Pre-existing condition coverage in insurance refers to protection for medical conditions that existed before the policy start date, often covered with specific terms or exclusions. The waiting period is the timeframe after policy initiation during which claims for certain conditions, including pre-existing ones, may be restricted or denied. Explore how understanding these distinctions can impact your insurance choices and benefits.

Why it is important

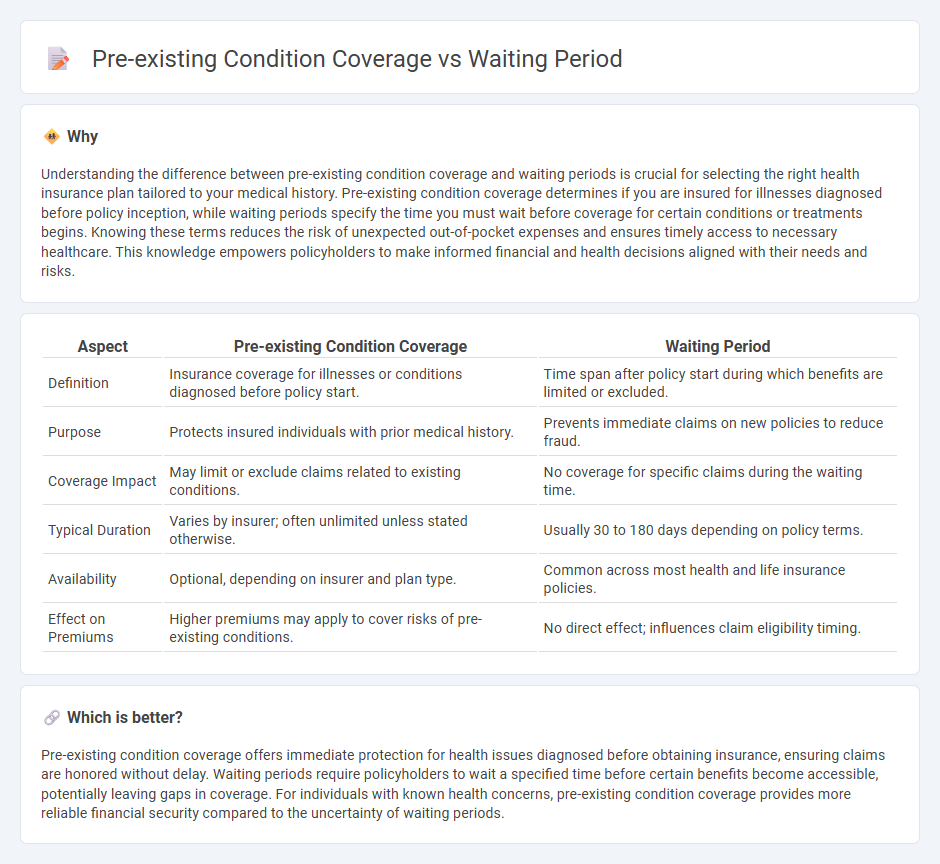

Understanding the difference between pre-existing condition coverage and waiting periods is crucial for selecting the right health insurance plan tailored to your medical history. Pre-existing condition coverage determines if you are insured for illnesses diagnosed before policy inception, while waiting periods specify the time you must wait before coverage for certain conditions or treatments begins. Knowing these terms reduces the risk of unexpected out-of-pocket expenses and ensures timely access to necessary healthcare. This knowledge empowers policyholders to make informed financial and health decisions aligned with their needs and risks.

Comparison Table

| Aspect | Pre-existing Condition Coverage | Waiting Period |

|---|---|---|

| Definition | Insurance coverage for illnesses or conditions diagnosed before policy start. | Time span after policy start during which benefits are limited or excluded. |

| Purpose | Protects insured individuals with prior medical history. | Prevents immediate claims on new policies to reduce fraud. |

| Coverage Impact | May limit or exclude claims related to existing conditions. | No coverage for specific claims during the waiting time. |

| Typical Duration | Varies by insurer; often unlimited unless stated otherwise. | Usually 30 to 180 days depending on policy terms. |

| Availability | Optional, depending on insurer and plan type. | Common across most health and life insurance policies. |

| Effect on Premiums | Higher premiums may apply to cover risks of pre-existing conditions. | No direct effect; influences claim eligibility timing. |

Which is better?

Pre-existing condition coverage offers immediate protection for health issues diagnosed before obtaining insurance, ensuring claims are honored without delay. Waiting periods require policyholders to wait a specified time before certain benefits become accessible, potentially leaving gaps in coverage. For individuals with known health concerns, pre-existing condition coverage provides more reliable financial security compared to the uncertainty of waiting periods.

Connection

Pre-existing condition coverage in insurance policies often comes with a waiting period, which is the time during which claims related to those conditions are not payable. This waiting period serves to mitigate risk for insurers by preventing immediate claims for known health issues when a policy starts. Understanding the duration and terms of this waiting period is crucial for insured individuals to ensure proper financial planning and timely medical care access.

Key Terms

Waiting Period

The waiting period defines the time frame an insured must wait before certain benefits become accessible, directly impacting the coverage commencement for specific treatments or conditions. Insurance policies often use waiting periods to manage risk associated with pre-existing conditions, delaying coverage to prevent misuse. Explore detailed comparisons to understand how waiting periods influence your health insurance benefits effectively.

Pre-existing Condition

Pre-existing condition coverage outlines the healthcare benefits available for conditions diagnosed before obtaining insurance, significantly impacting claim approvals and policy pricing. Insurers often implement restrictions or exclusions on pre-existing conditions, influencing access to treatment and financial protection. Explore detailed insights on pre-existing condition coverage to make informed health insurance decisions.

Coverage Exclusion

Waiting periods impose a delay before insurance benefits start, often excluding coverage for medical services related to newly diagnosed conditions during that timeframe. Pre-existing condition coverage exclusions deny benefits for health issues present before the policy's start date, affecting claims tied to prior illnesses or injuries. Explore detailed comparisons to understand how these exclusions impact your insurance plan choices.

Source and External Links

Waiting Period: Meaning & Definition - Waiting periods refer to the time insureds must wait for their coverage to kick in, affecting various types of insurance like homeowner, short-term, and long-term disability policies.

Insurance Waiting Period: What It Is & How It Works - A waiting period is the time between signing up for insurance and when it becomes effective, varying by insurance type and company rules.

Waiting period - A waiting period is the time between when an action is requested or mandated and when it occurs, used in contexts like insurance, gun control, and marriage licenses.

dowidth.com

dowidth.com