Yield farming maximizes returns by providing liquidity to decentralized finance (DeFi) protocols, often earning rewards in the form of tokens. Trading involves buying and selling financial assets, such as stocks or cryptocurrencies, to profit from price fluctuations. Explore our detailed comparison to understand which strategy aligns best with your financial goals.

Why it is important

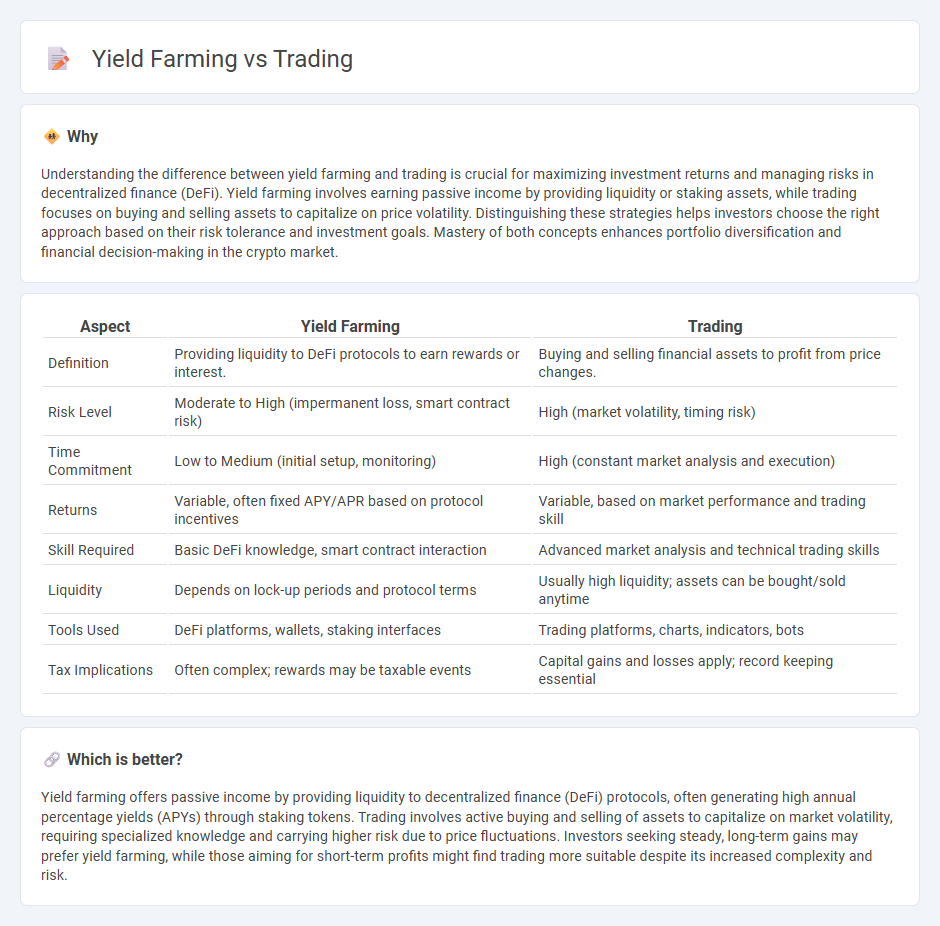

Understanding the difference between yield farming and trading is crucial for maximizing investment returns and managing risks in decentralized finance (DeFi). Yield farming involves earning passive income by providing liquidity or staking assets, while trading focuses on buying and selling assets to capitalize on price volatility. Distinguishing these strategies helps investors choose the right approach based on their risk tolerance and investment goals. Mastery of both concepts enhances portfolio diversification and financial decision-making in the crypto market.

Comparison Table

| Aspect | Yield Farming | Trading |

|---|---|---|

| Definition | Providing liquidity to DeFi protocols to earn rewards or interest. | Buying and selling financial assets to profit from price changes. |

| Risk Level | Moderate to High (impermanent loss, smart contract risk) | High (market volatility, timing risk) |

| Time Commitment | Low to Medium (initial setup, monitoring) | High (constant market analysis and execution) |

| Returns | Variable, often fixed APY/APR based on protocol incentives | Variable, based on market performance and trading skill |

| Skill Required | Basic DeFi knowledge, smart contract interaction | Advanced market analysis and technical trading skills |

| Liquidity | Depends on lock-up periods and protocol terms | Usually high liquidity; assets can be bought/sold anytime |

| Tools Used | DeFi platforms, wallets, staking interfaces | Trading platforms, charts, indicators, bots |

| Tax Implications | Often complex; rewards may be taxable events | Capital gains and losses apply; record keeping essential |

Which is better?

Yield farming offers passive income by providing liquidity to decentralized finance (DeFi) protocols, often generating high annual percentage yields (APYs) through staking tokens. Trading involves active buying and selling of assets to capitalize on market volatility, requiring specialized knowledge and carrying higher risk due to price fluctuations. Investors seeking steady, long-term gains may prefer yield farming, while those aiming for short-term profits might find trading more suitable despite its increased complexity and risk.

Connection

Yield farming and trading intersect through the strategic management of digital assets to maximize returns in decentralized finance (DeFi). Traders leverage yield farming protocols to earn passive income by lending or staking cryptocurrencies while actively optimizing their positions based on market trends and token price fluctuations. This dynamic synergy enhances liquidity provision and capital efficiency within blockchain ecosystems.

Key Terms

Liquidity

Trading involves actively buying and selling assets to capitalize on market price fluctuations, often requiring significant liquidity for quick order execution and minimal slippage. Yield farming, on the other hand, emphasizes providing liquidity to decentralized finance (DeFi) protocols in exchange for interest or rewards, effectively locking assets within liquidity pools to generate passive income. Explore the nuances of liquidity's role in optimizing both trading strategies and yield farming opportunities.

Volatility

Volatility in trading presents opportunities for quick profits through rapid price fluctuations, demanding active market analysis and timely decision-making. Yield farming, however, relies less on market volatility and more on strategic allocation of assets in DeFi protocols to earn passive income via interest and rewards. Explore how volatility impacts your risk and return strategies in both trading and yield farming for optimized financial outcomes.

Return

Trading offers short-term returns through market volatility, with profits depending on timing and market analysis accuracy. Yield farming provides passive income by staking or lending cryptocurrencies to earn interest or rewards, often delivering higher APYs but with increased smart contract risks. Explore detailed comparisons to determine which strategy aligns best with your return goals.

Source and External Links

Trading for Beginners: A Complete Guide | IG International - Trading involves speculating on the price movement of assets like shares or forex without owning them, and traders can profit by going long or short depending on market predictions; demo accounts are available to practice risk-free before trading real money.

Trading strategy - Wikipedia - A trading strategy is a fixed plan designed to achieve profits by going long or short in markets, typically involving asset selection, entry/exit points, and money management, often based on fundamental or technical analysis and verified by backtesting and forward testing.

What is Trading and How Does It Work? | IG International - Trading is buying and selling financial instruments such as shares, currencies, commodities, and indices to profit from price movements influenced by supply and demand, with trades done either OTC or on centralized exchanges, offering access to over 13,000 CFD markets.

dowidth.com

dowidth.com