Climate risk insurance provides financial protection against losses from extreme weather events by assessing actual damages, offering tailored coverage for climate-related disasters. Index-based insurance pays out benefits based on predetermined climate indices like rainfall or temperature thresholds, enabling quicker and more transparent claims processing without the need for individual loss assessments. Explore the differences and benefits of each approach to determine the best insurance strategy for managing climate risks.

Why it is important

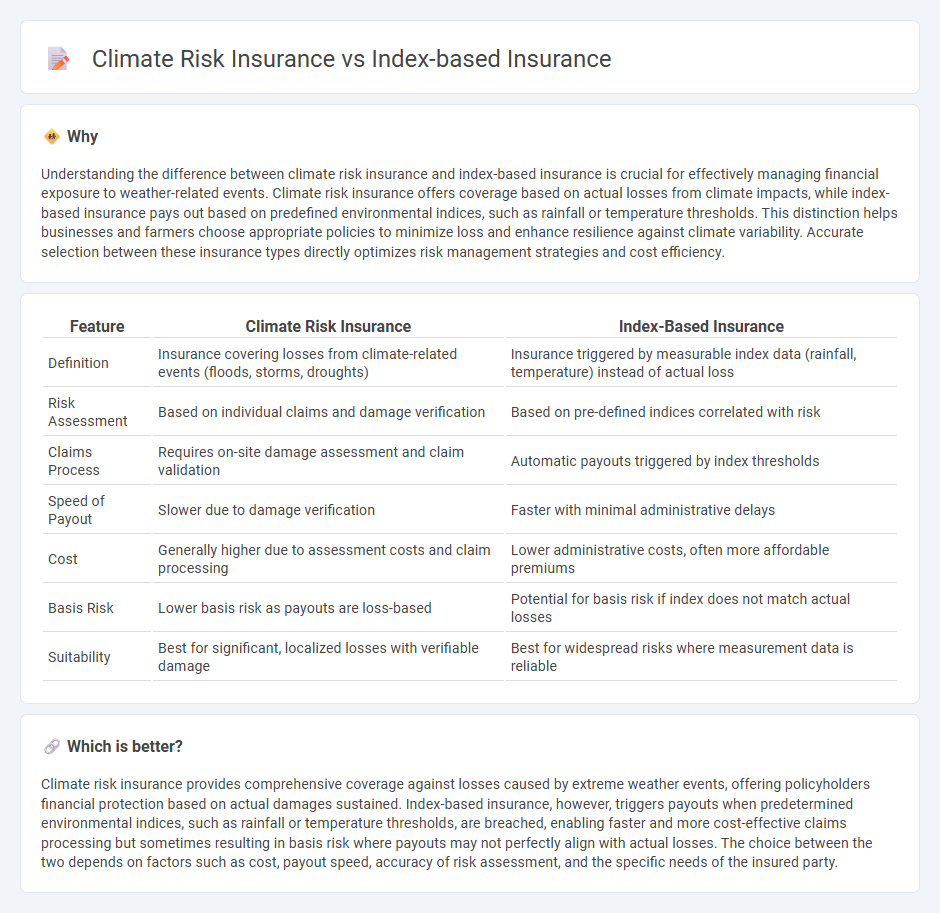

Understanding the difference between climate risk insurance and index-based insurance is crucial for effectively managing financial exposure to weather-related events. Climate risk insurance offers coverage based on actual losses from climate impacts, while index-based insurance pays out based on predefined environmental indices, such as rainfall or temperature thresholds. This distinction helps businesses and farmers choose appropriate policies to minimize loss and enhance resilience against climate variability. Accurate selection between these insurance types directly optimizes risk management strategies and cost efficiency.

Comparison Table

| Feature | Climate Risk Insurance | Index-Based Insurance |

|---|---|---|

| Definition | Insurance covering losses from climate-related events (floods, storms, droughts) | Insurance triggered by measurable index data (rainfall, temperature) instead of actual loss |

| Risk Assessment | Based on individual claims and damage verification | Based on pre-defined indices correlated with risk |

| Claims Process | Requires on-site damage assessment and claim validation | Automatic payouts triggered by index thresholds |

| Speed of Payout | Slower due to damage verification | Faster with minimal administrative delays |

| Cost | Generally higher due to assessment costs and claim processing | Lower administrative costs, often more affordable premiums |

| Basis Risk | Lower basis risk as payouts are loss-based | Potential for basis risk if index does not match actual losses |

| Suitability | Best for significant, localized losses with verifiable damage | Best for widespread risks where measurement data is reliable |

Which is better?

Climate risk insurance provides comprehensive coverage against losses caused by extreme weather events, offering policyholders financial protection based on actual damages sustained. Index-based insurance, however, triggers payouts when predetermined environmental indices, such as rainfall or temperature thresholds, are breached, enabling faster and more cost-effective claims processing but sometimes resulting in basis risk where payouts may not perfectly align with actual losses. The choice between the two depends on factors such as cost, payout speed, accuracy of risk assessment, and the specific needs of the insured party.

Connection

Climate risk insurance and index-based insurance are connected through their focus on providing financial protection against climate-related hazards by using predefined environmental indices like rainfall or temperature data. Index-based insurance reduces moral hazard and adverse selection by triggering payouts based on objective, verifiable climate parameters rather than individual loss assessments. This innovative approach enhances resilience for vulnerable communities and agricultural sectors by ensuring faster, more transparent compensation after climate shocks.

Key Terms

Index-based insurance:

Index-based insurance uses predefined indices such as rainfall levels or temperature thresholds to trigger payouts, minimizing the need for on-site loss assessment. This type of insurance supports farmers and businesses by providing faster compensation, reducing administrative costs, and promoting financial resilience against climate variability. Discover how index-based insurance can enhance risk management strategies in vulnerable regions.

Parametric Trigger

Index-based insurance uses pre-determined indices such as rainfall or temperature measurements to trigger payouts, reducing the need for on-site damage assessment. Climate risk insurance often incorporates parametric triggers to provide swift financial support following specific climate events like hurricanes, droughts, or floods. Discover how parametric triggers enhance risk management and financial resilience in both insurance models.

Weather Index

Index-based insurance relies on predefined indices such as rainfall or temperature thresholds to trigger payouts, reducing the need for on-ground loss assessment and enabling faster claims processing. Climate risk insurance encompasses a broader scope, addressing various climate-related damages, including extreme weather events and long-term environmental changes, often combining multiple risk factors beyond simple weather indices. Explore the nuances of Weather Index Insurance and its impact on managing agricultural risks under climate variability to gain deeper insights.

Source and External Links

FAQ - What is Index Insurance? - Index insurance pays out benefits based on a predetermined index, such as rainfall levels, to cover losses from weather and catastrophic events.

Index-based insurance - This type of insurance is primarily used in agriculture, offering payouts based on indices like rainfall or yield to manage losses efficiently.

Index-Based Insurance - Index-based insurance provides an affordable alternative to traditional coverage, speeding up payouts and enhancing farmers' livelihoods by reducing transaction costs.

dowidth.com

dowidth.com