Artificial intelligence underwriting leverages machine learning algorithms and big data analytics to assess risks more accurately and swiftly than traditional rules-based underwriting, which relies on predefined criteria and human judgment. AI systems adapt to new information and patterns, improving predictive accuracy and reducing underwriting errors. Explore how AI transforms insurance underwriting efficiency and accuracy.

Why it is important

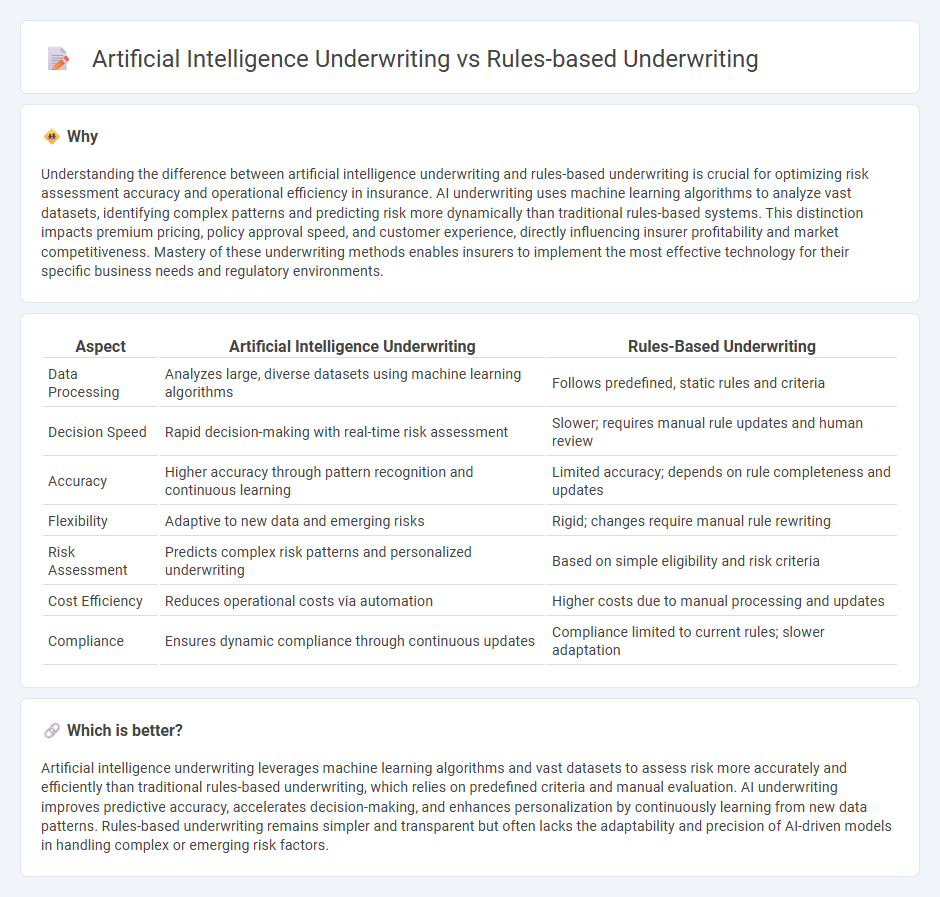

Understanding the difference between artificial intelligence underwriting and rules-based underwriting is crucial for optimizing risk assessment accuracy and operational efficiency in insurance. AI underwriting uses machine learning algorithms to analyze vast datasets, identifying complex patterns and predicting risk more dynamically than traditional rules-based systems. This distinction impacts premium pricing, policy approval speed, and customer experience, directly influencing insurer profitability and market competitiveness. Mastery of these underwriting methods enables insurers to implement the most effective technology for their specific business needs and regulatory environments.

Comparison Table

| Aspect | Artificial Intelligence Underwriting | Rules-Based Underwriting |

|---|---|---|

| Data Processing | Analyzes large, diverse datasets using machine learning algorithms | Follows predefined, static rules and criteria |

| Decision Speed | Rapid decision-making with real-time risk assessment | Slower; requires manual rule updates and human review |

| Accuracy | Higher accuracy through pattern recognition and continuous learning | Limited accuracy; depends on rule completeness and updates |

| Flexibility | Adaptive to new data and emerging risks | Rigid; changes require manual rule rewriting |

| Risk Assessment | Predicts complex risk patterns and personalized underwriting | Based on simple eligibility and risk criteria |

| Cost Efficiency | Reduces operational costs via automation | Higher costs due to manual processing and updates |

| Compliance | Ensures dynamic compliance through continuous updates | Compliance limited to current rules; slower adaptation |

Which is better?

Artificial intelligence underwriting leverages machine learning algorithms and vast datasets to assess risk more accurately and efficiently than traditional rules-based underwriting, which relies on predefined criteria and manual evaluation. AI underwriting improves predictive accuracy, accelerates decision-making, and enhances personalization by continuously learning from new data patterns. Rules-based underwriting remains simpler and transparent but often lacks the adaptability and precision of AI-driven models in handling complex or emerging risk factors.

Connection

Artificial intelligence underwriting enhances rules-based underwriting by automating the evaluation of risk factors using machine learning algorithms trained on vast datasets, enabling more accurate and efficient policy assessments. Rules-based underwriting relies on predefined criteria and logic, while AI can adapt and refine these rules dynamically based on emerging data patterns and predictive analytics. This integration optimizes risk analysis, reduces human error, and accelerates the underwriting process in the insurance industry.

Key Terms

Decision Logic

Rules-based underwriting relies on predefined decision logic using fixed criteria and thresholds to evaluate risk, ensuring consistency but limited adaptability. Artificial intelligence underwriting employs machine learning algorithms to analyze vast datasets, identifying complex patterns beyond explicit rules for more accurate, dynamic decision-making. Explore how AI enhances decision logic to revolutionize underwriting precision and efficiency.

Machine Learning

Rules-based underwriting relies on predefined criteria and fixed algorithms to assess risk, limiting flexibility in handling complex cases. Artificial intelligence underwriting leverages machine learning models to analyze vast datasets, identify patterns, and adapt to new information, improving accuracy and speed. Explore how machine learning transforms underwriting by enhancing predictive capabilities and risk assessment.

Automation

Rules-based underwriting relies on predefined criteria and fixed algorithms to automate decision-making processes, ensuring consistency but limiting adaptability. Artificial intelligence underwriting employs machine learning models to analyze vast datasets, enabling dynamic risk assessment and improved accuracy over time. Explore how AI-driven automation transforms underwriting efficiency and risk evaluation in the insurance industry.

Source and External Links

Rules-Based vs. AI Underwriting: Which One Scales Better for MGAs? - Rules-based underwriting uses clear, pre-defined "if-then" logic rules coded into guidelines or decision tables to assess risk and set premiums, ensuring consistency and compliance but facing limits with complex scenarios or large volumes.

Automated Underwriting - Under.io - Rules-based underwriting is a traditional insurance approach that gathers applicant data and applies predetermined rules to determine eligibility and set premium rates, commonly used for simpler or low-risk policies.

What is Automated Underwriting? - Camunda - Traditional rules-based underwriting uses predefined industry

dowidth.com

dowidth.com