Micro-mobility insurance specifically covers risks associated with devices like electric scooters and bikes, protecting users against accidents, theft, and liability during short-distance urban travel. Travel insurance provides broader coverage for trips, including medical emergencies, trip cancellations, lost luggage, and travel delays worldwide. Explore the key differences and benefits of each insurance type to choose the best protection for your journey.

Why it is important

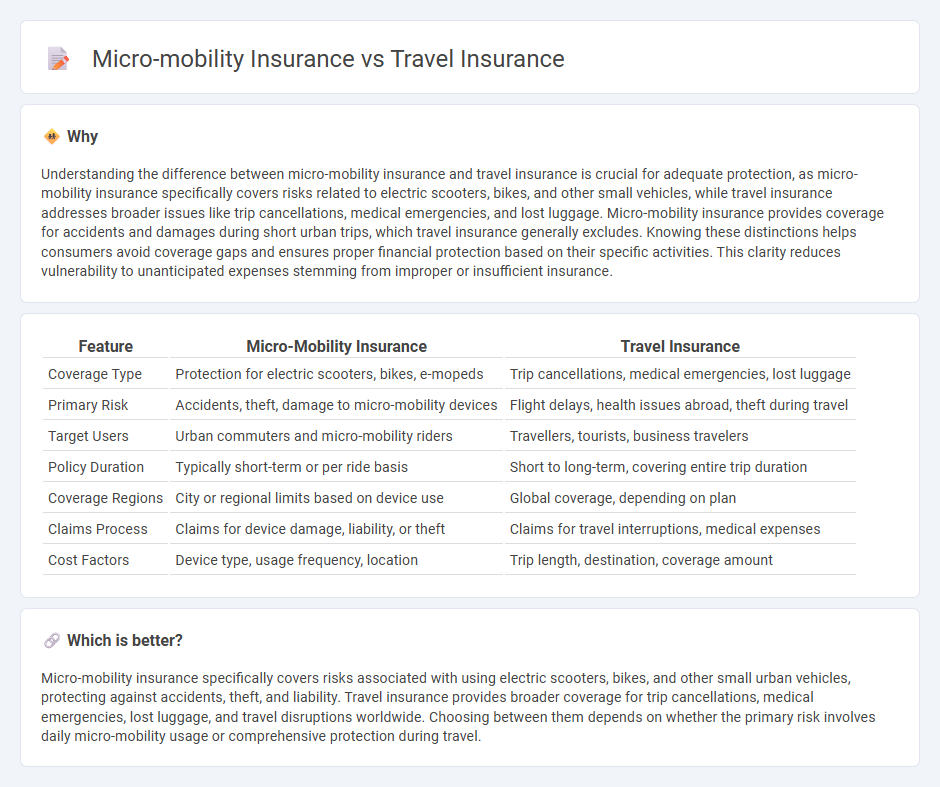

Understanding the difference between micro-mobility insurance and travel insurance is crucial for adequate protection, as micro-mobility insurance specifically covers risks related to electric scooters, bikes, and other small vehicles, while travel insurance addresses broader issues like trip cancellations, medical emergencies, and lost luggage. Micro-mobility insurance provides coverage for accidents and damages during short urban trips, which travel insurance generally excludes. Knowing these distinctions helps consumers avoid coverage gaps and ensures proper financial protection based on their specific activities. This clarity reduces vulnerability to unanticipated expenses stemming from improper or insufficient insurance.

Comparison Table

| Feature | Micro-Mobility Insurance | Travel Insurance |

|---|---|---|

| Coverage Type | Protection for electric scooters, bikes, e-mopeds | Trip cancellations, medical emergencies, lost luggage |

| Primary Risk | Accidents, theft, damage to micro-mobility devices | Flight delays, health issues abroad, theft during travel |

| Target Users | Urban commuters and micro-mobility riders | Travellers, tourists, business travelers |

| Policy Duration | Typically short-term or per ride basis | Short to long-term, covering entire trip duration |

| Coverage Regions | City or regional limits based on device use | Global coverage, depending on plan |

| Claims Process | Claims for device damage, liability, or theft | Claims for travel interruptions, medical expenses |

| Cost Factors | Device type, usage frequency, location | Trip length, destination, coverage amount |

Which is better?

Micro-mobility insurance specifically covers risks associated with using electric scooters, bikes, and other small urban vehicles, protecting against accidents, theft, and liability. Travel insurance provides broader coverage for trip cancellations, medical emergencies, lost luggage, and travel disruptions worldwide. Choosing between them depends on whether the primary risk involves daily micro-mobility usage or comprehensive protection during travel.

Connection

Micro-mobility insurance and travel insurance both address risk management for individuals on the move, covering liabilities and potential accidents involving scooters, bicycles, or other small vehicles. They provide financial protection for medical expenses, theft, and property damage, ensuring safety during daily commutes or leisure travel. Integrating these insurance types supports comprehensive coverage tailored to the growing demand for flexible, location-independent transportation modes.

Key Terms

Travel insurance:

Travel insurance provides comprehensive coverage for trip cancellations, medical emergencies, lost luggage, and travel delays, ensuring financial protection and peace of mind during your journey. This type of insurance typically includes benefits like emergency evacuation, trip interruption, and coverage for unforeseen medical expenses abroad. Explore our detailed guide to understand the specific advantages and coverage options of travel insurance.

Trip Cancellation

Trip cancellation coverage in travel insurance reimburses non-refundable expenses when unforeseen events disrupt travel plans, ensuring financial protection against cancellations due to illness or emergencies. Micro-mobility insurance often excludes trip cancellation, concentrating instead on liability and physical damage for devices like e-scooters or bikes during urban commutes. Explore detailed comparisons to determine which insurance best safeguards your travel and micro-mobility risks.

Emergency Medical Coverage

Travel insurance covers emergency medical expenses such as hospital stays, emergency surgeries, and medical evacuations during trips abroad, often providing extensive protection for travelers worldwide. Micro-mobility insurance primarily focuses on immediate accident-related medical coverage for users of electric scooters, bikes, and other short-distance transport, emphasizing quick medical response and liability protection. Explore the differences to choose the best policy tailored to your travel or micro-mobility safety needs.

Source and External Links

Travelers Travel Insurance - Offers travel protection for trip cancellations, medical expenses, and baggage, providing several plan options including single-trip and multi-trip plans.

Travel Guard - Provides comprehensive travel insurance plans covering trip cancellations, medical expenses, and emergency services, suitable for various types of trips.

Squaremouth Travel Insurance - Allows comparison of quotes from multiple insurance companies and offers policies with coverage for unexpected medical expenses and trip cancellations.

dowidth.com

dowidth.com