Crop insurance protects farmers against losses from natural disasters, pests, or crop failures, ensuring financial stability in agriculture. Marine insurance covers loss or damage to ships, cargo, and transit due to perils at sea, essential for global trade risk management. Explore more about how these insurance types safeguard critical sectors in our detailed guide.

Why it is important

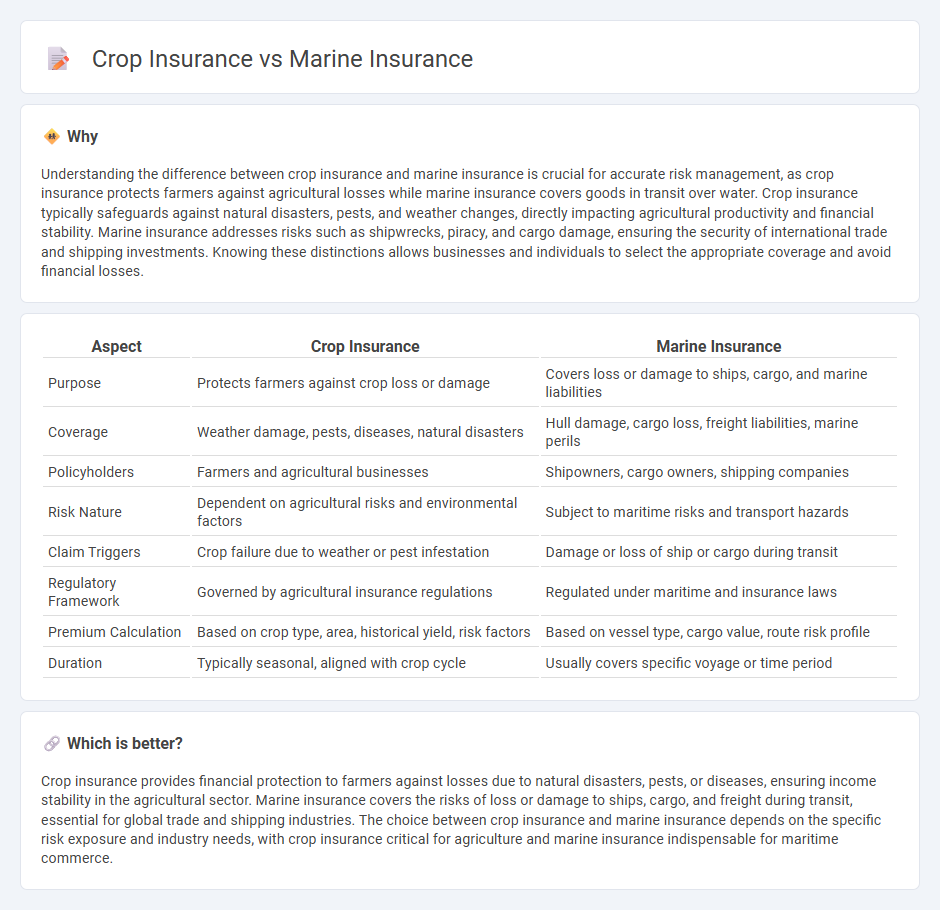

Understanding the difference between crop insurance and marine insurance is crucial for accurate risk management, as crop insurance protects farmers against agricultural losses while marine insurance covers goods in transit over water. Crop insurance typically safeguards against natural disasters, pests, and weather changes, directly impacting agricultural productivity and financial stability. Marine insurance addresses risks such as shipwrecks, piracy, and cargo damage, ensuring the security of international trade and shipping investments. Knowing these distinctions allows businesses and individuals to select the appropriate coverage and avoid financial losses.

Comparison Table

| Aspect | Crop Insurance | Marine Insurance |

|---|---|---|

| Purpose | Protects farmers against crop loss or damage | Covers loss or damage to ships, cargo, and marine liabilities |

| Coverage | Weather damage, pests, diseases, natural disasters | Hull damage, cargo loss, freight liabilities, marine perils |

| Policyholders | Farmers and agricultural businesses | Shipowners, cargo owners, shipping companies |

| Risk Nature | Dependent on agricultural risks and environmental factors | Subject to maritime risks and transport hazards |

| Claim Triggers | Crop failure due to weather or pest infestation | Damage or loss of ship or cargo during transit |

| Regulatory Framework | Governed by agricultural insurance regulations | Regulated under maritime and insurance laws |

| Premium Calculation | Based on crop type, area, historical yield, risk factors | Based on vessel type, cargo value, route risk profile |

| Duration | Typically seasonal, aligned with crop cycle | Usually covers specific voyage or time period |

Which is better?

Crop insurance provides financial protection to farmers against losses due to natural disasters, pests, or diseases, ensuring income stability in the agricultural sector. Marine insurance covers the risks of loss or damage to ships, cargo, and freight during transit, essential for global trade and shipping industries. The choice between crop insurance and marine insurance depends on the specific risk exposure and industry needs, with crop insurance critical for agriculture and marine insurance indispensable for maritime commerce.

Connection

Crop insurance and marine insurance are connected through their role in risk management for agricultural and maritime sectors, respectively, providing financial protection against losses caused by natural disasters, accidents, or adverse conditions. Both types of insurance employ policies that cover physical goods--crops in the agricultural context and goods or vessels in marine transport--ensuring continuity and stability in supply chains and trade. The underlying principle of indemnification and premium calculation based on risk exposure links these insurance types in mitigating economic uncertainties for producers, traders, and investors.

Key Terms

**Marine Insurance:**

Marine insurance provides coverage for loss or damage to ships, cargo, terminals, and any transport by which goods are transferred, acquired, or held between points of origin and final destination. It includes hull insurance, cargo insurance, and protection and indemnity insurance, catering to maritime risks like piracy, weather perils, and accidents at sea. Explore the essential aspects of marine insurance to safeguard your maritime assets effectively.

Hull

Marine hull insurance protects vessels against physical damage or loss caused by perils such as storms, collisions, or grounding, covering ships, boats, and their machinery. Crop insurance primarily safeguards agricultural producers from financial losses due to adverse weather, pests, or disease affecting crop yields. Explore more to understand how marine hull and crop insurance policies differ in coverage, risk management, and claims processes.

Cargo

Marine insurance primarily covers the risk of loss or damage to cargo during transit over water, protecting goods against perils like storms, piracy, and accidents. Crop insurance, in contrast, safeguards agricultural produce against risks such as adverse weather, pests, and diseases, but does not extend coverage to transport-related cargo loss. Explore detailed differences and benefits to understand which insurance suits your specific cargo protection needs.

Source and External Links

Marine insurance - Wikipedia - Marine insurance covers loss or damage to ships, cargo, terminals, and any transport by which the property is transferred, and it is typically underwritten on a subscription basis with standard policies such as the MAR 91 form outlining cover details.

Inland & Ocean Marine Insurance | Markel - Markel provides customized inland and ocean marine insurance solutions tailored to protect vessels, cargo, marine businesses, and personal watercraft with expertise gained over 45 years.

Global Marine Insurance: Inland & Ocean | Zurich - Zurich offers global marine insurance to cover risks of loss or damage to goods in transport worldwide, backed by experienced underwriters and risk engineers to manage complex logistics risks.

dowidth.com

dowidth.com