Peer-to-peer insurance leverages a community-based model where policyholders pool their premiums to cover claims, reducing overhead costs and aligning interests between members. Bancassurance integrates insurance products directly within banking institutions, offering customers streamlined access to financial services and insurance through a single provider. Explore how these innovative insurance models transform customer experience and market dynamics.

Why it is important

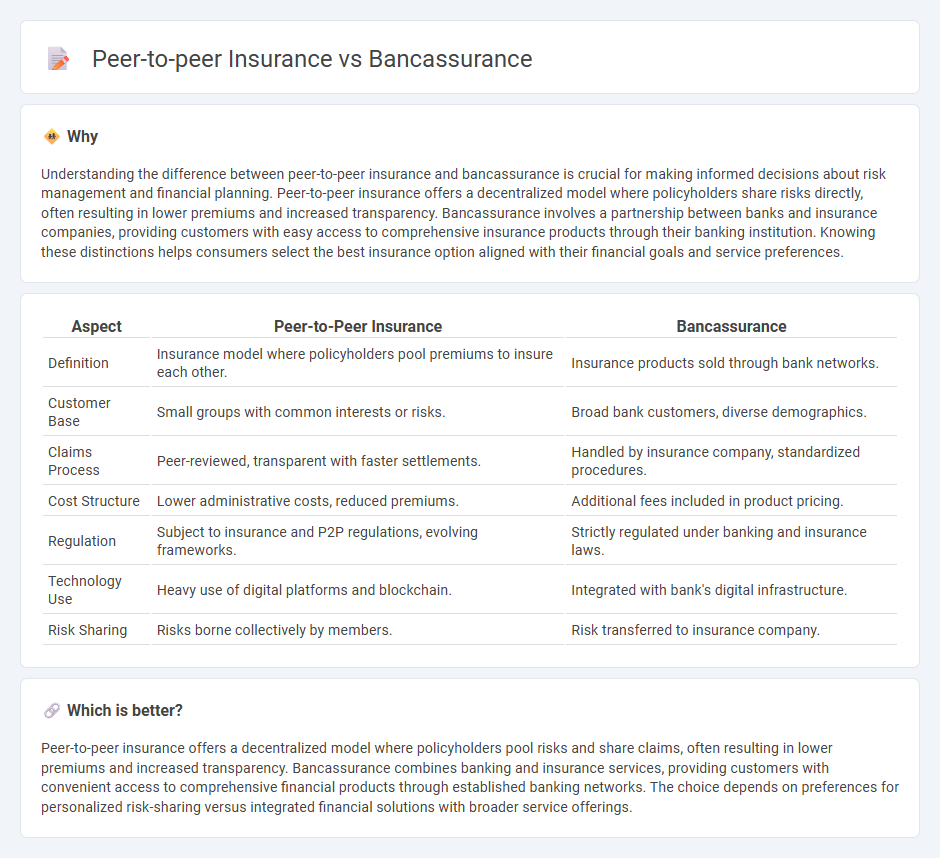

Understanding the difference between peer-to-peer insurance and bancassurance is crucial for making informed decisions about risk management and financial planning. Peer-to-peer insurance offers a decentralized model where policyholders share risks directly, often resulting in lower premiums and increased transparency. Bancassurance involves a partnership between banks and insurance companies, providing customers with easy access to comprehensive insurance products through their banking institution. Knowing these distinctions helps consumers select the best insurance option aligned with their financial goals and service preferences.

Comparison Table

| Aspect | Peer-to-Peer Insurance | Bancassurance |

|---|---|---|

| Definition | Insurance model where policyholders pool premiums to insure each other. | Insurance products sold through bank networks. |

| Customer Base | Small groups with common interests or risks. | Broad bank customers, diverse demographics. |

| Claims Process | Peer-reviewed, transparent with faster settlements. | Handled by insurance company, standardized procedures. |

| Cost Structure | Lower administrative costs, reduced premiums. | Additional fees included in product pricing. |

| Regulation | Subject to insurance and P2P regulations, evolving frameworks. | Strictly regulated under banking and insurance laws. |

| Technology Use | Heavy use of digital platforms and blockchain. | Integrated with bank's digital infrastructure. |

| Risk Sharing | Risks borne collectively by members. | Risk transferred to insurance company. |

Which is better?

Peer-to-peer insurance offers a decentralized model where policyholders pool risks and share claims, often resulting in lower premiums and increased transparency. Bancassurance combines banking and insurance services, providing customers with convenient access to comprehensive financial products through established banking networks. The choice depends on preferences for personalized risk-sharing versus integrated financial solutions with broader service offerings.

Connection

Peer-to-peer insurance leverages social networks to pool risk among individuals, creating a decentralized model that reduces costs and increases transparency. Bancassurance integrates insurance products into banking services, facilitating seamless access and distribution through established financial institutions. Both models innovate traditional insurance by enhancing customer engagement and broadening market reach through collaborative and multi-channel frameworks.

Key Terms

Distribution Channel

Bancassurance leverages established bank networks to distribute insurance products, providing customers with convenient access through trusted financial institutions. Peer-to-peer insurance relies on digital platforms to connect individuals, facilitating direct risk sharing without traditional intermediaries. Explore further to understand the impact of distribution channels on customer experience and market penetration.

Risk Pooling

Bancassurance leverages established financial institutions to pool risks across a broad customer base, ensuring stability through regulated frameworks and diversified portfolios. Peer-to-peer insurance creates decentralized risk pools by connecting individuals directly, promoting transparency and potentially lower costs by eliminating traditional intermediaries. Discover more about how risk pooling differentiates these innovative insurance models.

Intermediation

Bancassurance leverages established banking networks to distribute insurance products, optimizing customer acquisition through trusted financial intermediaries. Peer-to-peer insurance disrupts traditional intermediation by directly connecting policyholders, reducing costs and fostering community-based risk sharing. Explore the detailed dynamics of intermediation to understand which model best suits your insurance needs.

Source and External Links

Bancassurance - Bancassurance is a partnership between banks and insurance companies aimed at offering insurance products through the bank's channels.

Bancassurance - Overview, History, Products, Challenges - Bancassurance is defined as an agreement where banks provide distribution channels for insurance products, and in return, receive fees from insurance companies.

Bancassurance: Definition and Benefits - Bancassurance is a business relationship allowing customers to obtain tailored insurance products from insurance companies via their bank branches.

dowidth.com

dowidth.com