Carbon credits incentivize companies to reduce greenhouse gas emissions by allowing them to buy and sell emission allowances, creating a market-driven approach to environmental impact. Sustainability-linked loans tie borrowing costs directly to achieving specific environmental, social, and governance (ESG) targets, aligning financial incentives with sustainable business practices. Explore how these financial instruments drive corporate responsibility and innovation in sustainable finance.

Why it is important

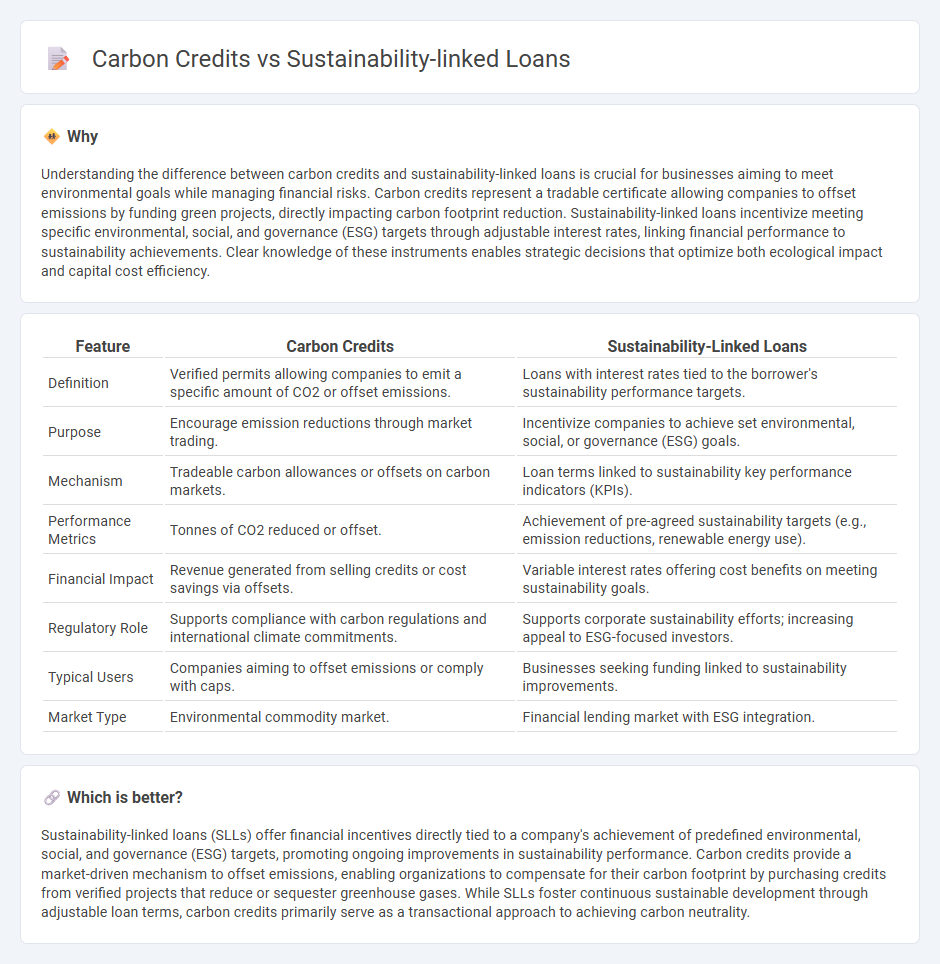

Understanding the difference between carbon credits and sustainability-linked loans is crucial for businesses aiming to meet environmental goals while managing financial risks. Carbon credits represent a tradable certificate allowing companies to offset emissions by funding green projects, directly impacting carbon footprint reduction. Sustainability-linked loans incentivize meeting specific environmental, social, and governance (ESG) targets through adjustable interest rates, linking financial performance to sustainability achievements. Clear knowledge of these instruments enables strategic decisions that optimize both ecological impact and capital cost efficiency.

