Buy-now-pay-later protection allows consumers to secure insurance coverage immediately while deferring premium payments, enhancing affordability and cash flow management. Usage-based insurance (UBI) leverages telematics to adjust premiums based on individual driving behavior, promoting personalized risk assessment and potential cost savings. Explore how these innovative insurance models can optimize your coverage and expenses.

Why it is important

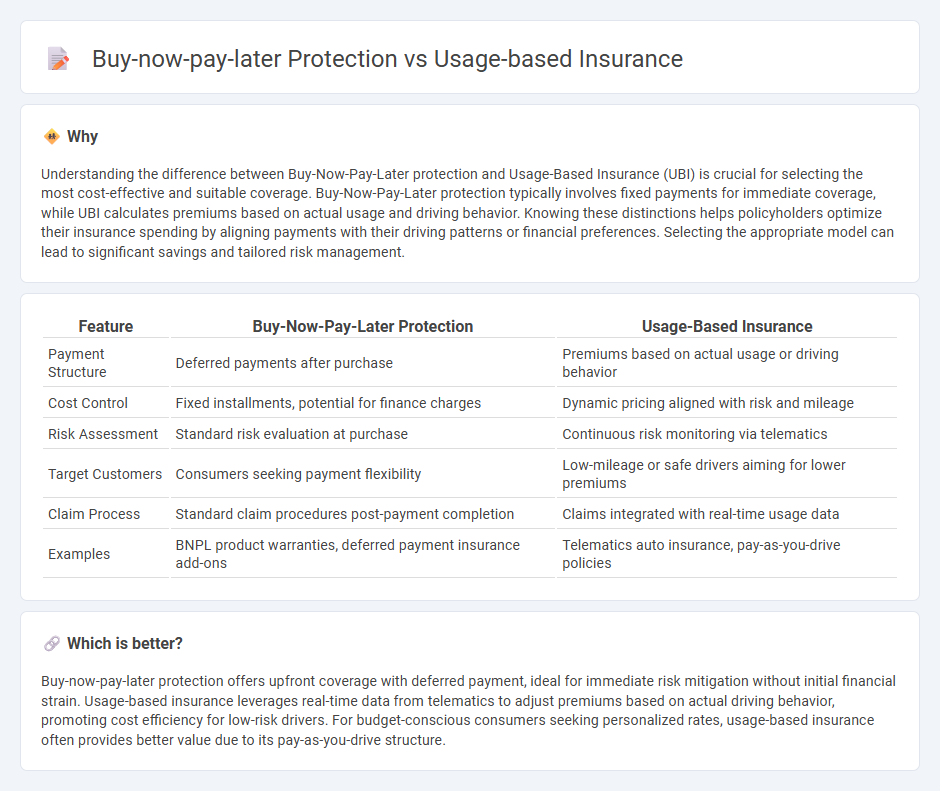

Understanding the difference between Buy-Now-Pay-Later protection and Usage-Based Insurance (UBI) is crucial for selecting the most cost-effective and suitable coverage. Buy-Now-Pay-Later protection typically involves fixed payments for immediate coverage, while UBI calculates premiums based on actual usage and driving behavior. Knowing these distinctions helps policyholders optimize their insurance spending by aligning payments with their driving patterns or financial preferences. Selecting the appropriate model can lead to significant savings and tailored risk management.

Comparison Table

| Feature | Buy-Now-Pay-Later Protection | Usage-Based Insurance |

|---|---|---|

| Payment Structure | Deferred payments after purchase | Premiums based on actual usage or driving behavior |

| Cost Control | Fixed installments, potential for finance charges | Dynamic pricing aligned with risk and mileage |

| Risk Assessment | Standard risk evaluation at purchase | Continuous risk monitoring via telematics |

| Target Customers | Consumers seeking payment flexibility | Low-mileage or safe drivers aiming for lower premiums |

| Claim Process | Standard claim procedures post-payment completion | Claims integrated with real-time usage data |

| Examples | BNPL product warranties, deferred payment insurance add-ons | Telematics auto insurance, pay-as-you-drive policies |

Which is better?

Buy-now-pay-later protection offers upfront coverage with deferred payment, ideal for immediate risk mitigation without initial financial strain. Usage-based insurance leverages real-time data from telematics to adjust premiums based on actual driving behavior, promoting cost efficiency for low-risk drivers. For budget-conscious consumers seeking personalized rates, usage-based insurance often provides better value due to its pay-as-you-drive structure.

Connection

Buy-now-pay-later protection enhances customer financial flexibility by covering installment payments in case of unforeseen events, aligning closely with usage-based insurance that adjusts premiums according to actual vehicle usage and risk behavior. Both insurance models leverage real-time data and consumer behavior analytics to offer personalized, affordable coverage options, reducing financial strain while promoting responsible usage. Integrating these solutions enables insurers to optimize risk management and provide dynamic protection tailored to individual payment and usage patterns.

Key Terms

Telematics

Usage-based insurance leverages telematics technology to monitor driving behavior, enabling personalized premiums based on real-time data such as speed, distance, and braking patterns. Buy-now-pay-later protection, on the other hand, offers financial coverage for deferred payments without integrating telematics insights. Explore how telematics transforms risk assessment and customer engagement in insurance models to learn more.

Underwriting

Usage-based insurance leverages telematics data to assess real-time driving behavior, enabling precise risk evaluation and personalized premium pricing. Buy-now-pay-later protection underwriting centers on credit risk analysis, incorporating payment history, transaction data, and consumer credit scores to mitigate default risks. Explore the nuances of underwriting models used in these financial innovations to understand their distinct risk management strategies.

Premium Financing

Premium financing offers a strategic approach to manage high insurance costs by allowing policyholders to spread payment over time, enhancing affordability while maintaining coverage continuity. Usage-based insurance (UBI) tailors premiums according to actual driving behavior, optimizing costs for low-mileage or safe drivers but may still require upfront payment without financing options. Explore in-depth comparisons to understand how premium financing can complement or contrast with usage-based insurance and buy-now-pay-later models in the evolving insurance market.

Source and External Links

Usage-Based Car Insurance | Progressive - Usage-based insurance (UBI) calculates auto insurance premiums by analyzing how often and how safely you drive, using data from a device or app, with driving behavior such as braking, acceleration, and mileage factored into pricing.

Usage-based insurance | Office of the Insurance Commissioner - UBI uses telematics technology to track driving behavior (including miles driven, location, and driving style) to customize premiums, though it raises privacy concerns and not all drivers qualify for discounts.

Want Your Auto Insurer to Track Your Driving? Understanding Usage-Based Insurance - UBI programs offer premiums based on individual driving information collected via devices or smartphones, supplementing traditional factors with real-time behavior like speed and time driven.

dowidth.com

dowidth.com