NFT insurance protects digital assets like non-fungible tokens from risks such as cyber theft, fraud, and platform failures, ensuring the value and ownership of unique blockchain-based items. Usage-based insurance (UBI) leverages real-time data from telematics devices to offer personalized premiums based on individual driving behaviors, promoting fairer pricing and incentivizing safer driving. Discover more about how these innovative insurance models are reshaping risk management and consumer protection.

Why it is important

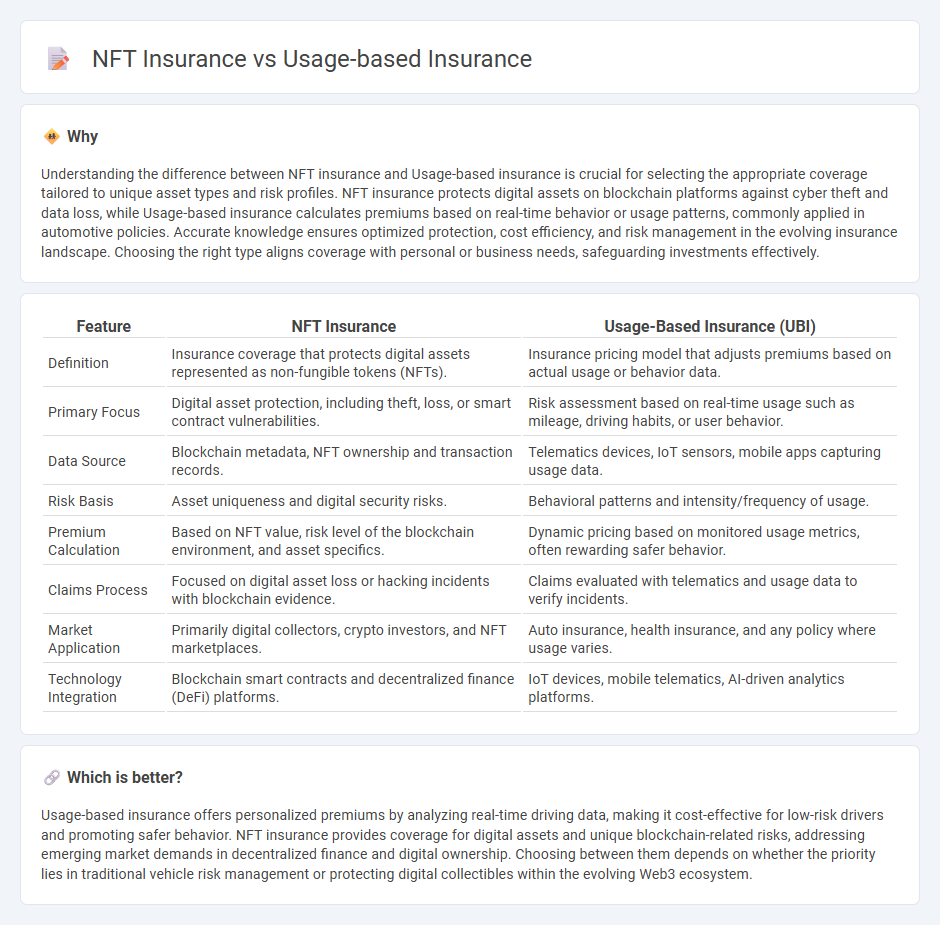

Understanding the difference between NFT insurance and Usage-based insurance is crucial for selecting the appropriate coverage tailored to unique asset types and risk profiles. NFT insurance protects digital assets on blockchain platforms against cyber theft and data loss, while Usage-based insurance calculates premiums based on real-time behavior or usage patterns, commonly applied in automotive policies. Accurate knowledge ensures optimized protection, cost efficiency, and risk management in the evolving insurance landscape. Choosing the right type aligns coverage with personal or business needs, safeguarding investments effectively.

