Alternative data scraping captures diverse financial and behavioral indicators from unconventional sources like social media, web activity, and satellite imagery to enhance credit risk assessments and market predictions. Credit card transaction data offers precise consumer spending patterns, providing real-time insights into purchasing behavior and economic trends. Explore how these data types revolutionize financial analysis and decision-making.

Why it is important

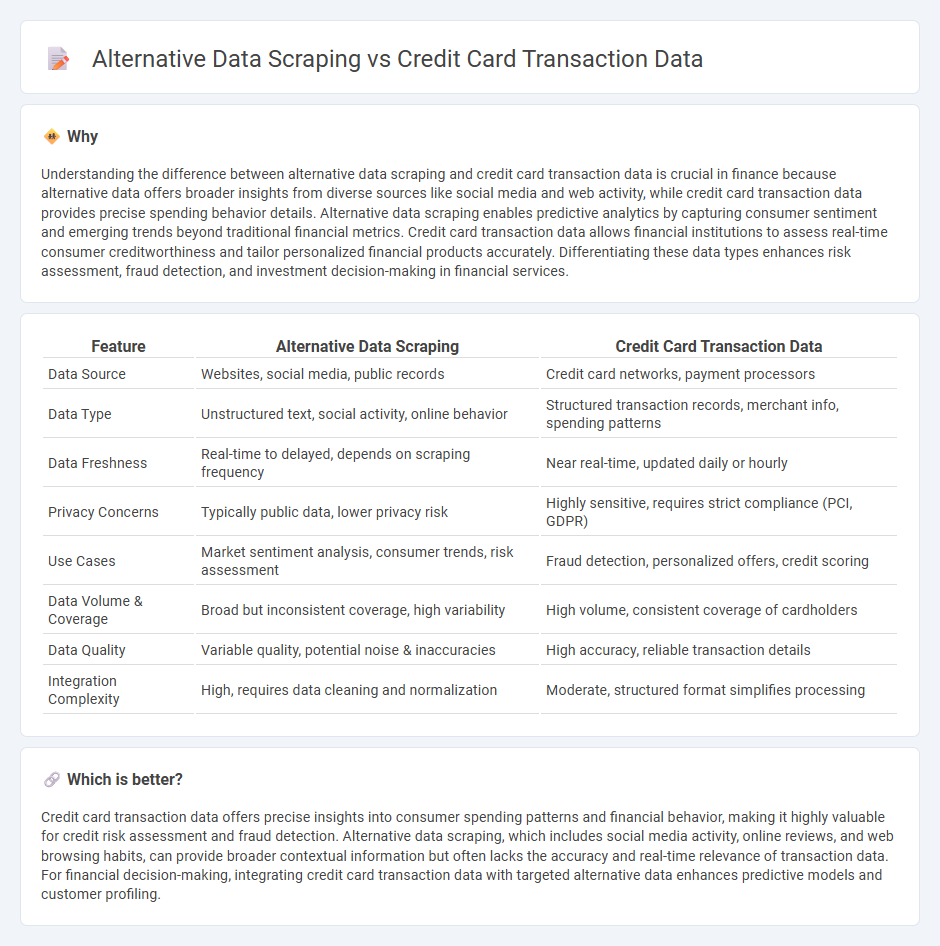

Understanding the difference between alternative data scraping and credit card transaction data is crucial in finance because alternative data offers broader insights from diverse sources like social media and web activity, while credit card transaction data provides precise spending behavior details. Alternative data scraping enables predictive analytics by capturing consumer sentiment and emerging trends beyond traditional financial metrics. Credit card transaction data allows financial institutions to assess real-time consumer creditworthiness and tailor personalized financial products accurately. Differentiating these data types enhances risk assessment, fraud detection, and investment decision-making in financial services.

Comparison Table

| Feature | Alternative Data Scraping | Credit Card Transaction Data |

|---|---|---|

| Data Source | Websites, social media, public records | Credit card networks, payment processors |

| Data Type | Unstructured text, social activity, online behavior | Structured transaction records, merchant info, spending patterns |

| Data Freshness | Real-time to delayed, depends on scraping frequency | Near real-time, updated daily or hourly |

| Privacy Concerns | Typically public data, lower privacy risk | Highly sensitive, requires strict compliance (PCI, GDPR) |

| Use Cases | Market sentiment analysis, consumer trends, risk assessment | Fraud detection, personalized offers, credit scoring |

| Data Volume & Coverage | Broad but inconsistent coverage, high variability | High volume, consistent coverage of cardholders |

| Data Quality | Variable quality, potential noise & inaccuracies | High accuracy, reliable transaction details |

| Integration Complexity | High, requires data cleaning and normalization | Moderate, structured format simplifies processing |

Which is better?

Credit card transaction data offers precise insights into consumer spending patterns and financial behavior, making it highly valuable for credit risk assessment and fraud detection. Alternative data scraping, which includes social media activity, online reviews, and web browsing habits, can provide broader contextual information but often lacks the accuracy and real-time relevance of transaction data. For financial decision-making, integrating credit card transaction data with targeted alternative data enhances predictive models and customer profiling.

Connection

Alternative data scraping collects non-traditional financial information, enhancing credit risk assessment by incorporating diverse data points beyond standard credit reports. Credit card transaction data, as a key subset, provides real-time insights into consumer spending patterns, helping lenders predict repayment behavior more accurately. Combining both data sources enables more precise credit scoring models, improving loan approval rates and reducing default risks.

Key Terms

Transaction History

Credit card transaction data provides detailed insights into consumer spending patterns, highlighting purchase frequency, merchant categories, and transaction amounts that reveal financial behavior over time. Alternative data scraping collects broader information from sources such as social media, web activity, and utility payments, enriching credit profiles with non-traditional indicators. Explore more to understand how combining these datasets enhances credit risk assessment and personalization strategies.

Web Scraping

Credit card transaction data offers direct insights into consumer spending patterns, whereas alternative data scraping, particularly web scraping, extracts diverse information from online sources such as social media, review sites, and e-commerce platforms to analyze market trends and consumer sentiment. Web scraping enables the collection of real-time, unstructured data at scale, providing companies with detailed competitive intelligence and customer behavior analytics beyond traditional financial records. Explore the benefits and techniques of web scraping to leverage alternative data for enhanced business intelligence.

Credit Scoring

Credit card transaction data provides detailed insights into consumer spending patterns, repayment behavior, and financial stability, making it a reliable metric for credit scoring algorithms. Alternative data scraping gathers non-traditional information such as social media activity, utility payments, and rental history, enhancing credit risk assessment for individuals with limited credit history. Explore the growing impact of these data sources on credit scoring models and financial inclusion.

Source and External Links

Credit Card Transactions Dataset - Kaggle - This dataset contains over 1.85 million detailed credit card transactions including timestamps, amounts, merchant information, and cardholder demographics, useful for fraud detection, customer segmentation, and behavioral analysis.

Credit card transaction data - Techsalerator - Credit card transaction data records details such as transaction date/time, merchant, and amount, collected mainly from financial institutions and payment processors, and is used for spending analysis, fraud detection, and business insights.

Card Transaction Data - Wikipedia - Card transaction data varies in levels from basic transaction details (Level 1) to detailed product and sales information (Level 3), with higher levels requiring more data submission and enabling incentives for merchants who provide richer transaction information.

dowidth.com

dowidth.com