Green bond laddering enhances sustainable investment strategies by systematically staggering maturity dates to optimize yield and liquidity while supporting environmental projects. Fixed-income diversification spreads risk across different asset types, sectors, and durations to stabilize returns and reduce portfolio volatility. Explore the comparative advantages and strategic applications of these approaches to strengthen your financial planning.

Why it is important

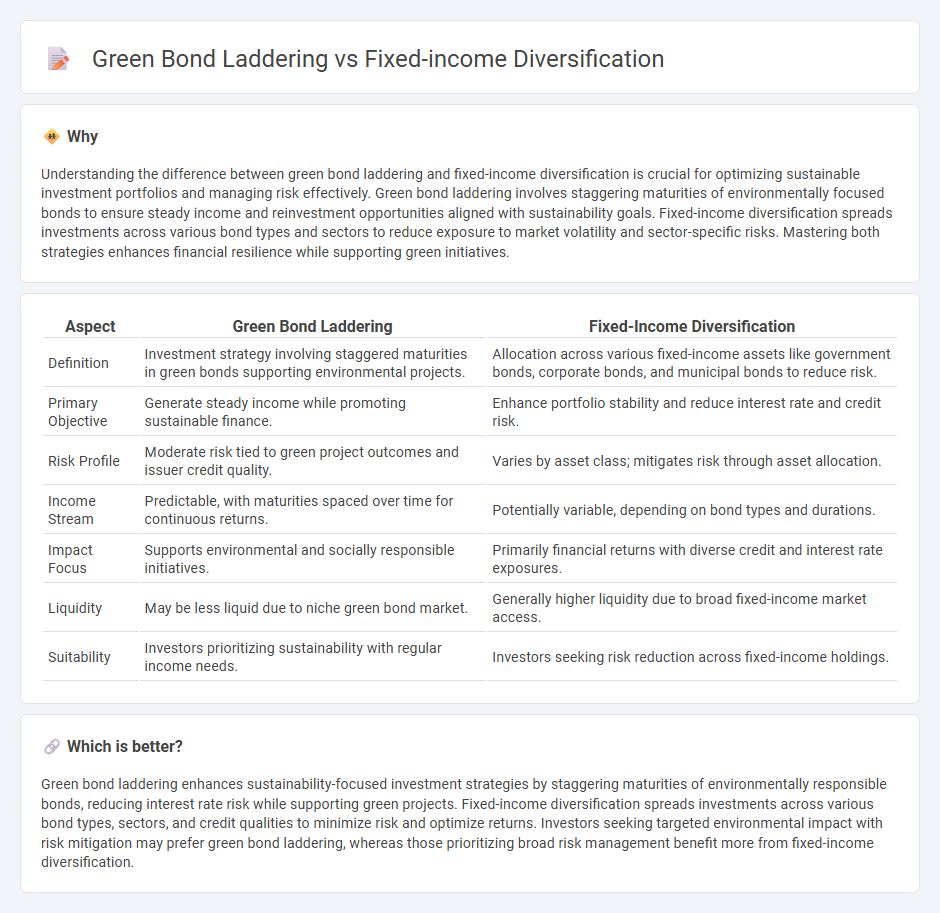

Understanding the difference between green bond laddering and fixed-income diversification is crucial for optimizing sustainable investment portfolios and managing risk effectively. Green bond laddering involves staggering maturities of environmentally focused bonds to ensure steady income and reinvestment opportunities aligned with sustainability goals. Fixed-income diversification spreads investments across various bond types and sectors to reduce exposure to market volatility and sector-specific risks. Mastering both strategies enhances financial resilience while supporting green initiatives.

Comparison Table

| Aspect | Green Bond Laddering | Fixed-Income Diversification |

|---|---|---|

| Definition | Investment strategy involving staggered maturities in green bonds supporting environmental projects. | Allocation across various fixed-income assets like government bonds, corporate bonds, and municipal bonds to reduce risk. |

| Primary Objective | Generate steady income while promoting sustainable finance. | Enhance portfolio stability and reduce interest rate and credit risk. |

| Risk Profile | Moderate risk tied to green project outcomes and issuer credit quality. | Varies by asset class; mitigates risk through asset allocation. |

| Income Stream | Predictable, with maturities spaced over time for continuous returns. | Potentially variable, depending on bond types and durations. |

| Impact Focus | Supports environmental and socially responsible initiatives. | Primarily financial returns with diverse credit and interest rate exposures. |

| Liquidity | May be less liquid due to niche green bond market. | Generally higher liquidity due to broad fixed-income market access. |

| Suitability | Investors prioritizing sustainability with regular income needs. | Investors seeking risk reduction across fixed-income holdings. |

Which is better?

Green bond laddering enhances sustainability-focused investment strategies by staggering maturities of environmentally responsible bonds, reducing interest rate risk while supporting green projects. Fixed-income diversification spreads investments across various bond types, sectors, and credit qualities to minimize risk and optimize returns. Investors seeking targeted environmental impact with risk mitigation may prefer green bond laddering, whereas those prioritizing broad risk management benefit more from fixed-income diversification.

Connection

Green bond laddering enhances fixed-income diversification by distributing investments across varying maturities of environmentally-focused bonds, which balances risk and return. This strategy mitigates interest rate risk while supporting sustainable projects, aligning portfolio objectives with environmental, social, and governance (ESG) criteria. Integrating green bonds into a diversified fixed-income portfolio strengthens resilience against market volatility and promotes responsible investing.

Key Terms

Credit Risk

Fixed-income diversification reduces credit risk by spreading investments across various issuers, industries, and credit qualities, lowering exposure to any single default event. Green bond laddering, while targeting environmentally sustainable projects, can still face concentrated credit risk if the issuance is limited to fewer sectors or issuers with similar credit profiles. Explore the nuances of credit risk management strategies in sustainable and diversified fixed-income portfolios to enhance your investment approach.

Environmental Impact

Fixed-income diversification enhances portfolio resilience by spreading risks across various bond types, including corporate, municipal, and sovereign bonds, yet may not specifically target environmental outcomes. Green bond laddering strategically involves purchasing green bonds with staggered maturities, optimizing cash flow management while directly funding projects that promote renewable energy, sustainable infrastructure, and climate mitigation efforts. Explore how combining both approaches can maximize financial returns alongside meaningful environmental impact.

Maturity Structure

Fixed-income diversification enhances portfolio stability by spreading risk across various bond types, maturities, and issuers, reducing exposure to interest rate volatility and credit defaults. Green bond laddering strategically staggers maturities specifically in environmentally focused bonds, optimizing cash flow while promoting sustainable investments aligned with ESG criteria. Explore how balancing maturity structure can maximize returns and sustainability in your fixed-income strategy.

Source and External Links

Diversifying Across Fixed Income - PGIM - Multi-sector bond strategies that diversify across asset classes and investment styles can mitigate risk, reduce volatility, and provide enhanced returns through active management of fixed income exposures.

Build Stronger Fixed Income Portfolios - J.P. Morgan Asset Management - Diversification across various fixed income sectors, including non-core sectors, helps manage risk, increase yield, and smooth portfolio volatility, improving overall fixed income portfolio performance.

Building a diversified bond portfolio - RBC Global Asset Management - Fixed income diversification involves combining investments across different issuers, sectors, risk levels, and geographies to achieve specific investment objectives and mitigate risk since no single fixed income category consistently outperforms.

dowidth.com

dowidth.com