Embedded insurance integrates coverage directly into the purchase of products or services, streamlining the buying process and enhancing customer convenience. Agent-led insurance relies on licensed professionals who provide personalized advice and tailor policies to individual needs, often ensuring comprehensive risk assessment. Explore the differences and benefits of embedded versus agent-led insurance to choose the best option for your protection needs.

Why it is important

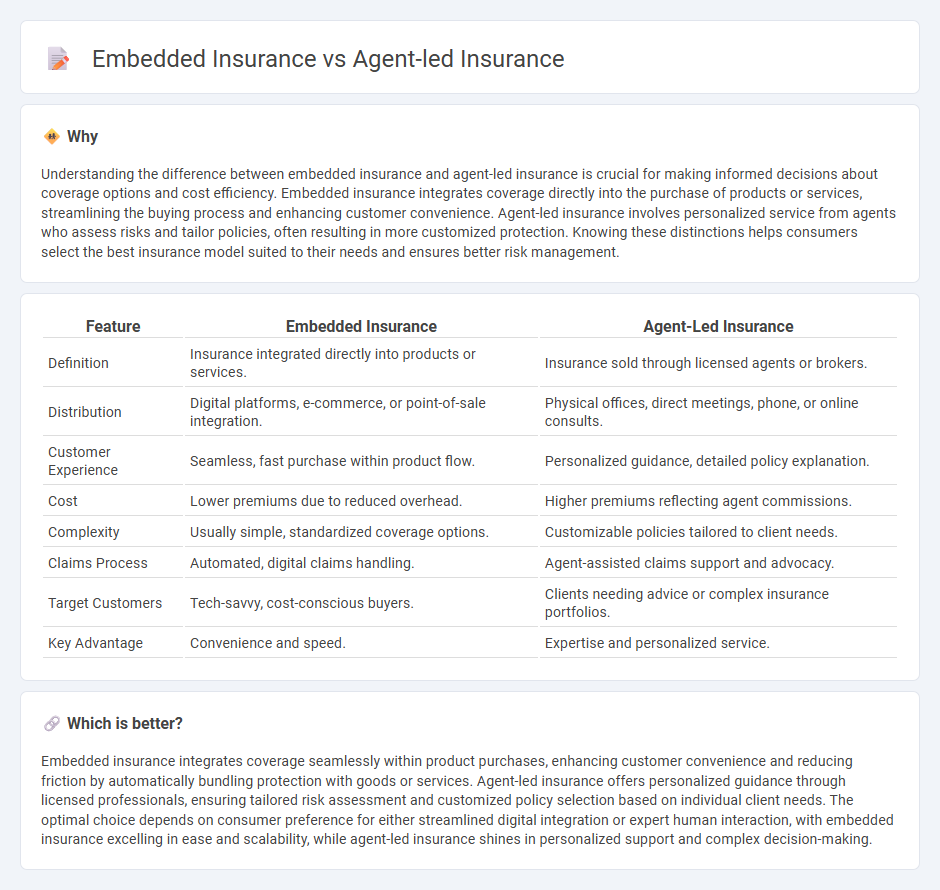

Understanding the difference between embedded insurance and agent-led insurance is crucial for making informed decisions about coverage options and cost efficiency. Embedded insurance integrates coverage directly into the purchase of products or services, streamlining the buying process and enhancing customer convenience. Agent-led insurance involves personalized service from agents who assess risks and tailor policies, often resulting in more customized protection. Knowing these distinctions helps consumers select the best insurance model suited to their needs and ensures better risk management.

Comparison Table

| Feature | Embedded Insurance | Agent-Led Insurance |

|---|---|---|

| Definition | Insurance integrated directly into products or services. | Insurance sold through licensed agents or brokers. |

| Distribution | Digital platforms, e-commerce, or point-of-sale integration. | Physical offices, direct meetings, phone, or online consults. |

| Customer Experience | Seamless, fast purchase within product flow. | Personalized guidance, detailed policy explanation. |

| Cost | Lower premiums due to reduced overhead. | Higher premiums reflecting agent commissions. |

| Complexity | Usually simple, standardized coverage options. | Customizable policies tailored to client needs. |

| Claims Process | Automated, digital claims handling. | Agent-assisted claims support and advocacy. |

| Target Customers | Tech-savvy, cost-conscious buyers. | Clients needing advice or complex insurance portfolios. |

| Key Advantage | Convenience and speed. | Expertise and personalized service. |

Which is better?

Embedded insurance integrates coverage seamlessly within product purchases, enhancing customer convenience and reducing friction by automatically bundling protection with goods or services. Agent-led insurance offers personalized guidance through licensed professionals, ensuring tailored risk assessment and customized policy selection based on individual client needs. The optimal choice depends on consumer preference for either streamlined digital integration or expert human interaction, with embedded insurance excelling in ease and scalability, while agent-led insurance shines in personalized support and complex decision-making.

Connection

Embedded insurance integrates coverage directly into product or service purchases, streamlining the customer experience. Agent-led insurance leverages agents to guide clients through personalized policy options, enhancing trust and tailored service. Both models aim to increase accessibility and convenience, with embedded insurance facilitating seamless inclusion and agent-led insurance providing expert navigation.

Key Terms

Distribution Channel

Agent-led insurance relies on licensed agents who provide personalized advice and facilitate policy sales through direct client interactions, ensuring trust and tailored service. Embedded insurance integrates coverage options directly into non-insurance platforms or products, streamlining the customer journey by offering insurance at the point of purchase. Explore the evolving dynamics between these distribution channels to understand their impact on customer experience and market reach.

Customer Experience

Agent-led insurance offers personalized service through direct human interaction, facilitating tailored advice and trust-building, while embedded insurance integrates coverage seamlessly within product purchases, enhancing convenience and reducing friction. Customer experience in agent-led models benefits from expert guidance and emotional reassurance, whereas embedded insurance excels in speed and simplicity, often leveraging digital platforms for instant policy issuance. Explore further to understand which approach best aligns with evolving consumer expectations and digital transformation trends.

Personalization

Agent-led insurance offers personalized coverage through direct interactions, allowing agents to tailor policies based on individual client needs and preferences. Embedded insurance integrates seamlessly within product offerings, using data analytics and customer behavior insights to provide contextual and automatic personalization. Explore how these approaches enhance customer experience and drive policy customization in today's insurance landscape.

Source and External Links

Balancing self-service and agent-led channels in healthcare - Agent-led insurance remains important as 61% of consumers prefer using agents via face-to-face or phone, highlighting the need for insurers to balance self-service with agent-led experiences effectively.

Agency MVP: The Best Lead Management System For ... - Agency MVP is a smart lead management system designed specifically for insurance agents, helping P&C agents identify and prioritize the most valuable prospects to increase sales and optimize agent-led engagement.

7 Lead Generation Strategies for Insurance Agents - Successful agent-led insurance growth relies on combining referrals, networking, digital marketing, social media, and lead nurturing with CRM systems to build a robust pipeline of insurance leads.

dowidth.com

dowidth.com