Behavioral policy pricing uses data on customer behaviors such as driving habits, lifestyle choices, and payment patterns to tailor insurance premiums more accurately. Claims-based pricing, on the other hand, relies primarily on historical claims data and loss experience to determine policy costs. Explore how these approaches impact risk assessment and premium setting to optimize your insurance strategy.

Why it is important

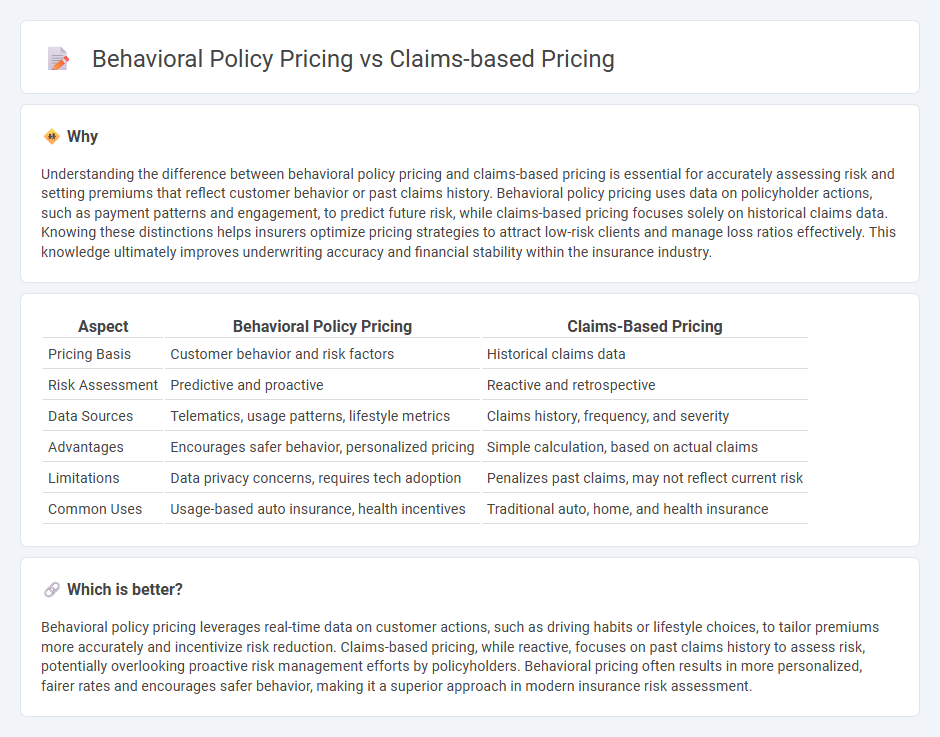

Understanding the difference between behavioral policy pricing and claims-based pricing is essential for accurately assessing risk and setting premiums that reflect customer behavior or past claims history. Behavioral policy pricing uses data on policyholder actions, such as payment patterns and engagement, to predict future risk, while claims-based pricing focuses solely on historical claims data. Knowing these distinctions helps insurers optimize pricing strategies to attract low-risk clients and manage loss ratios effectively. This knowledge ultimately improves underwriting accuracy and financial stability within the insurance industry.

Comparison Table

| Aspect | Behavioral Policy Pricing | Claims-Based Pricing |

|---|---|---|

| Pricing Basis | Customer behavior and risk factors | Historical claims data |

| Risk Assessment | Predictive and proactive | Reactive and retrospective |

| Data Sources | Telematics, usage patterns, lifestyle metrics | Claims history, frequency, and severity |

| Advantages | Encourages safer behavior, personalized pricing | Simple calculation, based on actual claims |

| Limitations | Data privacy concerns, requires tech adoption | Penalizes past claims, may not reflect current risk |

| Common Uses | Usage-based auto insurance, health incentives | Traditional auto, home, and health insurance |

Which is better?

Behavioral policy pricing leverages real-time data on customer actions, such as driving habits or lifestyle choices, to tailor premiums more accurately and incentivize risk reduction. Claims-based pricing, while reactive, focuses on past claims history to assess risk, potentially overlooking proactive risk management efforts by policyholders. Behavioral pricing often results in more personalized, fairer rates and encourages safer behavior, making it a superior approach in modern insurance risk assessment.

Connection

Behavioral policy pricing and claims-based pricing are interconnected through their reliance on individual policyholder data to assess risk accurately and set premiums. Behavioral pricing uses metrics like driving habits or lifestyle choices, while claims-based pricing incorporates historical claims data to predict future risk and cost. Combining these approaches enhances precision in underwriting, leading to more tailored insurance premiums and better risk management.

Key Terms

Claims History

Claims-based pricing directly evaluates an individual's past insurance claims to set premiums, reflecting their historical risk profile with precise data. Behavioral policy pricing incorporates broader behavioral patterns and personal characteristics, potentially reducing reliance on explicit claims history while using indirect indicators of risk. Explore how claims history impacts premium accuracy and customer fairness in different pricing models.

Risk Assessment

Claims-based pricing evaluates policyholder risk based on historical claims data, directly correlating past incidents to anticipated future costs. Behavioral policy pricing analyzes real-time behavior patterns, such as driving habits or online activity, to dynamically adjust premiums with greater precision. Explore how integrating advanced risk assessment models enhances pricing accuracy and customer segmentation.

Policyholder Behavior

Claims-based pricing evaluates premiums primarily on historical claims data, directly linking policy costs to the frequency and severity of past claims. Behavioral policy pricing incorporates a broader analysis of policyholder behavior patterns, such as driving habits or payment consistency, to predict future risk more dynamically. Explore the nuances between these pricing strategies to optimize insurance underwriting and customer segmentation.

Source and External Links

Comparison of Claims-based Pricing Policies vs As-charged Policies - This webpage explains how claims-based pricing policies adjust premiums based on an individual's claims history, affecting future premiums.

Portfolio-based vs Claim-based Premium Pricing - Discusses claim-based pricing where premiums are determined by an individual's claims experience, contrasting it with portfolio-based pricing.

Claims Based Premium Pricing - Describes Prudential's claims-based premium pricing as a fairer approach that rewards policyholders for staying healthy with lower premiums.

dowidth.com

dowidth.com