Digital health insurance leverages advanced technologies and data analytics to offer personalized coverage and streamlined claims processing, enhancing user convenience and efficiency. Telemedicine-based insurance specifically integrates remote medical consultations and virtual healthcare services into policies, reducing the need for in-person visits and lowering overall healthcare costs. Explore further to understand how these innovative insurance models can transform access to healthcare and optimize coverage options.

Why it is important

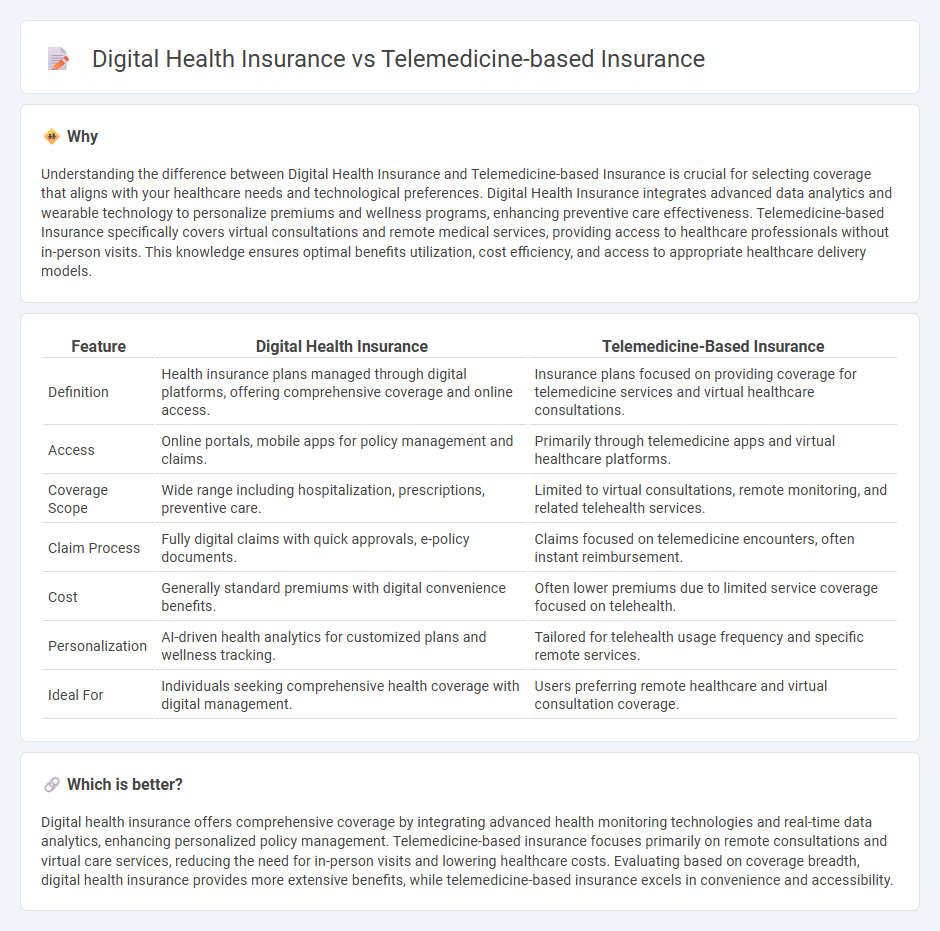

Understanding the difference between Digital Health Insurance and Telemedicine-based Insurance is crucial for selecting coverage that aligns with your healthcare needs and technological preferences. Digital Health Insurance integrates advanced data analytics and wearable technology to personalize premiums and wellness programs, enhancing preventive care effectiveness. Telemedicine-based Insurance specifically covers virtual consultations and remote medical services, providing access to healthcare professionals without in-person visits. This knowledge ensures optimal benefits utilization, cost efficiency, and access to appropriate healthcare delivery models.

Comparison Table

| Feature | Digital Health Insurance | Telemedicine-Based Insurance |

|---|---|---|

| Definition | Health insurance plans managed through digital platforms, offering comprehensive coverage and online access. | Insurance plans focused on providing coverage for telemedicine services and virtual healthcare consultations. |

| Access | Online portals, mobile apps for policy management and claims. | Primarily through telemedicine apps and virtual healthcare platforms. |

| Coverage Scope | Wide range including hospitalization, prescriptions, preventive care. | Limited to virtual consultations, remote monitoring, and related telehealth services. |

| Claim Process | Fully digital claims with quick approvals, e-policy documents. | Claims focused on telemedicine encounters, often instant reimbursement. |

| Cost | Generally standard premiums with digital convenience benefits. | Often lower premiums due to limited service coverage focused on telehealth. |

| Personalization | AI-driven health analytics for customized plans and wellness tracking. | Tailored for telehealth usage frequency and specific remote services. |

| Ideal For | Individuals seeking comprehensive health coverage with digital management. | Users preferring remote healthcare and virtual consultation coverage. |

Which is better?

Digital health insurance offers comprehensive coverage by integrating advanced health monitoring technologies and real-time data analytics, enhancing personalized policy management. Telemedicine-based insurance focuses primarily on remote consultations and virtual care services, reducing the need for in-person visits and lowering healthcare costs. Evaluating based on coverage breadth, digital health insurance provides more extensive benefits, while telemedicine-based insurance excels in convenience and accessibility.

Connection

Digital health insurance and telemedicine-based insurance are interconnected through their integration of technology to enhance healthcare accessibility and efficiency. Telemedicine-based insurance leverages digital platforms to provide remote medical consultations, which digital health insurance policies increasingly cover, reducing the need for in-person visits. This synergy improves patient experience, lowers healthcare costs, and expands coverage options by using real-time data and virtual care services.

Key Terms

**Telemedicine-based insurance:**

Telemedicine-based insurance integrates virtual healthcare services directly into insurance plans, allowing policyholders to access remote medical consultations and treatment without visiting physical clinics. This model reduces costs and wait times while increasing convenience and continuous care, leveraging advanced telecommunication technologies. Explore how telemedicine-based insurance can transform your healthcare experience and reduce overall expenses.

Remote Consultation Coverage

Telemedicine-based insurance primarily covers remote consultations through video calls or phone services, ensuring patients receive medical advice without physical visits. Digital health insurance expands this coverage by integrating wearable devices, AI diagnostics, and health apps to offer a comprehensive digital healthcare ecosystem. Explore the differences in coverage and benefits to determine the best fit for your remote healthcare needs.

Virtual Care Network

Telemedicine-based insurance primarily covers remote consultations and treatments, leveraging a Virtual Care Network to connect patients with healthcare providers through video calls, phone, or messaging platforms. Digital health insurance expands these services by integrating wearable devices, AI diagnostics, and personalized health management tools alongside telemedicine functions. Explore how Virtual Care Networks transform patient access and insurance benefits in the evolving digital healthcare landscape.

Source and External Links

Telehealth Coverage - The Doctors Company - Offers medical professional liability insurance for telemedicine across all 50 states in the U.S.

Telehealth: What Is It, How to Prepare, Is It Covered? - Discusses how many insurance providers, including Medicaid, cover telehealth services but notes variability in coverage by state.

Private Insurance Coverage for Telehealth - Explains that most insurance providers cover some form of telehealth services, emphasizing the need to verify coverage with specific providers.

dowidth.com

dowidth.com