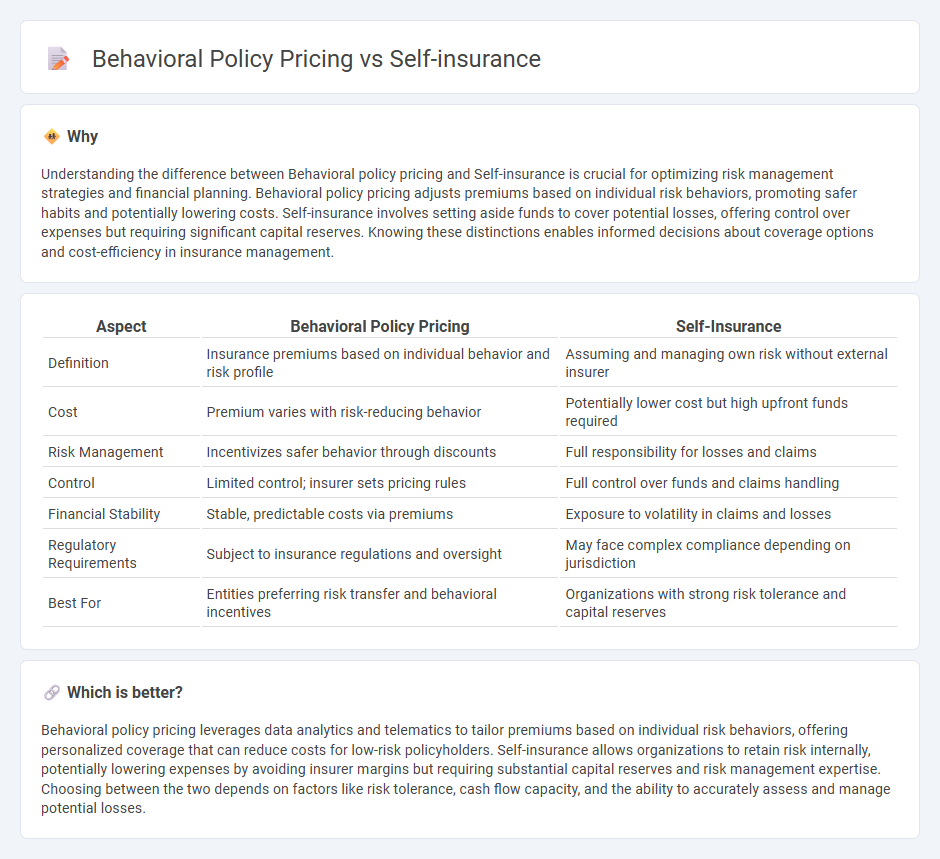

Understanding the difference between Behavioral policy pricing and Self-insurance is crucial for optimizing risk management strategies and financial planning. Behavioral policy pricing adjusts premiums based on individual risk behaviors, promoting safer habits and potentially lowering costs. Self-insurance involves setting aside funds to cover potential losses, offering control over expenses but requiring significant capital reserves. Knowing these distinctions enables informed decisions about coverage options and cost-efficiency in insurance management.

Comparison Table

| Aspect | Behavioral Policy Pricing | Self-Insurance |

|---|---|---|

| Definition | Insurance premiums based on individual behavior and risk profile | Assuming and managing own risk without external insurer |

| Cost | Premium varies with risk-reducing behavior | Potentially lower cost but high upfront funds required |

| Risk Management | Incentivizes safer behavior through discounts | Full responsibility for losses and claims |

| Control | Limited control; insurer sets pricing rules | Full control over funds and claims handling |

| Financial Stability | Stable, predictable costs via premiums | Exposure to volatility in claims and losses |

| Regulatory Requirements | Subject to insurance regulations and oversight | May face complex compliance depending on jurisdiction |

| Best For | Entities preferring risk transfer and behavioral incentives | Organizations with strong risk tolerance and capital reserves |

Which is better?

Behavioral policy pricing leverages data analytics and telematics to tailor premiums based on individual risk behaviors, offering personalized coverage that can reduce costs for low-risk policyholders. Self-insurance allows organizations to retain risk internally, potentially lowering expenses by avoiding insurer margins but requiring substantial capital reserves and risk management expertise. Choosing between the two depends on factors like risk tolerance, cash flow capacity, and the ability to accurately assess and manage potential losses.

Connection

Behavioral policy pricing leverages data on individual policyholders' behaviors to tailor premiums, incentivizing safer actions and reducing risk exposure. Self-insurance, where individuals or businesses assume financial responsibility for losses, benefits from behavioral insights by encouraging proactive risk management and cost control. Both concepts converge in optimizing risk mitigation strategies and aligning financial incentives with responsible behavior.

Key Terms

Risk Retention

Risk retention plays a critical role in differentiating self-insurance from behavioral policy pricing, where organizations choosing self-insurance assume full financial responsibility for their losses, enabling customized risk management strategies. Behavioral policy pricing leverages risk retention data to adjust premiums based on policyholder behavior, promoting safer practices and reducing overall claims costs. Explore deeper insights into how risk retention influences cost management and pricing accuracy in modern insurance models.

Underwriting

Self-insurance shifts risk retention to the policyholder, requiring precise risk assessment and underwriting expertise to ensure financial solvency. Behavioral policy pricing relies on data-driven insights into policyholder actions, leveraging predictive analytics for tailored premium adjustments and loss prevention. Explore deeper into underwriting strategies to optimize risk management and pricing accuracy.

Moral Hazard

Self-insurance often reduces moral hazard by making individuals directly accountable for their losses, encouraging more cautious behavior compared to traditional behavioral policy pricing, which may inadvertently incentivize risk-taking due to coverage. Behavioral policy pricing attempts to mitigate moral hazard through incentives and penalties based on observed behavior but can be limited by information asymmetry and inaccurate risk assessment. Explore detailed analyses of moral hazard impacts and mitigation strategies in self-insurance and behavioral policy frameworks for a comprehensive understanding.

Source and External Links

Self-insurance - Wikipedia - Self-insurance is a risk management method where an organization chooses to bear the risk itself without buying third-party insurance, setting aside funds to cover potential losses, usually resulting in cost savings compared to commercial insurance premiums.

What Is Self-Insurance? - Business Credentialing Services - Self-insurance occurs when a business independently allocates funds to cover unexpected claims instead of purchasing third-party insurance, benefiting from cost savings and more control, but facing risks of significant losses and administrative complexity.

A Guide to Self-Insurance - APP Tech - To become self-insured, businesses create a risk management team, conduct financial analysis, develop policies, consider stop-loss insurance, and use claims management tools to balance flexibility and risk exposure effectively.

dowidth.com

dowidth.com