Comparison Table

| Feature | NFT Insurance | Usage-Based Insurance (UBI) |

|---|---|---|

| Definition | Insurance coverage that protects digital assets represented as non-fungible tokens (NFTs). | Insurance pricing model that adjusts premiums based on actual usage or behavior data. |

| Primary Focus | Digital asset protection, including theft, loss, or smart contract vulnerabilities. | Risk assessment based on real-time usage such as mileage, driving habits, or user behavior. |

| Data Source | Blockchain metadata, NFT ownership and transaction records. | Telematics devices, IoT sensors, mobile apps capturing usage data. |

| Risk Basis | Asset uniqueness and digital security risks. | Behavioral patterns and intensity/frequency of usage. |

| Premium Calculation | Based on NFT value, risk level of the blockchain environment, and asset specifics. | Dynamic pricing based on monitored usage metrics, often rewarding safer behavior. |

| Claims Process | Focused on digital asset loss or hacking incidents with blockchain evidence. | Claims evaluated with telematics and usage data to verify incidents. |

| Market Application | Primarily digital collectors, crypto investors, and NFT marketplaces. | Auto insurance, health insurance, and any policy where usage varies. |

| Technology Integration | Blockchain smart contracts and decentralized finance (DeFi) platforms. | IoT devices, mobile telematics, AI-driven analytics platforms. |

Which is better?

Usage-based insurance offers personalized premiums by analyzing real-time driving data, making it cost-effective for low-risk drivers and promoting safer behavior. NFT insurance provides coverage for digital assets and unique blockchain-related risks, addressing emerging market demands in decentralized finance and digital ownership. Choosing between them depends on whether the priority lies in traditional vehicle risk management or protecting digital collectibles within the evolving Web3 ecosystem.

Connection

NFT insurance leverages blockchain technology to provide secure, transparent coverage for digital assets, while usage-based insurance (UBI) utilizes real-time data to tailor premiums based on individual behavior. Both insurance models rely on data-driven insights and smart contracts to automate claims and policy adjustments, enhancing efficiency and personalization. The convergence of NFT insurance and UBI represents an innovative shift towards dynamic, technology-enabled risk management in the insurance industry.

Key Terms

Telematics

Usage-based insurance leverages telematics devices to monitor driving behavior in real-time, enabling personalized premiums based on actual usage and risk profiles. NFT insurance integrates blockchain technology to provide digital asset coverage while exploring innovative risk assessment methods, but lacks direct telematics application. Discover how telematics reshapes insurance models and the contrasting roles in usage-based and NFT insurance by exploring our detailed analysis.

Smart Contracts

Usage-based insurance leverages telematics data to calculate premiums based on actual driving behavior, enhancing personalized risk assessment through smart contracts that automate claims and payments. NFT insurance employs blockchain technology by embedding coverage details within unique digital tokens, enabling transparent, tamper-proof contracts that execute automatically under predefined conditions. Explore further to understand how smart contracts revolutionize both insurance models for efficiency and trust.

Tokenization

Usage-based insurance leverages telematics data to calculate premiums based on real-time driving behavior, enhancing personalized risk assessment and pricing accuracy. NFT insurance utilizes blockchain technology to create digital tokens representing unique insurance contracts or policies, enabling transparent, immutable ownership and automated claims processing through smart contracts. Explore how tokenization is transforming insurance models by linking usage data with blockchain innovations for cutting-edge risk management.

Source and External Links

Usage-Based Car Insurance | Progressive - Usage-based insurance calculates auto insurance rates by analyzing how often and safely you drive, using devices or apps to monitor driving habits.

Usage-based Insurance | Office of the Insurance Commissioner - Usage-based insurance involves tracking driving behavior to determine premiums, using factors like speed, braking, and time of day.

Usage-based Insurance - Wikipedia - Usage-based insurance, including pay-as-you-drive and pay-how-you-drive, bases premiums on factors like distance driven and driving habits.

dowidth.com

dowidth.com