Comparison Table

| Feature | Carbon Credits | Sustainability-Linked Loans |

|---|---|---|

| Definition | Verified permits allowing companies to emit a specific amount of CO2 or offset emissions. | Loans with interest rates tied to the borrower's sustainability performance targets. |

| Purpose | Encourage emission reductions through market trading. | Incentivize companies to achieve set environmental, social, or governance (ESG) goals. |

| Mechanism | Tradeable carbon allowances or offsets on carbon markets. | Loan terms linked to sustainability key performance indicators (KPIs). |

| Performance Metrics | Tonnes of CO2 reduced or offset. | Achievement of pre-agreed sustainability targets (e.g., emission reductions, renewable energy use). |

| Financial Impact | Revenue generated from selling credits or cost savings via offsets. | Variable interest rates offering cost benefits on meeting sustainability goals. |

| Regulatory Role | Supports compliance with carbon regulations and international climate commitments. | Supports corporate sustainability efforts; increasing appeal to ESG-focused investors. |

| Typical Users | Companies aiming to offset emissions or comply with caps. | Businesses seeking funding linked to sustainability improvements. |

| Market Type | Environmental commodity market. | Financial lending market with ESG integration. |

Which is better?

Sustainability-linked loans (SLLs) offer financial incentives directly tied to a company's achievement of predefined environmental, social, and governance (ESG) targets, promoting ongoing improvements in sustainability performance. Carbon credits provide a market-driven mechanism to offset emissions, enabling organizations to compensate for their carbon footprint by purchasing credits from verified projects that reduce or sequester greenhouse gases. While SLLs foster continuous sustainable development through adjustable loan terms, carbon credits primarily serve as a transactional approach to achieving carbon neutrality.

Connection

Carbon credits provide measurable environmental impact metrics that enhance the risk assessment and performance criteria in sustainability-linked loans. These loans tie interest rates or repayment terms to borrowers' achievement of sustainability targets, often verified through carbon credit reductions. Financial institutions increasingly integrate carbon credits into loan frameworks to incentivize corporate carbon footprint reduction and promote greener investment portfolios.

Key Terms

Performance Targets

Sustainability-linked loans (SLLs) are financial instruments tied to a borrower's achievement of specific environmental, social, and governance (ESG) performance targets, promoting measurable improvements such as reduced carbon emissions or increased energy efficiency. Carbon credits represent tradable certificates that quantify and offset greenhouse gas emissions, allowing companies to meet regulatory or voluntary sustainability goals without direct operational changes. Explore how integrating SLLs and carbon credits can maximize environmental impact and financial incentives.

Emissions Reduction

Sustainability-linked loans incentivize emissions reduction by tying financial terms to a borrower's performance on predefined environmental targets, promoting continuous improvement in carbon footprint management. Carbon credits represent quantifiable emissions reductions, allowing organizations to offset their carbon footprint by purchasing credits generated from verified projects that reduce or remove greenhouse gases. Explore the mechanisms, benefits, and impact of these tools to understand their role in achieving net-zero emissions.

Verification

Sustainability-linked loans require rigorous performance verification through independent third-party assessments to ensure borrowers meet predefined sustainability targets. Carbon credits depend on strict monitoring, reporting, and verification (MRV) frameworks to confirm genuine emission reductions or removals. Explore how these verification processes impact the credibility and effectiveness of climate finance instruments.

Source and External Links

Sustainability Linked Loan Principles - Sustainability-linked loans support sustainable economic growth by linking loan terms to borrowers achieving specific environmental, social, and governance (ESG) performance targets such as reducing greenhouse gas emissions, increasing renewable energy use, or improving biodiversity protection.

Sustainability Linked Loans - These loans allow borrowers to use funds for general purposes while incentivizing improved ESG performance, offering benefits such as discounted loan rates, enhanced stakeholder trust, and alignment with sustainable finance commitments.

The Issuance and Design of Sustainability-linked Loans - Sustainability-linked loans often feature up to 20% lower interest rates compared to traditional loans for borrowers with strong ESG performance, serving as a signal of advanced sustainability practices and lowering financing costs.

dowidth.com

dowidth.com