Tax loss harvesting involves selling securities at a loss to offset capital gains and reduce taxable income, while direct indexing allows investors to own individual securities that mirror an index for personalized tax management and portfolio customization. Both strategies aim to enhance after-tax returns by leveraging tax-efficient investment techniques. Explore these methods further to optimize your investment tax strategy and maximize savings.

Why it is important

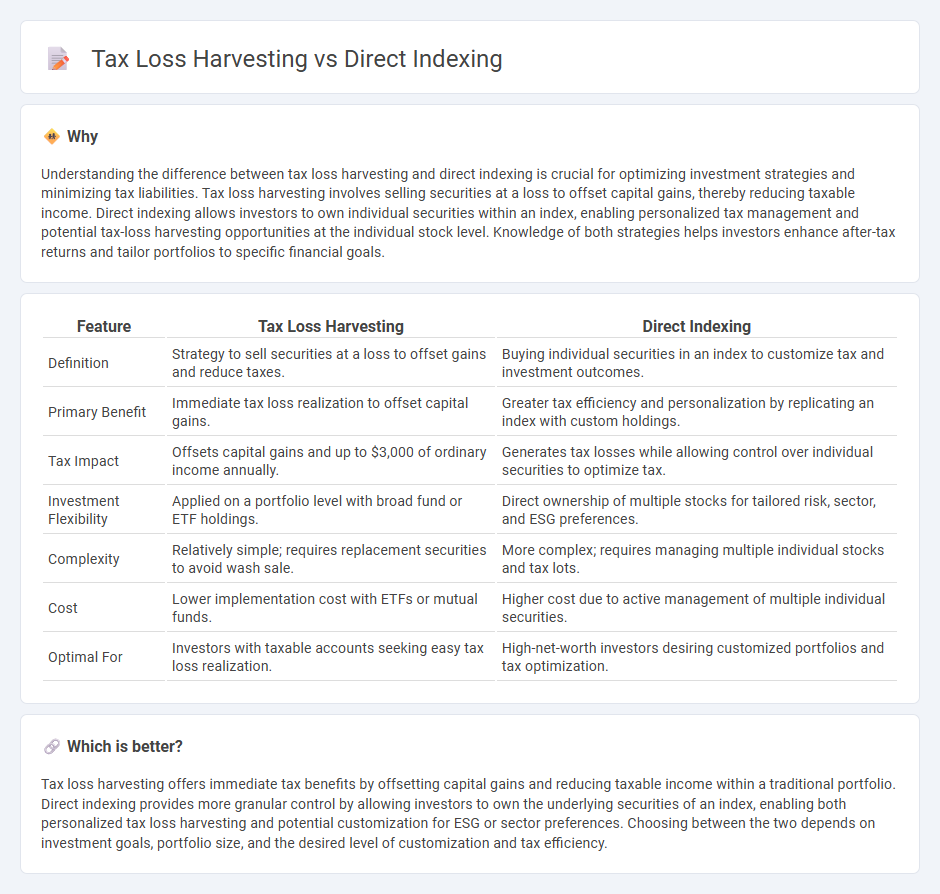

Understanding the difference between tax loss harvesting and direct indexing is crucial for optimizing investment strategies and minimizing tax liabilities. Tax loss harvesting involves selling securities at a loss to offset capital gains, thereby reducing taxable income. Direct indexing allows investors to own individual securities within an index, enabling personalized tax management and potential tax-loss harvesting opportunities at the individual stock level. Knowledge of both strategies helps investors enhance after-tax returns and tailor portfolios to specific financial goals.

Comparison Table

| Feature | Tax Loss Harvesting | Direct Indexing |

|---|---|---|

| Definition | Strategy to sell securities at a loss to offset gains and reduce taxes. | Buying individual securities in an index to customize tax and investment outcomes. |

| Primary Benefit | Immediate tax loss realization to offset capital gains. | Greater tax efficiency and personalization by replicating an index with custom holdings. |

| Tax Impact | Offsets capital gains and up to $3,000 of ordinary income annually. | Generates tax losses while allowing control over individual securities to optimize tax. |

| Investment Flexibility | Applied on a portfolio level with broad fund or ETF holdings. | Direct ownership of multiple stocks for tailored risk, sector, and ESG preferences. |

| Complexity | Relatively simple; requires replacement securities to avoid wash sale. | More complex; requires managing multiple individual stocks and tax lots. |

| Cost | Lower implementation cost with ETFs or mutual funds. | Higher cost due to active management of multiple individual securities. |

| Optimal For | Investors with taxable accounts seeking easy tax loss realization. | High-net-worth investors desiring customized portfolios and tax optimization. |

Which is better?

Tax loss harvesting offers immediate tax benefits by offsetting capital gains and reducing taxable income within a traditional portfolio. Direct indexing provides more granular control by allowing investors to own the underlying securities of an index, enabling both personalized tax loss harvesting and potential customization for ESG or sector preferences. Choosing between the two depends on investment goals, portfolio size, and the desired level of customization and tax efficiency.

Connection

Tax loss harvesting and direct indexing are closely connected through their shared goal of optimizing after-tax investment returns by strategically managing capital gains. Direct indexing allows investors to customize portfolios by owning individual securities, enabling precise identification and sale of losing positions to offset taxable gains, a process central to tax loss harvesting. This synergy enhances tax efficiency and portfolio personalization, making direct indexing a powerful tool for implementing effective tax loss harvesting strategies.

Key Terms

Customization

Direct indexing offers unparalleled customization by allowing investors to tailor their portfolios to specific preferences, such as excluding certain sectors or emphasizing ESG factors, which is not typically possible with traditional tax loss harvesting strategies that focus solely on offsetting gains. This approach provides greater control over individual stock selection, enabling precise alignment with personal values and investment goals while optimizing tax efficiency. Explore how direct indexing can revolutionize your portfolio customization and tax strategy by learning more about its advantages.

Capital Gains

Direct indexing allows investors to replicate an index by purchasing individual securities, enabling precise control over capital gains realization and tailored tax-loss harvesting opportunities. Tax loss harvesting, on the other hand, involves selling securities at a loss to offset capital gains taxes, but without the personalized customization offered by direct indexing. Explore how combining direct indexing with tax-loss harvesting strategies can maximize after-tax returns and capital gains management.

Index Replication

Direct indexing involves purchasing individual securities to replicate an index, allowing for customized portfolio construction and targeted tax loss harvesting by selectively selling underperforming stocks. Tax loss harvesting in direct indexing can optimize after-tax returns by offsetting gains with realized losses while maintaining close adherence to the desired index performance. Explore more to understand how direct indexing enhances index replication and tax efficiency strategies.

Source and External Links

Direct Indexing: What It Is and Its Benefits | Morgan Stanley - Direct indexing involves owning the individual stocks of an index directly in a separately managed account, allowing for greater tax efficiency and customization compared to mutual funds or ETFs that track the same index.

What Is Direct Indexing? - Parametric Portfolio Associates - Direct indexing enables investors to hold individual securities directly, offering customization such as exclusion of industries, tax loss harvesting, and factor tilts, unlike ETFs or mutual funds.

UNLEASHING THE POWER OF DIRECT INDEXING | Russell Investments (PDF) - Direct indexing gives investors the ability to replicate an index with individual security ownership in a separately managed account and customize holdings to reflect personal goals, though this may lead to some tracking error relative to the index.

dowidth.com

dowidth.com