Pet insurance covers veterinary expenses for illnesses, accidents, and routine care, ensuring your pets receive necessary medical attention without financial strain. Disability insurance provides income replacement if you become unable to work due to injury or illness, safeguarding your financial stability during recovery. Explore detailed comparisons to determine which insurance best fits your needs.

Why it is important

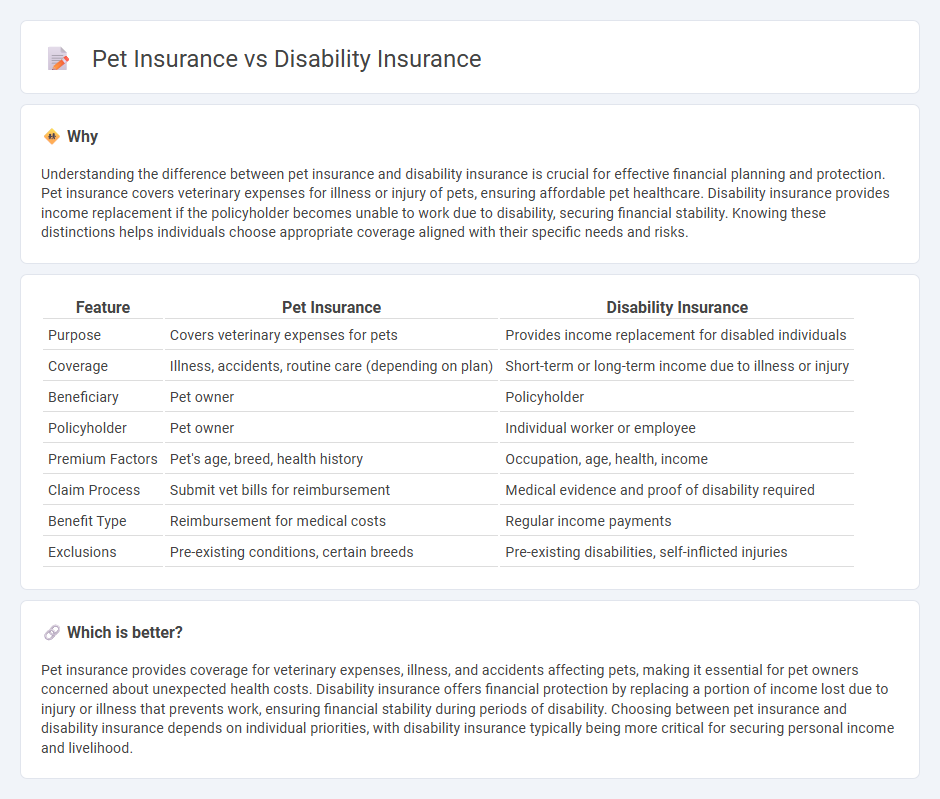

Understanding the difference between pet insurance and disability insurance is crucial for effective financial planning and protection. Pet insurance covers veterinary expenses for illness or injury of pets, ensuring affordable pet healthcare. Disability insurance provides income replacement if the policyholder becomes unable to work due to disability, securing financial stability. Knowing these distinctions helps individuals choose appropriate coverage aligned with their specific needs and risks.

Comparison Table

| Feature | Pet Insurance | Disability Insurance |

|---|---|---|

| Purpose | Covers veterinary expenses for pets | Provides income replacement for disabled individuals |

| Coverage | Illness, accidents, routine care (depending on plan) | Short-term or long-term income due to illness or injury |

| Beneficiary | Pet owner | Policyholder |

| Policyholder | Pet owner | Individual worker or employee |

| Premium Factors | Pet's age, breed, health history | Occupation, age, health, income |

| Claim Process | Submit vet bills for reimbursement | Medical evidence and proof of disability required |

| Benefit Type | Reimbursement for medical costs | Regular income payments |

| Exclusions | Pre-existing conditions, certain breeds | Pre-existing disabilities, self-inflicted injuries |

Which is better?

Pet insurance provides coverage for veterinary expenses, illness, and accidents affecting pets, making it essential for pet owners concerned about unexpected health costs. Disability insurance offers financial protection by replacing a portion of income lost due to injury or illness that prevents work, ensuring financial stability during periods of disability. Choosing between pet insurance and disability insurance depends on individual priorities, with disability insurance typically being more critical for securing personal income and livelihood.

Connection

Pet insurance and disability insurance both provide financial protection against unexpected events that impact daily life and well-being. Pet insurance covers veterinary expenses for illnesses or injuries, while disability insurance offers income replacement when a policyholder cannot work due to illness or injury. Together, these insurances reduce financial strain by addressing health-related disruptions affecting both pets and policyholders.

Key Terms

**Elimination Period**

Disability insurance typically features an elimination period ranging from 30 to 180 days, during which policyholders must wait before benefits are payable, whereas pet insurance often has a shorter waiting period, usually 14 days or less, before coverage activates. The elimination period directly affects premium costs and claim eligibility, with longer waiting periods generally leading to lower premiums but delayed financial support. Explore detailed comparisons of elimination periods to select the right insurance tailored to your needs.

**Benefit Amount**

Disability insurance typically offers a benefit amount based on a percentage of the insured's pre-disability income, often ranging from 50% to 70%, ensuring financial support during periods of lost earning capacity. Pet insurance benefits, however, are usually structured as reimbursement for veterinary expenses, with annual or per-incident limits that vary widely, often between $5,000 and $20,000. Explore our detailed comparison to understand how benefit amounts can impact your insurance choice.

**Pre-existing Conditions**

Pre-existing conditions are typically excluded from disability insurance, meaning any illness or injury prior to policy start may not be covered, limiting financial protection for those with prior health issues. Pet insurance, however, varies by provider, with some plans offering coverage for pre-existing conditions if the pet has been symptom-free for a certain period, while others exclude them entirely. Explore detailed policy comparisons to understand how pre-existing conditions impact your coverage options.

Source and External Links

Disability Insurance - State Farm offers disability insurance to protect income if you're unable to work due to illness or injury, providing funds for expenses like mortgages and car loans.

Affordable Disability Insurance Plans - Guardian offers long-term and short-term disability insurance plans to replace income if illness or injury prevents working, with options for individuals and businesses.

Disability Insurance - The Standard provides disability insurance, which includes short-term and long-term options, to help protect income if you're disabled and unable to work.

dowidth.com

dowidth.com