Digital health insurance leverages technology to offer personalized coverage, telemedicine access, and streamlined claims processing, enhancing convenience and efficiency for policyholders. Critical illness insurance provides lump-sum financial support upon diagnosis of severe conditions like cancer, heart attack, or stroke, ensuring policyholders can cover treatment costs and maintain financial stability. Explore the key differences to determine which insurance best suits your healthcare needs.

Why it is important

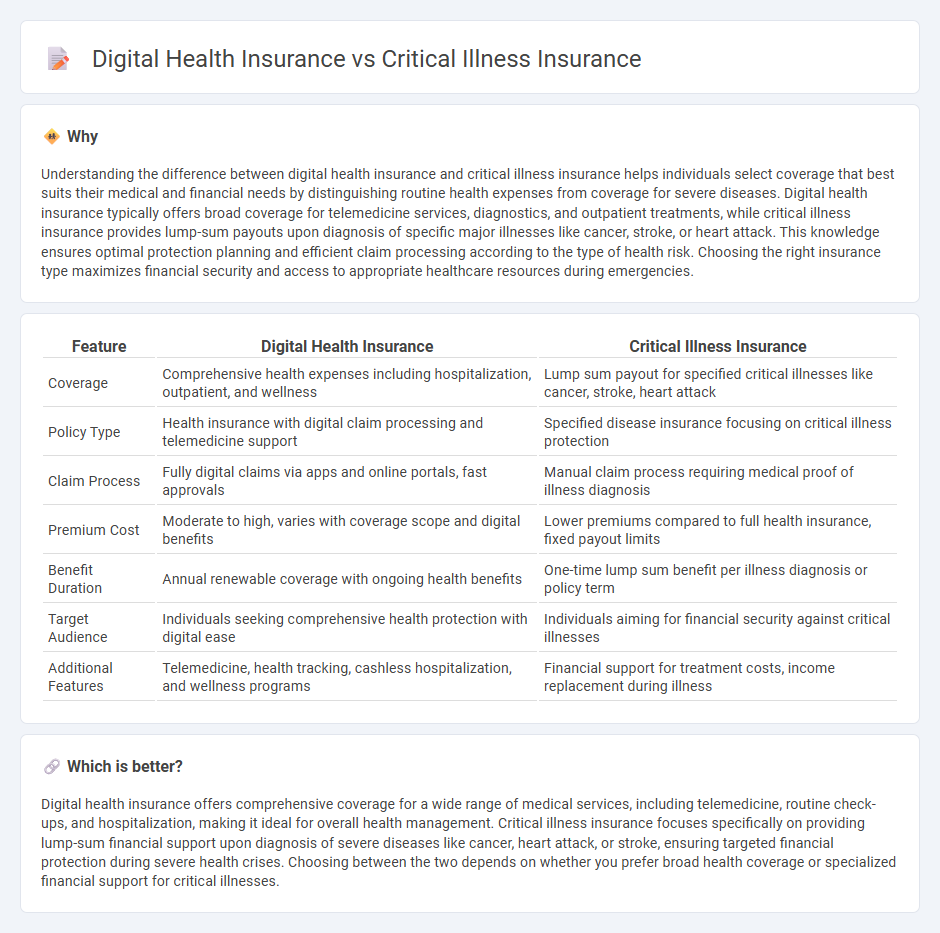

Understanding the difference between digital health insurance and critical illness insurance helps individuals select coverage that best suits their medical and financial needs by distinguishing routine health expenses from coverage for severe diseases. Digital health insurance typically offers broad coverage for telemedicine services, diagnostics, and outpatient treatments, while critical illness insurance provides lump-sum payouts upon diagnosis of specific major illnesses like cancer, stroke, or heart attack. This knowledge ensures optimal protection planning and efficient claim processing according to the type of health risk. Choosing the right insurance type maximizes financial security and access to appropriate healthcare resources during emergencies.

Comparison Table

| Feature | Digital Health Insurance | Critical Illness Insurance |

|---|---|---|

| Coverage | Comprehensive health expenses including hospitalization, outpatient, and wellness | Lump sum payout for specified critical illnesses like cancer, stroke, heart attack |

| Policy Type | Health insurance with digital claim processing and telemedicine support | Specified disease insurance focusing on critical illness protection |

| Claim Process | Fully digital claims via apps and online portals, fast approvals | Manual claim process requiring medical proof of illness diagnosis |

| Premium Cost | Moderate to high, varies with coverage scope and digital benefits | Lower premiums compared to full health insurance, fixed payout limits |

| Benefit Duration | Annual renewable coverage with ongoing health benefits | One-time lump sum benefit per illness diagnosis or policy term |

| Target Audience | Individuals seeking comprehensive health protection with digital ease | Individuals aiming for financial security against critical illnesses |

| Additional Features | Telemedicine, health tracking, cashless hospitalization, and wellness programs | Financial support for treatment costs, income replacement during illness |

Which is better?

Digital health insurance offers comprehensive coverage for a wide range of medical services, including telemedicine, routine check-ups, and hospitalization, making it ideal for overall health management. Critical illness insurance focuses specifically on providing lump-sum financial support upon diagnosis of severe diseases like cancer, heart attack, or stroke, ensuring targeted financial protection during severe health crises. Choosing between the two depends on whether you prefer broad health coverage or specialized financial support for critical illnesses.

Connection

Digital health insurance platforms streamline the management and claims processing of critical illness insurance by leveraging telemedicine, electronic health records, and AI-powered risk assessments. Critical illness insurance offers financial protection against severe medical conditions, while digital health insurance enhances accessibility, policy customization, and real-time health monitoring. Together, they create a seamless, tech-driven approach to managing health risks and optimizing insurance benefits.

Key Terms

Critical Illness Coverage

Critical illness insurance provides a lump sum payout upon diagnosis of specified severe health conditions such as cancer, heart attack, or stroke, offering financial protection for treatment and recovery costs. Digital health insurance integrates technology-driven services like telemedicine and health monitoring but may have limited or no critical illness coverage compared to traditional plans. Explore detailed comparisons to understand how critical illness coverage varies between these insurance types.

Telemedicine

Critical illness insurance provides coverage for severe health conditions such as cancer, heart attack, or stroke, offering a lump-sum payout upon diagnosis to help manage treatment costs and income loss. Digital health insurance increasingly integrates telemedicine services, enabling policyholders to access virtual consultations, remote diagnostics, and continuous health monitoring, enhancing convenience and timely medical support. Explore how telemedicine is revolutionizing health insurance by bridging critical care and digital innovation for comprehensive protection.

Lump Sum Benefit

Critical illness insurance offers a lump sum benefit upon diagnosis of specified severe diseases such as cancer, heart attack, or stroke, designed to cover medical and living expenses during treatment. Digital health insurance integrates technology to streamline claims and wellness tracking but may emphasize continuous coverage rather than one-time lump sum payouts. Explore the nuances and benefits of each to determine which lump sum benefit aligns best with your financial protection needs.

Source and External Links

Critical Illness Insurance - What Is It - Critical illness insurance provides a lump sum or monthly payments when diagnosed with a major illness like heart attack, stroke, or cancer, supplementing existing health insurance to help cover extra costs during recovery.

Critical illness insurance - This insurance pays a lump sum or income if diagnosed with specific illnesses, often requiring survival beyond a short period post-diagnosis, with policies defining exact claim conditions and possibly paying providers directly for treatments.

Critical Illness Insurance Plans - MetLife's critical illness insurance offers lump-sum payments to cover expenses beyond medical bills, with benefits starting immediately, coverage portability, and no health questions during enrollment.

dowidth.com

dowidth.com