Regenerative finance focuses on sustainable investment strategies that prioritize environmental restoration, social equity, and long-term economic resilience, contrasting sharply with traditional finance's emphasis on short-term profits and capital accumulation. This innovative approach integrates circular economy principles and impact investing to address systemic economic challenges and promote inclusive growth. Explore how regenerative finance is reshaping the future of economic systems and offering viable alternatives to conventional financial models.

Why it is important

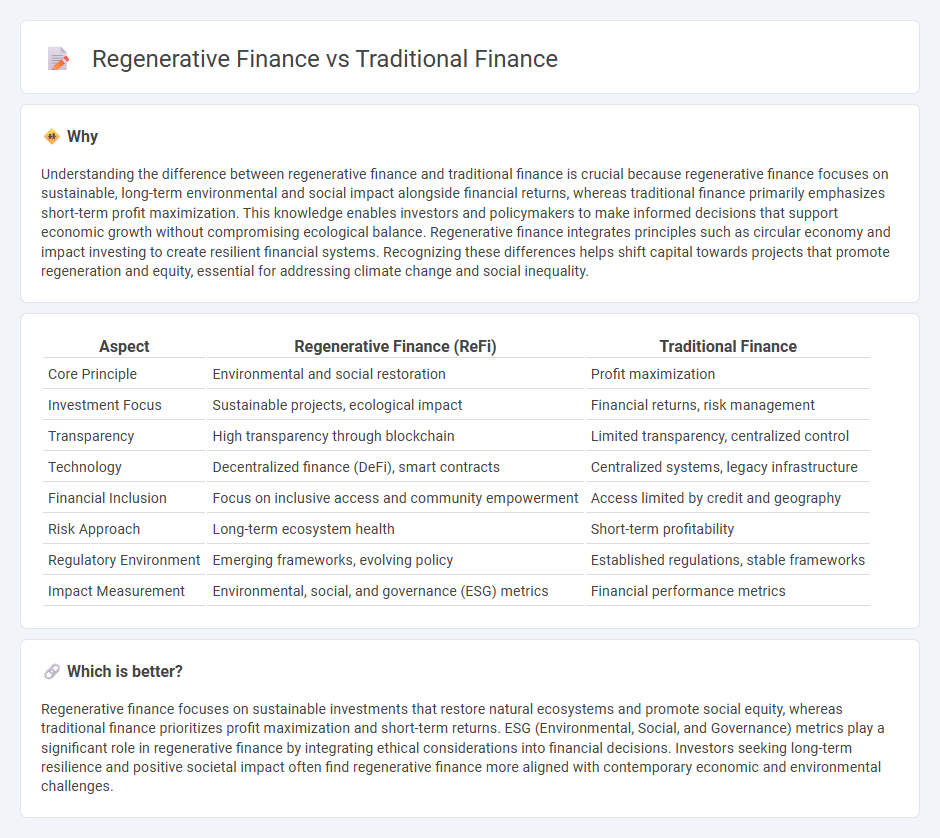

Understanding the difference between regenerative finance and traditional finance is crucial because regenerative finance focuses on sustainable, long-term environmental and social impact alongside financial returns, whereas traditional finance primarily emphasizes short-term profit maximization. This knowledge enables investors and policymakers to make informed decisions that support economic growth without compromising ecological balance. Regenerative finance integrates principles such as circular economy and impact investing to create resilient financial systems. Recognizing these differences helps shift capital towards projects that promote regeneration and equity, essential for addressing climate change and social inequality.

Comparison Table

| Aspect | Regenerative Finance (ReFi) | Traditional Finance |

|---|---|---|

| Core Principle | Environmental and social restoration | Profit maximization |

| Investment Focus | Sustainable projects, ecological impact | Financial returns, risk management |

| Transparency | High transparency through blockchain | Limited transparency, centralized control |

| Technology | Decentralized finance (DeFi), smart contracts | Centralized systems, legacy infrastructure |

| Financial Inclusion | Focus on inclusive access and community empowerment | Access limited by credit and geography |

| Risk Approach | Long-term ecosystem health | Short-term profitability |

| Regulatory Environment | Emerging frameworks, evolving policy | Established regulations, stable frameworks |

| Impact Measurement | Environmental, social, and governance (ESG) metrics | Financial performance metrics |

Which is better?

Regenerative finance focuses on sustainable investments that restore natural ecosystems and promote social equity, whereas traditional finance prioritizes profit maximization and short-term returns. ESG (Environmental, Social, and Governance) metrics play a significant role in regenerative finance by integrating ethical considerations into financial decisions. Investors seeking long-term resilience and positive societal impact often find regenerative finance more aligned with contemporary economic and environmental challenges.

Connection

Regenerative finance integrates sustainable investing principles by prioritizing environmental, social, and governance (ESG) criteria within traditional finance frameworks, thereby reshaping capital allocation toward long-term ecological and social value. Traditional finance provides the foundational infrastructure, such as markets, instruments, and regulatory mechanisms, which regenerative finance leverages to drive impact investing and circular economy initiatives. This synergy promotes a financial ecosystem that balances profitability with resilience and sustainability goals.

Key Terms

Centralization vs. Decentralization

Traditional finance relies on centralized institutions such as banks and financial intermediaries to manage transactions and assets, often leading to limited transparency and slower processes. Regenerative finance emphasizes decentralization through blockchain technology and peer-to-peer networks, fostering increased transparency, inclusivity, and sustainable economic growth. Explore how decentralization transforms financial ecosystems and promotes resilience in modern economies.

Profit Maximization vs. Sustainability

Traditional finance prioritizes profit maximization through short-term gains and shareholder returns, often overlooking environmental and social impacts. Regenerative finance integrates sustainability principles by investing in projects that promote ecological balance, social equity, and long-term value creation. Explore how regenerative finance is reshaping investment strategies and fostering resilient economies.

Shareholder Value vs. Stakeholder Value

Traditional finance prioritizes maximizing shareholder value, emphasizing short-term profits and stock price appreciation for investors. Regenerative finance shifts focus to stakeholder value by integrating social, environmental, and economic well-being to promote sustainable long-term growth. Explore how regenerative finance redefines investment strategies for a resilient future.

Source and External Links

What is meant by 'traditional finance'? - This webpage explores traditional finance, which includes funding solutions like loans and overdrafts from established lenders like banks and credit unions.

TradFi (Traditional Finance) - It describes traditional finance as the conventional financial systems provided by institutions like banks and insurance companies under a centralized model.

TradFi Meaning - This webpage defines traditional finance as managing money through institutions like banks and stock markets, characterized by centralized structures and regulation.

dowidth.com

dowidth.com